I don't often comment on the longer term outlook as my purpose is to try and provide information that will help you improve your swing trading results. It is important though I believe you understand the longer term view. I believe we have a couple of blueprints that help us understand the likely outcomes.

First there is Japan and the continued intervention in the economy the last 20 years. There have been many stimulus programs in Japan with limited success. The bad debt racked up in the 70s and 80s is still in the process of being run off. So we can see that government intervention extends the financial flushing process. Arguably the pain is the same as a quick reset (recession/depression), but it is spread over a longer period and inhibits a quick recovery.

Second there is the mortgage/housing situation in the US. We see as mortgage debt gets repudiated by non-payment housing prices deflate. Now imagine this happens with large corporations. Yes, I know - you hear it every day - corporations are flush with cash. Yet, you see large corporations like MSFT and IBM floating large bond offerings. Yes, they show large cash balances - but they also show large debt balances on their balance sheets. So what is the truth? According to Federal Reserve numbers corporations have $30 trillion in debt. That is twice the Federal government debt. We can assume from this there exists a few cash rich companies, but overall there is a lot of corporate debt that could get repudiated (and this leads to deflation as investor balance sheets take huge hits).

Then there is sovereign debt. Europe gave us a plan to have a plan by March (assuming they can work the details out). Leaves me with a warm and fuzzy feeling. NOT. There are going to be sovereign failures. In Europe at this time you have Greece, Ireland, Portugal, Spain and Italy as potential failed sovereigns. This list probably will grow.... Then there is China. Yes China. They papered over financial crises in 1999 and 2004. They took failed debt and put it in a SIV. These SIVs gave the banks bonds for this failed debt. Those banks are carrying those bonds on their books at full value. It is magic - bad debt becomes good debt. In reality the banks in China will be lucky if those bonds are worth 20% of face value. China is a disaster waiting to happen.

Unless the US changes direction - stops racking up debt and balances its budget they are headed down the same road as Europe (and China). And we know from our mortgage blueprint that repudiation of debt leads to deflation. The FED can try, but I doubt even the FED can print enough money to address the problems likely to hit the global economy over the next 2-3 years. Think about it. Has QE1 and QE2 fixed the economy. The FED added a lot of GSE and treasury debt to its balance sheet. Now this supposedly adds liquidity and makes it easier to get business loans. It hasn't. You have this little thing called velocity of money. Back in 2006-2007 the velocity was high. Every dollar may turn over 2 or 3 times a week. At 3 times velocity ever $1000 provided $3000 of spending a week. The velocity of money has slowed to a crawl now (in comparsion). Let's say the velocity is now 1 times a week and every $1000 provides $1000 of spending in a week. The FED's QE efforts may have prevented spending from falling off a cliff, but it has not provided much in the way of increased net economic activity. It doesn't matter how much money the FED prints - if that money has no velocity spending remains stagnant. Reduced (stagnant) spending leads to deflation (see the housing blueprint and spending in that sector) not inflation.

People understand that they are getting nothing in the way of interest so they are using any excess income to pay off CCs, car loans and mortgages. Paying off a CC (avoiding 20% interest) is like getting 20% interest on that money. Maybe you have a 7% car loan or 5% mortgage - paying those off give you the equivalent of 7% and 5% respectively on your money. But this is not new spending - it is payment for past spending so it adds little in the way of economic stimulus. So with zero interest on savings and high interest on debt people are behaving rationally and reducing debt and FED QE efforts will do nothing to change this. Not only that FED zero interest rate policy is depriving savers of income they might actually spend (if they received it to spend). They say don't fight the FED - in this situation the FED seems powerless to make a difference and the natural economic evolution will happen. Fed and government policy (see Japan reference above) may have delayed and elongated the the economic cleansing, but it has not stopped it. It will happen.

Question is - what path do we take. Do we continue to have FED/government interference like Japan (or FDR during the 30s) or do we get out of the way and let the cleansing proceed at an accelerated rate. The second choice means severe pain and losses and shrunken balance sheets (sharp deflation), but it also means a faster path to a vigorous recovery. Others explain it better than I can:

http://www.safehaven.com/article/23606/the-road-not-taken

So why should you believe a correction is on the way? We had 2% (revised) growth in the 3rd qtr and have projected growth in the 4th qtr. Just a couple of things you may have noted this week. First Texas Instruments, Dupont and some lesser corporations issued warnings this past week. Second announced job reductions were announced by Citi, Astra Zenaca and others. These are not the announcements one expects to see in a healthy expanding economy.

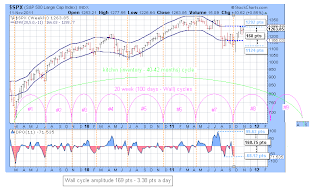

As to cycles and what they tell us. In 1770s the country was getting ready to go (and did) to war with England. Not the best of times. In the early 1890s the country was in a severe depression and workers were rioting in places like Cleveland. That is 120 years from mid 1770s to mid 1890s. It is now about 120 years since the mid 1890s. If theory turns into reality expect the bottom of the 120 year Grand (Mega) Super Cycle soon. Actually it has been hard down since the market peak in 1999. According to Kress a long cycle spends about 1/8 of its total length (12.5%) in a hard down phase. For the 120 year Grand Super Cycle that is 15 years. if we add 15 years to 1999 we get 2014 as an expected bottom to the Grand Super Cycle

The Grand Super cycle is composed of two 60 year cycles called the Super Cycles (K-Wave). The second of these two Super Cycles should bottom along with the Grand Super Cycle. Most cycle analysts agree the last super cycle bottom after the Korean War in 1952. I have seen claims it was as early as 1949 - still it was near the early 1950s. If we add 60 years to 1952 we get 2012. Now some experts claim that without Fed/government interference we would already be bottoming on these two longer cycles. Each Super Cycle is made up of two mini-Super cycle of 30 years (4 in a Grand Super Cycle). It is commonly believe 1982 was the last mini-Super cycle bottom. Thirty years later would be 2012... Again others explain this better than I ever could:

http://www.financialsense.com/contributors/clif-droke/2011/12/05/economic-armageddon-2012-or-2013

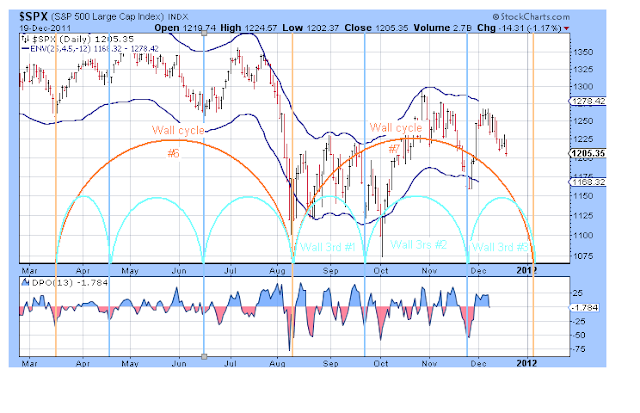

Her is my interpretation of the super cycles (I have allowed for a 2 year delay to bottom due to Fed?government interference:

To be continued