I expect the market to pull back into mid January as several cycles appear to be set to bottom then. Based on the 20 week DPI I am projecting a low in the 1340 area. Since we have other even longer cycles that may also be bottoming this may be too optimistic and a low in the 1200s for the S&P would not be surprising. After a bottom in mid January I expect some recovery into mid-February.

Here is a visual:

GL, Happy new year.... Wear your parachute for cliff jumping.

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Friday, December 28, 2012

silver

Silver looks good for a trade (long) thru mid-Jan for 8-10%.... Here is a visual:

UPDATE: http://www.safehaven.com/article/28215/silver-knocks-at-cited-window-of-opportunity-in-4-sessions Seems to agree with my analysis.

UPDATE: http://www.safehaven.com/article/28215/silver-knocks-at-cited-window-of-opportunity-in-4-sessions Seems to agree with my analysis.

Sunday, December 23, 2012

December 2012 update III

Looks like sideways most of the week. After that we should see some movement down the last day of 2012 and the first week of January. see these 2 shorter cycles starting to offset the second week of January, but could still move down into Jan 11. Take a look:

Merry Christmas

Saturday, December 22, 2012

Outlook for 2013

Well the Mayan end of the world came and we are still here. So I guess it is OK to think there may be a 2013. The cycle experts are calling for the bottoming of very long term cycles in the 2013-2015 time frame. I have talked about these cycles in the past, but since I focus on more tradable (shorter) cycles I do not spend a lot of time on them.

These shorter cycles account for movement within the longer term trends. As any student of the market can tell you the S&P will move 200 points (usually) to go up or down 100 points as a result of these shorter term cycles.

Just a reminder though - the uptrend we have been in since the bottom in March 2009 is almost 4 years old and that is mature for an uptrend so we may be due a longer trend reversal to the downside. If our government (president and congress) don't get their act together that reversal could be closer than many think.

But I digress - there are lots of blogs that cover fundamental and political happenings. The cycles seem to be saying it could be mid January before we get any type of deal in Washington. We will have several cycles bottoming in the mid January time frame (see charts prior post).

I believe if we get the expected selloff in early January then we may set the trend for the year. Old market axiom - as goes the first week of January - so goes January. As goes January so goes the year. That does not mean that there will not be times you will want to be long, just more cautious than usual.

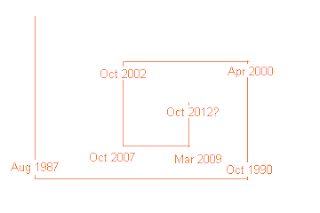

So I believe we set a bottom in January, reverse and set a top in mid April, pull back into early June. Move up into mid August. Then the market moves down the rest of the year with an attempt to rally in September/October.

Here is a visual:

GL, Merry CliffMess and Happy New Year.

These shorter cycles account for movement within the longer term trends. As any student of the market can tell you the S&P will move 200 points (usually) to go up or down 100 points as a result of these shorter term cycles.

Just a reminder though - the uptrend we have been in since the bottom in March 2009 is almost 4 years old and that is mature for an uptrend so we may be due a longer trend reversal to the downside. If our government (president and congress) don't get their act together that reversal could be closer than many think.

But I digress - there are lots of blogs that cover fundamental and political happenings. The cycles seem to be saying it could be mid January before we get any type of deal in Washington. We will have several cycles bottoming in the mid January time frame (see charts prior post).

I believe if we get the expected selloff in early January then we may set the trend for the year. Old market axiom - as goes the first week of January - so goes January. As goes January so goes the year. That does not mean that there will not be times you will want to be long, just more cautious than usual.

So I believe we set a bottom in January, reverse and set a top in mid April, pull back into early June. Move up into mid August. Then the market moves down the rest of the year with an attempt to rally in September/October.

Here is a visual:

GL, Merry CliffMess and Happy New Year.

Saturday, December 15, 2012

December 2012 update II

The downside of the 22TD cycle was offset more than I expected by the 34TD cycle upside. We ended up mixed with the S&P and DOW down. In the coming week it appears the 34TD cycle turns down and the 22TD cycle up (offsetting each oter to a great extent).

I have reviewed the longer cycles based on current data and made some shifts. The Wall Cycle (141 calendar days, about 102 TDs, 4 5/8 months) appears to be running long (5+ months). This implies the kitchen cycle is running long also (46-48 months) and the 1/3 kitchin cycle is 15+ months (3 X Wall cycles).

After this review I have attempted to show this visually:

And the longer cycles (less cluttered):

It appears we may have seen our rally for December and a sizable selloff over the next 4-6 weeks. Time will tell.

GL, happy trading and Merry Christmas.

I have reviewed the longer cycles based on current data and made some shifts. The Wall Cycle (141 calendar days, about 102 TDs, 4 5/8 months) appears to be running long (5+ months). This implies the kitchen cycle is running long also (46-48 months) and the 1/3 kitchin cycle is 15+ months (3 X Wall cycles).

After this review I have attempted to show this visually:

And the longer cycles (less cluttered):

It appears we may have seen our rally for December and a sizable selloff over the next 4-6 weeks. Time will tell.

GL, happy trading and Merry Christmas.

Saturday, December 8, 2012

December 2012 update I

Less movement than I thought would happen this past week. Mixed close with S&P and DOW up, but NAZ down. I had though the market as a whole would be down 1-2%. Did not happen.

I have shifted my charts (short term cycles) a bit to better fit the data (I hope?). The 22 TD cycle (lunar cycle) topped in late November and should bottom by late next week. This cycle seems to have the most short term impact so we may get a 3-4% pull back during the week. CCI dropped belown +100 which I view as a short term trading sell signal. Time will tell.

Here is a visual:

GL traders

I have shifted my charts (short term cycles) a bit to better fit the data (I hope?). The 22 TD cycle (lunar cycle) topped in late November and should bottom by late next week. This cycle seems to have the most short term impact so we may get a 3-4% pull back during the week. CCI dropped belown +100 which I view as a short term trading sell signal. Time will tell.

Here is a visual:

GL traders

Wednesday, December 5, 2012

Saturday, December 1, 2012

Prime cycles

Shorter cycles are nested in longer cycles. This was observed by students of cycles like PQ Wall. Wall called these nested cycles (9 Wall cycles - 20 weeks - 100 trading days in a Kitchin cycle. And 16 Kitchin cycles in a K-Wave Super cycle [3.5 years x 16 = 56 years]) the Prime Cycles.

Here are these prime cycles:

OK, 8000 years is a bit long.

Update: 12/02/2012 -- In looking at the copied table I noticed that 141 days / 3 is 47 days (and not 35 days), but 141 / 4 is 35.25 days. On the other hand 141 days / 7 is 20.143 weeks. 20.143 weeks is 100.715 trading days. 100.714 /3 is 33.57 trading days.

33.57 / 3 = 11.157 trading days. 11.157 * 2 (or 2/3 * 33.57) is 22.314 trading days. 33.57 / 4 is 8.391 trading days. 8.391 / 4 is 2.797 trading days.

Gann liked eighths of 90 degrees (1/4 of 360 degrees [a circle]). 1/8 of 90 is 11.25, 2/8 of 90 is 22.50, 3/8 of 90 is 33.75, etc. 1 and 1/8 of 90 is 102.25. Given the approximate same vaues of the trading days derived from the Prime Cycles table I am incline to believe the Wall values (year, seasom, month) represent trading days and not calendar days.

If you differ please post your rationale.

Here are these prime cycles:

OK, 8000 years is a bit long.

Update: 12/02/2012 -- In looking at the copied table I noticed that 141 days / 3 is 47 days (and not 35 days), but 141 / 4 is 35.25 days. On the other hand 141 days / 7 is 20.143 weeks. 20.143 weeks is 100.715 trading days. 100.714 /3 is 33.57 trading days.

33.57 / 3 = 11.157 trading days. 11.157 * 2 (or 2/3 * 33.57) is 22.314 trading days. 33.57 / 4 is 8.391 trading days. 8.391 / 4 is 2.797 trading days.

Gann liked eighths of 90 degrees (1/4 of 360 degrees [a circle]). 1/8 of 90 is 11.25, 2/8 of 90 is 22.50, 3/8 of 90 is 33.75, etc. 1 and 1/8 of 90 is 102.25. Given the approximate same vaues of the trading days derived from the Prime Cycles table I am incline to believe the Wall values (year, seasom, month) represent trading days and not calendar days.

If you differ please post your rationale.

December 2012 outlook

Our outlook for November was a bit off the mark the last third or so the month as the market rallied more than expected. Hard to anticipate what the market will do from day to day as the market is news driven out of Washington (nothing is getting done to resolve tax/budget issues). But, I will give it my best effort....

The cycles should give us a bottom by the middle of the second week of December (December 12??). Depending on the news any down move could be substantial. So I would use trailing stops for any long positions to try and limit losses on any pullback. By mid December we should see a move up into January.

Here is a visual of the longer cycles:

If the downside (see DPO) of these longer cycles is realized we could see a pullback of 200 or more S&P points. With the foolishness going on in Washington - anything is possible.

Here is the shorter cycles:

These shorter cycles are projecting a pullback of about 72 points. So we expect a low in December around December 12 and a high toward the end of the month.

GL, traders. Cash out inverses over the next 5-7 trading days and go long is my basic strategy for the month of December.

The cycles should give us a bottom by the middle of the second week of December (December 12??). Depending on the news any down move could be substantial. So I would use trailing stops for any long positions to try and limit losses on any pullback. By mid December we should see a move up into January.

Here is a visual of the longer cycles:

If the downside (see DPO) of these longer cycles is realized we could see a pullback of 200 or more S&P points. With the foolishness going on in Washington - anything is possible.

Here is the shorter cycles:

These shorter cycles are projecting a pullback of about 72 points. So we expect a low in December around December 12 and a high toward the end of the month.

GL, traders. Cash out inverses over the next 5-7 trading days and go long is my basic strategy for the month of December.

Saturday, November 24, 2012

November 2012 update III

The market was up about 60 points from its low. It recovered almost 50% of its correction in a very short period. We can be confident this pace "up" can not be maintained, else the market would double in a very short period....

I took a look at the amplitude of the 22TD cycle (DPO(11) daily chart) and found out the amplitude of this short trading cycle was around 60 points. So we have fulfilled upside expectations (and then some) for this short swing cycle. Therfore, I expect the upside potential is limited the last week of November and think the possibilty of a down week are good.

Here is a visual of the short term outlook:

Might see some more up early week, fade by end of week?? GL traders - wrote covered calls on my RWM, hopefully will buy them back for a nice profit this week....

I took a look at the amplitude of the 22TD cycle (DPO(11) daily chart) and found out the amplitude of this short trading cycle was around 60 points. So we have fulfilled upside expectations (and then some) for this short swing cycle. Therfore, I expect the upside potential is limited the last week of November and think the possibilty of a down week are good.

Here is a visual of the short term outlook:

Might see some more up early week, fade by end of week?? GL traders - wrote covered calls on my RWM, hopefully will buy them back for a nice profit this week....

Saturday, November 17, 2012

Gann - years ending in 3 (2013)

Below is an extract from Gann's teaching:

Each decade or 10-year cycle, which is 1/10th of 100 years, marks an important campaign. The digits from 1-9 are important. All you have learn is to count the digit on your fingers in order to ascertain what kind of a year the market is in.

No.1 in a new decade is a year in which a bear market ends and a bull market begins. Look up 1901, 1911, 1921, 1931...

No.2 or the second year is a year of a mirror bull market, or a year in which a rally in a bear market will start at some time. See 1902, 1912, 1922...

No.3 starts a bear year, but the rally from the second year may run to March or April before culmination, or a decline from the second year may run down and make bottom in February or March, like 1903, 1913, 1923...

etc, etc...

Each decade or 10-year cycle, which is 1/10th of 100 years, marks an important campaign. The digits from 1-9 are important. All you have learn is to count the digit on your fingers in order to ascertain what kind of a year the market is in.

No.1 in a new decade is a year in which a bear market ends and a bull market begins. Look up 1901, 1911, 1921, 1931...

No.2 or the second year is a year of a mirror bull market, or a year in which a rally in a bear market will start at some time. See 1902, 1912, 1922...

No.3 starts a bear year, but the rally from the second year may run to March or April before culmination, or a decline from the second year may run down and make bottom in February or March, like 1903, 1913, 1923...

etc, etc...

November 2012 update II

The market has achieved the projected downside (plus a bit) for the 20 week Wall cycle (see DPO(51) on chart - 20 weeks is 100 days and half that plus 1 is 51). So the market may be slightly oversold here (say 15-20 S&P points?) and we may get a bounce into Thanksgiving, but I am expecting lower lows into the first week of December.

Here is the shorter swing cycles visual:

The Wall cycle and 35TD cycle should provide some downside pressure into the first week of December, partially offset by the 22TD (lunar) cycle being up. Also, the 3rd 1/3 Kitchin cycle (equal 3 Wall cycles and the third of the 3 Wall cycles is generally provides the most action) is down into the end of the month. Since this is the 3rd 1/3Kitchin that means the Kitchin cycle is also ready to bottom. With longer cycles we normally get the strongest move near a bottom/top (turning point). So I believe we could see another 100 points down over the next 10-11 trading days....

Here is a visual of these longer cycles:

GL traders and happy Thanksgiving.

Here is the shorter swing cycles visual:

The Wall cycle and 35TD cycle should provide some downside pressure into the first week of December, partially offset by the 22TD (lunar) cycle being up. Also, the 3rd 1/3 Kitchin cycle (equal 3 Wall cycles and the third of the 3 Wall cycles is generally provides the most action) is down into the end of the month. Since this is the 3rd 1/3Kitchin that means the Kitchin cycle is also ready to bottom. With longer cycles we normally get the strongest move near a bottom/top (turning point). So I believe we could see another 100 points down over the next 10-11 trading days....

Here is a visual of these longer cycles:

GL traders and happy Thanksgiving.

Saturday, November 10, 2012

November 2012 update I

It appears the upside move by the shorter term swing cycles were frustrated by the longer Kitchin/Wall cycles which I anticipate will bottom by year end (or early 2013). Seems the market is squarely focused on the fiscal cliff - which would correlate nicely with a bottom in the Wall and Kitchin cycles.

May get an attempt to rally (33TD cycle topping) first 2 days this upcoming week, but do not expect a lot of upside. Buy back inverses on any strength. After mid week the shorter swing cycles turn down along with the longer Kitchin/Wall cycles. In other words the push down could get even nastier by mid-week.

Here is a visual:

GL traders...

Update 11-13:

Well the attempt to go up Mon-Tue was futile. Told you not to expect a lot of upside (We got some during the day). Interesting FIB ratio on the hourly S&P chart (thanks to Astro - see blog list for the chart):

May get an attempt to rally (33TD cycle topping) first 2 days this upcoming week, but do not expect a lot of upside. Buy back inverses on any strength. After mid week the shorter swing cycles turn down along with the longer Kitchin/Wall cycles. In other words the push down could get even nastier by mid-week.

Here is a visual:

GL traders...

Update 11-13:

Well the attempt to go up Mon-Tue was futile. Told you not to expect a lot of upside (We got some during the day). Interesting FIB ratio on the hourly S&P chart (thanks to Astro - see blog list for the chart):

Monday, November 5, 2012

November 2012 outlook

Based on the swing cycles (22TD or lunar cycle - 28.4 calendar days, and the 33-35TD cycle) it appears that the market should show some upside the first couple of weeks of November (green shaded area) and down the second half of November (orange shaded). Some speculate given an eclipse in mid November we could see a cycle inversion associated with that eclipse. We will see...

So I would take some profits on your inverses (Russell up 4-5% from where I suggested you get into inverses) and maybe buy an equal $ amount of the Russell Index ETF with the intent to switch back in mid November.

I estimate the S&P index will go up 4% or so over the next 2 weeks. Here is a visual:

GL traders - have a profitable November.

update 11/07/2012:

longer cycles bottoming end of Dec???

So I would take some profits on your inverses (Russell up 4-5% from where I suggested you get into inverses) and maybe buy an equal $ amount of the Russell Index ETF with the intent to switch back in mid November.

I estimate the S&P index will go up 4% or so over the next 2 weeks. Here is a visual:

GL traders - have a profitable November.

update 11/07/2012:

longer cycles bottoming end of Dec???

Saturday, October 27, 2012

Economic cycles III

We have covered 2 of the 3 economic cycles we identified as important within the economy. We covered the Kitchin (inventory) cycle and Jugular (investment) cycle. This leaves the third cycle:

The last time all three of these cycles were bottoming in close proximity was in the 1970s. So one might suspect that 2008-2018 will be similiar to the 1970s. Of course, there will be differences - longer cycles like the K-Wave are at different time frames than in the 1970s.

We included the Kuznet cycle in our last post - so review that for a visual. Here though is how this fits within the longer K-Cycle:

Note: the Kuznet cycles nest within (4 cycles) the K-cycle.

Next week should be a temporary swing trade bottom. The 35TD and 22TD cycles should bottom by the end of the week. I have placed limit orders to sell 1/2 of my "inverse" insurance (RWM) around $26.50.

Here is a visual of RWM:

GL traders..... Vote and vote often. ;)

The three most important cycles are:

- ...

- ...

- the 15-18 year Kuznets cycle in housing construction / prices and associated consumer spending.

The last time all three of these cycles were bottoming in close proximity was in the 1970s. So one might suspect that 2008-2018 will be similiar to the 1970s. Of course, there will be differences - longer cycles like the K-Wave are at different time frames than in the 1970s.

We included the Kuznet cycle in our last post - so review that for a visual. Here though is how this fits within the longer K-Cycle:

Note: the Kuznet cycles nest within (4 cycles) the K-cycle.

Next week should be a temporary swing trade bottom. The 35TD and 22TD cycles should bottom by the end of the week. I have placed limit orders to sell 1/2 of my "inverse" insurance (RWM) around $26.50.

Here is a visual of RWM:

GL traders..... Vote and vote often. ;)

Tuesday, October 23, 2012

Economic cycles II

The three most important cycles are:

The investment cycle (Jugular) seems to be at an end as companies have invested to improve margins the past 3 1/2 or so years, but now are postponing investment as margin improvements are hard to achieve and has probably topped.

In 2008-2009 companies trimmed staff substantially. Today we are back near the highs achieved in GDP, but we still have high levels of unemployment. What happened to all those jobs from back in 2008-2009? Companies used that as an excuse to upgrade manufacturing and processes using more machines and equipment.

Over time you can expect this trend to continue. At the current time companies are meeting consumer demand with reduced staffs and improved productivity. Even though machines/equipment can work 7/24 they require no vacation or holidays off, require no health insurance. When demand is being met there is no reason to continue to invest in more productivity improvement machines and systems. I believe we reached that point in the first half of 2012.

If you have the technical training and can program robotic controllers like Allen Bradley PLCs there are jobs for you. If you have no specialized skills or training there are no jobs for you. So we have a large unemployed segment of the population. This supresses demand and the investment cycle stagnates.

At this time it appears the 22TD, 34TD, Wall cycle (100TD) are synched to the down side (in addition to longe cycle impact). So the bear appears to still be in control. I expect that to continue through Oct and possibly the first week of Nov. GL traders .. continue to hold your inverses (shorts).

downside target just under 1370 by end of month....

35TD downside satisfied, 100TD cycle amplitude should give us a pullback to around 1367:

- ...

- the 7-10 year Jugular business investment cycle and

- ...

The investment cycle (Jugular) seems to be at an end as companies have invested to improve margins the past 3 1/2 or so years, but now are postponing investment as margin improvements are hard to achieve and has probably topped.

In 2008-2009 companies trimmed staff substantially. Today we are back near the highs achieved in GDP, but we still have high levels of unemployment. What happened to all those jobs from back in 2008-2009? Companies used that as an excuse to upgrade manufacturing and processes using more machines and equipment.

Over time you can expect this trend to continue. At the current time companies are meeting consumer demand with reduced staffs and improved productivity. Even though machines/equipment can work 7/24 they require no vacation or holidays off, require no health insurance. When demand is being met there is no reason to continue to invest in more productivity improvement machines and systems. I believe we reached that point in the first half of 2012.

If you have the technical training and can program robotic controllers like Allen Bradley PLCs there are jobs for you. If you have no specialized skills or training there are no jobs for you. So we have a large unemployed segment of the population. This supresses demand and the investment cycle stagnates.

Combined with a Kitchin cycle that is also looking for a bottom and you have a high risk equities market. Here is a visual of the kitchin/Jugular cycles...

At this time it appears the 22TD, 34TD, Wall cycle (100TD) are synched to the down side (in addition to longe cycle impact). So the bear appears to still be in control. I expect that to continue through Oct and possibly the first week of Nov. GL traders .. continue to hold your inverses (shorts).

downside target just under 1370 by end of month....

35TD downside satisfied, 100TD cycle amplitude should give us a pullback to around 1367:

Monday, October 15, 2012

Economic cycles I

The ten minute mini-day times 144 reappears as the day (1440 minutes), times 144 as the twenty week Wall Cycle, times 144 as the inflation/deflation Kondratieff Wave, times 144 as the 8000 year Spengler cycle in which four mighty cultures (of 2000 years each) rise and fall.

The desire/will pendulum within a complete cycle one can be pictured as follows:

Year of Dawn: from the lairs of night herds of Southern Desire emerge and begin to timidly graze.

Year of Noon: grown bold, the herds of desire graze everywhere.

Year of Sunset: the answering predators of Northern Will begin to trim the ranks.

Year of Midnight: the predators of will dine en masse in a royal contest for turf.

We derive these moods from only two sets of contraries: desire vs. will and joy (superfluous energy) vs hunger or gloomy revenge (lagging energy). These will modulate into a fourfold sequence such as that of the Years above, shown here as four phases of the (48 to 64 year) Kondratieff Wave.

Of course these are driven by economic events which account for cycles in the equity markets. In theory equity markets anticipate economic cycle.

The three most important cycles are:

JD Hunt the largest trucker just reported a stinko quarter. Fedex issued negative guidance.This implies that inventory levels are high and retailers/merchants are ordering less as they try to work off inventory. Also, import levels are not increasing as the Eurozone is in a recession and China is showing slower growth. All pointing to a slow down in inventory accumulation and probably a pull back in inventory levels.

In summary - an inventory trough is approaching. Now, the economic cycles and equity cycles do not often occur at the same time. If as expected the equity market moves first that could occur in the 4th qtr of 2012 or 1st qtr of 2013. It is due within the 3-4 year (average about 3.5 years or 42 months), but may be nearer the 4 year (48 month) time frame because of Federal Reserve intervention.

Here is a visual of the Kitchin and shorter nested cycles:

We will discuss other longer cycles in subsequent posts. As you would expect if we get multiple economic cycles contributing to a move then that move becomes substantial.

Our call for the prior week (downside bias and suggesion of buying and inverse as insurance) was on the mark. IMO the bears continue to be in control for now, so hold your inverses... GL traders.

The desire/will pendulum within a complete cycle one can be pictured as follows:

Year of Dawn: from the lairs of night herds of Southern Desire emerge and begin to timidly graze.

Year of Noon: grown bold, the herds of desire graze everywhere.

Year of Sunset: the answering predators of Northern Will begin to trim the ranks.

Year of Midnight: the predators of will dine en masse in a royal contest for turf.

We derive these moods from only two sets of contraries: desire vs. will and joy (superfluous energy) vs hunger or gloomy revenge (lagging energy). These will modulate into a fourfold sequence such as that of the Years above, shown here as four phases of the (48 to 64 year) Kondratieff Wave.

Of course these are driven by economic events which account for cycles in the equity markets. In theory equity markets anticipate economic cycle.

The three most important cycles are:

- the 3-4 year Kitchin inventory cycle,

- the 7-10 year Juglar business investment cycle and

- the 15-18 year Kuznets cycle in housing construction / prices and associated consumer spending.

JD Hunt the largest trucker just reported a stinko quarter. Fedex issued negative guidance.This implies that inventory levels are high and retailers/merchants are ordering less as they try to work off inventory. Also, import levels are not increasing as the Eurozone is in a recession and China is showing slower growth. All pointing to a slow down in inventory accumulation and probably a pull back in inventory levels.

In summary - an inventory trough is approaching. Now, the economic cycles and equity cycles do not often occur at the same time. If as expected the equity market moves first that could occur in the 4th qtr of 2012 or 1st qtr of 2013. It is due within the 3-4 year (average about 3.5 years or 42 months), but may be nearer the 4 year (48 month) time frame because of Federal Reserve intervention.

Here is a visual of the Kitchin and shorter nested cycles:

We will discuss other longer cycles in subsequent posts. As you would expect if we get multiple economic cycles contributing to a move then that move becomes substantial.

Our call for the prior week (downside bias and suggesion of buying and inverse as insurance) was on the mark. IMO the bears continue to be in control for now, so hold your inverses... GL traders.

Saturday, October 6, 2012

October 2012 swings

In my last post I told you I thought the week would be up, and it was. Time to take a look at the month ahead. This means I will look at the longer 20 week (Wall) or 100TD cycle as well as the 33TD cycle. Also it appears the 22TD cycle is starting to have more influence.

The 100TD/Wall cycle topped toward the end of August. Often a cycle's largest impact is in the last part of a leg. The Wall Cycle is now at the point where I would expect that impact to start to exert its downward pressure.

Looking at two indicators (MFI - Money Flow Indicator) and DPO (Detrended Price) I see that the Money Flow is down even though the DJIA and S&P are near highs. These divergences between Price and Money flow to the down side often occur at tops (The divergence often is to the upside at a bottom).

The DPO shows us the part of the price due to cyclical activity. If I use a parameter of "51" then I should see the portion of price movement due to the 100TD and shorter cycles (33TD and 22 TD cycles for example). This movement appears to be around 109 points over a half span (top to bottom or bottom to top) of the 100TD (Wall or 20 week) cycle.

The 100TD cycle is down and should bottom around 11/9 (election week?) with a target of 1320. Here is a visual (chart) showing the points discussed:

The 33TD cycle should top by the middle of next week (Oct 10?). Keep in mind the Wall cycle is down. Also th upside according to the 33TD DPO (parameter "17") is near to being met.

Looks like a potential double top aound 1478 at this time. After that the 33TD cycle should be down thru late Oct or early Nov. So starting by the middle of next week we have the Wall Cycle and 33TD cycle providing some downside pressure through the latter part of October.

Will we get an 8-10% correction into the election? Appears possible.

Here is a visual high lighting the 33TD cycle: Finally as I mentioned the 22TD cycle seems to be emerging and becoming a factor in the cyclic activity again. It is up (and should be for the next 6-8 trading days).

This will somewhat inhibit the downside from the longer (Wall and 33TD) cycles. So the next week should have a slight downward bias but the range will be limited by the upside from the 22TD cycle. Can you say sideways for the next week? The last 2 weeks of Oct (and first week of Nov?) has the potential of much more down side.

Here is a visual of the 22TD cycle: GL traders. Might be a good idea to add some inverse ETFs to protect yourself over the next few days.

The 100TD/Wall cycle topped toward the end of August. Often a cycle's largest impact is in the last part of a leg. The Wall Cycle is now at the point where I would expect that impact to start to exert its downward pressure.

Looking at two indicators (MFI - Money Flow Indicator) and DPO (Detrended Price) I see that the Money Flow is down even though the DJIA and S&P are near highs. These divergences between Price and Money flow to the down side often occur at tops (The divergence often is to the upside at a bottom).

The DPO shows us the part of the price due to cyclical activity. If I use a parameter of "51" then I should see the portion of price movement due to the 100TD and shorter cycles (33TD and 22 TD cycles for example). This movement appears to be around 109 points over a half span (top to bottom or bottom to top) of the 100TD (Wall or 20 week) cycle.

The 100TD cycle is down and should bottom around 11/9 (election week?) with a target of 1320. Here is a visual (chart) showing the points discussed:

The 33TD cycle should top by the middle of next week (Oct 10?). Keep in mind the Wall cycle is down. Also th upside according to the 33TD DPO (parameter "17") is near to being met.

Looks like a potential double top aound 1478 at this time. After that the 33TD cycle should be down thru late Oct or early Nov. So starting by the middle of next week we have the Wall Cycle and 33TD cycle providing some downside pressure through the latter part of October.

Will we get an 8-10% correction into the election? Appears possible.

Here is a visual high lighting the 33TD cycle: Finally as I mentioned the 22TD cycle seems to be emerging and becoming a factor in the cyclic activity again. It is up (and should be for the next 6-8 trading days).

This will somewhat inhibit the downside from the longer (Wall and 33TD) cycles. So the next week should have a slight downward bias but the range will be limited by the upside from the 22TD cycle. Can you say sideways for the next week? The last 2 weeks of Oct (and first week of Nov?) has the potential of much more down side.

Here is a visual of the 22TD cycle: GL traders. Might be a good idea to add some inverse ETFs to protect yourself over the next few days.

Saturday, September 29, 2012

Play the swing cycle

The swing cycle that appears to currently dominate is the 33-36 trading days cycle. This means the current correction should complete in the coming week (33TD cycle - 16+ day leg would complete by Tuesday; a 36TD cycle would complete Thursday 10/04). So if you ae short or holding an inverse such as RWM you will want to watch for an exit in the coming week....

After the bottom we should see about 17 TD up into late Oct, then down into the presidential election. Don't forget - there are other cycles at play that can influence the amplitude of any move by this swing cycle (Which is 1/3 of a Wall cycle).

Here is a visual:

Compare this to the predictions of the Spiral calendar:

http://spiraldates.com/

GL traders.

After the bottom we should see about 17 TD up into late Oct, then down into the presidential election. Don't forget - there are other cycles at play that can influence the amplitude of any move by this swing cycle (Which is 1/3 of a Wall cycle).

Here is a visual:

Compare this to the predictions of the Spiral calendar:

http://spiraldates.com/

GL traders.

Monday, September 24, 2012

VIX trend change signal

1) VIX retreated over 50% from last high around 28

2) S&P has now had 3 consecutive down days.

I consider this a trend change signal.

Seems to me the fundamentals are now such that not much in the offing to move the market:

1) ECB - instituted QE, FED instituted QE, Japan instituted QE. The sugar high should wear off fairly quickly.

2) Many Euro countries in recession

3) China growth slowing

4) Many emerging countries slowing (Brazil, India)

5) US growth anemic

5) Economic #s continue to be poor

Also technicals seem to be lining up to suggest a top:

1) EW proponents are suggesting a substantial top in the making

2) Spirals suggesting top near

3) Slow Stos suggest a top near

4) VIX suggesting a trend change

5) Cycles suggest a top in the making

These are just some of the markers suggesting a pull back is near.

GL traders

2) S&P has now had 3 consecutive down days.

I consider this a trend change signal.

Seems to me the fundamentals are now such that not much in the offing to move the market:

1) ECB - instituted QE, FED instituted QE, Japan instituted QE. The sugar high should wear off fairly quickly.

2) Many Euro countries in recession

3) China growth slowing

4) Many emerging countries slowing (Brazil, India)

5) US growth anemic

5) Economic #s continue to be poor

Also technicals seem to be lining up to suggest a top:

1) EW proponents are suggesting a substantial top in the making

2) Spirals suggesting top near

3) Slow Stos suggest a top near

4) VIX suggesting a trend change

5) Cycles suggest a top in the making

These are just some of the markers suggesting a pull back is near.

GL traders

Friday, September 21, 2012

Slow Sto calling for a pull back?

According to Robert McHugh if the Slow Sto stays above 20 for 2.5 months a sell off normally occurs (+/- 2 weeks).

gl traders

gl traders

Thursday, September 6, 2012

Spirals and what they tell us

http://ermanometry.com/articles/log_spirals_in_the_stock_market.php

HALF SECTION VIEW OF A NAUTILUS SHELL. Successive increments of growth are united by a constant common ratio of expansion. An example of a spiral found in nature... See the above referenced article for more information on stock market cycles and their use in stock pivot point identification.

Below is a rough approximation of the spiral referenced in my last post. We should see a significant top soon (see spiral below).

Hope you find the referenced article as informative as I did.

GL traders

HALF SECTION VIEW OF A NAUTILUS SHELL. Successive increments of growth are united by a constant common ratio of expansion. An example of a spiral found in nature... See the above referenced article for more information on stock market cycles and their use in stock pivot point identification.

Below is a rough approximation of the spiral referenced in my last post. We should see a significant top soon (see spiral below).

Hope you find the referenced article as informative as I did.

GL traders

Monday, September 3, 2012

A death spiral??

Based upon the Fibonacci sequence, 1, 1, 2, 3, 5, 8, 13, 21, 34 etc we see an amazing occurence. From the 1932 bottom to 1966 top was 34 years and 1966 to 1987 was 21 years... subsequently we saw the 2000 top (13 years) and then the 2008 top (8 years). This is rather more than coincidence that every major top since 1932 was identified by following a contracting Fibonacci sequence. There is no indication for how long tops last, but in general, corrections are severe...at least 40-50%.

Five years from 2008 is 2013 suggesting a substantial top in 2013 followed by a 40-50% correction.

Implications for quickly approaching the point of singularity implies severe volatility, so do not take positions where money is required or involve leverage...this could kill you on the downside and if not, the sleepless nights could take a toll. We are just beginning to see a sampling of how volatile things are going to get in the coming years.

Timing the tops and getting out before sharp declines will be critical for ensuring no loss of capital. Tops will be closer together if the market continues to observe the contracting Fibonacci sequence (2013, 2016, 2018, etc),

In other words a DEATH spiral. Spirals is another subject for another time, but those who have studied spirals often relate then to Fibonacci sequences.....

Five years from 2008 is 2013 suggesting a substantial top in 2013 followed by a 40-50% correction.

Implications for quickly approaching the point of singularity implies severe volatility, so do not take positions where money is required or involve leverage...this could kill you on the downside and if not, the sleepless nights could take a toll. We are just beginning to see a sampling of how volatile things are going to get in the coming years.

Timing the tops and getting out before sharp declines will be critical for ensuring no loss of capital. Tops will be closer together if the market continues to observe the contracting Fibonacci sequence (2013, 2016, 2018, etc),

In other words a DEATH spiral. Spirals is another subject for another time, but those who have studied spirals often relate then to Fibonacci sequences.....

Thursday, August 30, 2012

Aug 30 update

Last post (Aug 21) I told you it appeared that we should be at a top. I see no reason to change that. I believe we have actually seen the DOW trade down for the month of August during the day today - so it is going to b interesting to see if Aug DOW is an up or down month.

You will sometimes see articles discussing the 15 month business or stock cycle. We have discussed the Wall cycles (9 in a Kitchin cycle) and the fact they could be grouped in 3 groups of 3. Also, we have noted the 3rd of a group is normally the weakest. Now a wall cycle is 20 weeks +/- and 20 week is about 4.7 months (using 30 days as an aveage month). so three Wall cycles (60+/- weeks is 3 x 4.7 months or around 14 months) corresponds approximately to this 15 month cycle. So I would contend that the so-called 15 month cycle is actually a group of 3 Wall cycles.

If I am right then this 14.1 month cycle is now down (the 3rd of 3 Wall cycles in a group of 3) and will remain so into the 3rd week of November.

Here is the situation graphically:

GL traders. RWM looks like a good way to protect to the downside here.

You will sometimes see articles discussing the 15 month business or stock cycle. We have discussed the Wall cycles (9 in a Kitchin cycle) and the fact they could be grouped in 3 groups of 3. Also, we have noted the 3rd of a group is normally the weakest. Now a wall cycle is 20 weeks +/- and 20 week is about 4.7 months (using 30 days as an aveage month). so three Wall cycles (60+/- weeks is 3 x 4.7 months or around 14 months) corresponds approximately to this 15 month cycle. So I would contend that the so-called 15 month cycle is actually a group of 3 Wall cycles.

If I am right then this 14.1 month cycle is now down (the 3rd of 3 Wall cycles in a group of 3) and will remain so into the 3rd week of November.

Here is the situation graphically:

GL traders. RWM looks like a good way to protect to the downside here.

Tuesday, August 21, 2012

Aug 21 outlook

So far I have gotten thru August without a hospital stay. This is the first month since March I have not spent 1-2 weeks of a month in the hospital. So you could say I am making good progress in my recovery? Still don't have a lot of energy or stamina as it will take some time and exercise to get that back.

In June I commented as follows: "Looking at the market it appears Jul/Aug will provide some volatility in a range of about 10% , but no actual large move up or down." This seems to be a fair description of market action (less volaility than expected) as it moved sideways with an upside bias.

The first week of June should have marked the bottom of a Wall Cycle (20 weeks) and we should be approaching or near a top of that 20 week cycle. So I am expecting a pullback soon that should last into mid Oct (maybe into the election if it goes long). Also, unless it goes longer than expected the Kitchin cycle (42 months - 3.5 years) should be bottoming by year's end (Mar 6 - 2009 + 3 years is Mar 6 2012 + 6 months is Sep 2012).

Here is a visual:

Gl traders. I will try to post on occasion - health permitting.

In June I commented as follows: "Looking at the market it appears Jul/Aug will provide some volatility in a range of about 10% , but no actual large move up or down." This seems to be a fair description of market action (less volaility than expected) as it moved sideways with an upside bias.

The first week of June should have marked the bottom of a Wall Cycle (20 weeks) and we should be approaching or near a top of that 20 week cycle. So I am expecting a pullback soon that should last into mid Oct (maybe into the election if it goes long). Also, unless it goes longer than expected the Kitchin cycle (42 months - 3.5 years) should be bottoming by year's end (Mar 6 - 2009 + 3 years is Mar 6 2012 + 6 months is Sep 2012).

Here is a visual:

Gl traders. I will try to post on occasion - health permitting.

Tuesday, July 17, 2012

07-17 status

Well, had a pacemaker/defib unit implanted around July 3. Was supposed to sync the beating of the two chambers and make the heart work better (so was the triple bypass). SWo was the triple bypass earlier.

I feel OK, blood pressure ok, blood sugar OK, weight holding steady, good appetite. BUT, there is still a problem of fluid accumulation in the chest. Since May 15 had to have it drained 3 time (over 3 liters each time). Now have a tube draining that they put in when they did the pacemaker. This weekend drained (Friday- Monday) drained almost 2 liters of fluid.

DR says I have a very delicate (iffy I would call it) heart situation. Don't know if they can do anything else.

This may be my last post. GL all.

I feel OK, blood pressure ok, blood sugar OK, weight holding steady, good appetite. BUT, there is still a problem of fluid accumulation in the chest. Since May 15 had to have it drained 3 time (over 3 liters each time). Now have a tube draining that they put in when they did the pacemaker. This weekend drained (Friday- Monday) drained almost 2 liters of fluid.

DR says I have a very delicate (iffy I would call it) heart situation. Don't know if they can do anything else.

This may be my last post. GL all.

Sunday, July 8, 2012

7-8-2012 recovery update

I wish I could tell you that recovery is going as expected and everything is fine. But that would not be true as I keep hitting speed bumps in my recovery. So far I have had fluid accumulation in the chest 3 times that had to be drained (over 3 liter each time). This much fluid in the chest cavity leads to supressed breathing.

In between I have tried to maintain a schedule of activity to improve my strength and stamina. So the cardio Drs decided I had a heart sychronization problem (left chamber fires off, then the right chamber fires off) . This leads to low effieiency of the heart. In other words I live in a very percarious condition.

On Mon/Tue I had a pacemaker/defib unit implanted along with a drainage tube. In measuring the drainage it seems to be decreasing over the past 3 days. This could be good news. Still the heart surgeon says I need to be close to family so they can keep an eye on me as I have a very fragile situation (guess this move happens over the next month).

Looking at the market it eappars Jul/Aug will provide some volatility in a range of about 10% , but no actual large move up or down. So I have re-established my RWM inverse position to trade on a 5% or greater move down in The Russell.

GL traders.

In between I have tried to maintain a schedule of activity to improve my strength and stamina. So the cardio Drs decided I had a heart sychronization problem (left chamber fires off, then the right chamber fires off) . This leads to low effieiency of the heart. In other words I live in a very percarious condition.

On Mon/Tue I had a pacemaker/defib unit implanted along with a drainage tube. In measuring the drainage it seems to be decreasing over the past 3 days. This could be good news. Still the heart surgeon says I need to be close to family so they can keep an eye on me as I have a very fragile situation (guess this move happens over the next month).

Looking at the market it eappars Jul/Aug will provide some volatility in a range of about 10% , but no actual large move up or down. So I have re-established my RWM inverse position to trade on a 5% or greater move down in The Russell.

GL traders.

Tuesday, May 22, 2012

Back 05-23-2012

I'm Back. Had to have a medical tune up. Seems the market is about where we predicted 04-23.

Going to be a while to get fully recuperated. You heard the one about th snail riding on the turtle's back yelling "whee". Right now I am the snail, but will post more as my condition permits.

Thanks for everone's support.

Going to be a while to get fully recuperated. You heard the one about th snail riding on the turtle's back yelling "whee". Right now I am the snail, but will post more as my condition permits.

Thanks for everone's support.

Monday, April 23, 2012

04-23-2012 the week ahead

I told you last week to expect a sideways week with a slight upside bias. Even though there was a lot of movement at the end of the week that is what we got.

It appears the short cyle (1/8 the Wall cycle 12-13 days) topped and turned down. The 1/4 Wall cycle remains up. The Half Wall and Wall cycle are down. Also the Kitchin cycle should be entering a hard down phase.

Over all it appears we should have a down week, and I suspect we may test recent lows and potentially head lower after that.

Here is a visual:

GL traders. I will probably not be posting for a few weeks. The market should be in correction mode the next 4-5 months. There will be bounces, so be careful.

It appears the short cyle (1/8 the Wall cycle 12-13 days) topped and turned down. The 1/4 Wall cycle remains up. The Half Wall and Wall cycle are down. Also the Kitchin cycle should be entering a hard down phase.

Over all it appears we should have a down week, and I suspect we may test recent lows and potentially head lower after that.

Here is a visual:

GL traders. I will probably not be posting for a few weeks. The market should be in correction mode the next 4-5 months. There will be bounces, so be careful.

Tuesday, April 17, 2012

04-17-2010 observations

Th downturn is now taking a break as the shorter 1/4 Wall cycle has turned up. This will probably last a week or a bit more. The 1/2 wall cycle is down, the wall cycle is down but these will take a few days to build downside momentum. Could we set a new S&P high? Maybe, but I am doubtful this will happen as the Kitchin Cycle should be entering a "hard down" phase. Overall - it appears we trend sideways with a slight upside bias near term (next week or so).

Here is a visual:

GL traders.

Probably 1 more post before I enter the hospital for needed surgery after which I expect to be offline for at least 3-4 weeks as I recover. The next few weeks (and months) could get very interesting as we get a preview of the upcoming bottom in 2013-2014 as several major cycles bottom by 2014. The Kitchin cycle bottoming by mid-September or early October this year gives you that preview.

Here is a visual:

GL traders.

Probably 1 more post before I enter the hospital for needed surgery after which I expect to be offline for at least 3-4 weeks as I recover. The next few weeks (and months) could get very interesting as we get a preview of the upcoming bottom in 2013-2014 as several major cycles bottom by 2014. The Kitchin cycle bottoming by mid-September or early October this year gives you that preview.

Sunday, April 15, 2012

04-15-2012 Going forward

I have encountered some health issues (not insignificant) and may at times be unable to post relevant information in a timely manner over the next few months. I am hopeful I can overcome my health issues over the next few months. I appreciate ll your support the past 1.5 years and wish you the best of luck in your trading. Your best wishes and prayers are GREATLY appreciated. Inlet

Friday, April 6, 2012

04-09-2012 observations

If you looked close at the last set of charts posted you say that as of the end of March (First of April) both the 20 week Wall cycle and 10 week (1/2) Wall were down. This was enough to cause this past week to be down. This combination continues this week and expectations are we get a second down week,

The downside objective is around 1345 (1340-1350) for the week. The downside for April is lower as the 20 week Wall cycle does not bottom until late April (early May). Also keep in mind the Kitchin Cycle should start adding some serious downside by mid April. So a downside of 1300 or lower would not surprise by the end of the month,

We could talk about no new QE by the FED, Spain, or the employment #s - but then the talking heads on CNBC would have nothing to talk about.... Here is a zoomed in chart of the S&P:

GL traders. Sold 1/5 of my RWM that I bought about a week ago for about a 2% profit. Starting to get my cost on RWM down closer to current prices.

The downside objective is around 1345 (1340-1350) for the week. The downside for April is lower as the 20 week Wall cycle does not bottom until late April (early May). Also keep in mind the Kitchin Cycle should start adding some serious downside by mid April. So a downside of 1300 or lower would not surprise by the end of the month,

We could talk about no new QE by the FED, Spain, or the employment #s - but then the talking heads on CNBC would have nothing to talk about.... Here is a zoomed in chart of the S&P:

GL traders. Sold 1/5 of my RWM that I bought about a week ago for about a 2% profit. Starting to get my cost on RWM down closer to current prices.

Sunday, April 1, 2012

04-01-2012 April and beyond - observations

We know Nenner is calling for a top in the 1440s by mid April. How does that mesh with our analysis? Recently we have focused primary on the Kitchin cycle and its component cycles.

The Kitchin is 42-54 months in length. For convenience we have used 42 months in our discussion (measured bottom to bottom). The up leg of the Kitchin tends to be longer than the down phase. Of the 42 months the up phase will normally take 2 1/2 years (30 months) and the down phase 12 months (or more). So the cycle is not perfectly symmetrical as depicted on my charts.

The Kitchen cycle is actually a business cycle (sometimes called the inventory cycle) that we apply to stock analysis. The Kitchin cycle is often mistakenly called the 4 year cycle. The Kitchin cycle is composed of shorter cycles. One third of it as a sub-division (14 months or around 300 trading days). Each third of a Kitchin cycle is made up of 3 Wall cycles (about 4.5 months or 100 trading days). Each third Wall cycle tends to be the weakest in a group of 3 - that is the Wall that is within the downside of the 1/3 of a wall cycle so we see the impact of the 1/3 sub Kitchin cycle. So within the Kitchin cycle the 3rd, 6th and 9th Wall cycles will be the weakest.

The reason to emphasize the Kitchin cycle is we are now 3 years plus into it and should be entering the are of maximum downside pressure (the last 1/8 or 6 months of the cycle). Earliest bottom date could be 2nd week of September. If the cycle runs long it could be later in 2012 or early in 2013 before it bottoms. Given the expiration of Bush tax cuts, the payroll tax deduction, and the sequestering of funds starting in Jan 2013 it may run long.

Here is an ideal representation of the Kitchin cycle from the bottom in Mar 2009:

As you can see from the chart we should be in the "hard down" phase of the Kitchin cycle starting by mud-April. This aligns with Nenner's prediction of a top by then..... So I expect we could see a significant top in April.

Focusing in and looking at the 1/3 Kitchin cycle we see that we are in the 8th (of 9) Wall cycles within the Kitchin cycle. Each Wall cycle is about 4 1/2 months so the current (8th) wall cycle should bottom in late April. Then we go into the 9th Wall cycle (3rd in a group of 3) which tends to be weak. This is rational as the Kitchin cycle should be moving hard down. 4 1/2 months from late April puts you into the mid September time frame where we will start looking for a bottom. As mentioned above - there are tax ramifications Jan 2013 which could extend the down leg of the Kitchin cycle (42-54 months and we are using 42). Note: Many refer to this as the 4 year or presidential election cycle.

Take a close up look at the Kitchin third and Wall cycles:

In summary - we have the Kitchin ready to enter a hard down phase. We have the 3rd of 3 (9th) Wall cycle on deck and normally this would be a weak cycle. So April (as Nenner predicts) could be a pivotal month for a change in trend.

Gl traders

The Kitchin is 42-54 months in length. For convenience we have used 42 months in our discussion (measured bottom to bottom). The up leg of the Kitchin tends to be longer than the down phase. Of the 42 months the up phase will normally take 2 1/2 years (30 months) and the down phase 12 months (or more). So the cycle is not perfectly symmetrical as depicted on my charts.

The Kitchen cycle is actually a business cycle (sometimes called the inventory cycle) that we apply to stock analysis. The Kitchin cycle is often mistakenly called the 4 year cycle. The Kitchin cycle is composed of shorter cycles. One third of it as a sub-division (14 months or around 300 trading days). Each third of a Kitchin cycle is made up of 3 Wall cycles (about 4.5 months or 100 trading days). Each third Wall cycle tends to be the weakest in a group of 3 - that is the Wall that is within the downside of the 1/3 of a wall cycle so we see the impact of the 1/3 sub Kitchin cycle. So within the Kitchin cycle the 3rd, 6th and 9th Wall cycles will be the weakest.

The reason to emphasize the Kitchin cycle is we are now 3 years plus into it and should be entering the are of maximum downside pressure (the last 1/8 or 6 months of the cycle). Earliest bottom date could be 2nd week of September. If the cycle runs long it could be later in 2012 or early in 2013 before it bottoms. Given the expiration of Bush tax cuts, the payroll tax deduction, and the sequestering of funds starting in Jan 2013 it may run long.

Here is an ideal representation of the Kitchin cycle from the bottom in Mar 2009:

As you can see from the chart we should be in the "hard down" phase of the Kitchin cycle starting by mud-April. This aligns with Nenner's prediction of a top by then..... So I expect we could see a significant top in April.

Focusing in and looking at the 1/3 Kitchin cycle we see that we are in the 8th (of 9) Wall cycles within the Kitchin cycle. Each Wall cycle is about 4 1/2 months so the current (8th) wall cycle should bottom in late April. Then we go into the 9th Wall cycle (3rd in a group of 3) which tends to be weak. This is rational as the Kitchin cycle should be moving hard down. 4 1/2 months from late April puts you into the mid September time frame where we will start looking for a bottom. As mentioned above - there are tax ramifications Jan 2013 which could extend the down leg of the Kitchin cycle (42-54 months and we are using 42). Note: Many refer to this as the 4 year or presidential election cycle.

Take a close up look at the Kitchin third and Wall cycles:

In summary - we have the Kitchin ready to enter a hard down phase. We have the 3rd of 3 (9th) Wall cycle on deck and normally this would be a weak cycle. So April (as Nenner predicts) could be a pivotal month for a change in trend.

Gl traders

Thursday, March 29, 2012

03-30-2012 Martin Armstrong

There are few if any experts thought more highly of than Martin Armstrong. Here are recent thoughts from him:

http://www.safehaven.com/article/24880/martin-armstrong-on-the-sovereign-debt-crisis

GL readers

http://www.safehaven.com/article/24880/martin-armstrong-on-the-sovereign-debt-crisis

GL readers

03-30-2012 Charles Nenner speaking out

Been a while (several months) since I have seen anything from Nenner. Now there are multiple articles in March. His view seems to be the stock market tops by mid-April and heads down. I cannot argue with that and have talked about the 42 month Kitchen cycle which bottomed in March 2009 and should bottom around mid Sept 2012. With longer cycles you tend to get the most downside in about the last 1/8th of the cycle (1/8 x 42 = 5.25 months. October less 5 months is April, or time to head south).

Nenner also says he got out of gold last year around $1900, but it is now time to buy gold (and silver) with a target of $2500 on gold ($50+ on silver). But instead of me telling you - read for yourself - here are the links:

http://www.businessinsider.com/gold-2500-2012-3

http://www.forbes.com/sites/johnnavin/2012/03/25/an-interview-with-technical-analyst-charles-nenner/?feed=rss_home

http://finance.yahoo.com/blogs/breakout/market-rally-peak-next-month-charles-nenner-150005109.html

Gl traders

Nenner also says he got out of gold last year around $1900, but it is now time to buy gold (and silver) with a target of $2500 on gold ($50+ on silver). But instead of me telling you - read for yourself - here are the links:

http://www.businessinsider.com/gold-2500-2012-3

http://www.forbes.com/sites/johnnavin/2012/03/25/an-interview-with-technical-analyst-charles-nenner/?feed=rss_home

http://finance.yahoo.com/blogs/breakout/market-rally-peak-next-month-charles-nenner-150005109.html

Gl traders

Sunday, March 25, 2012

03-25-2012 observations

We said last week we expected the market to flatten and then turn down. I would say that is close to what happened. This week we expect the market to grudgingly give some ground. Since it is end of month and end of quarter we may see some portfolio adjustments. A fund that has seen APPL (IBM) exceed 5 % of the portfolio because of its rise may have to trim back under 5% (if they limit any one position to 5%). So we could see some weakness in high fliers if this happens. Not sure to what extent this could be an issue, but if high fliers give ground then the market as a whole will give ground. Just something to keep in mind.

Longer term is operation "Twist". QE1 and QE2 both boosted equities in the spring of 2010 and 2011. TWIST seems to be doing the same this year as the FED sells short term bonds and buys longer term bonds as it attempts to suppress longer term rates. This has been working, but 10 year rates have started to move up, so maybe the FED is out of ammo. Seems they are running out of short term bonds to sell. I suspect we may see a repeat of a sell off as the FED operation "Twist" comes to an end same as we did at the end of QE1 and QE2. And "Twist" may be coming to an end sooner than expected - which could lead to a market downturn as early as April/May (there is some indication of that in the cycles).

Here is the SPX:

GL traders, have a profitable week.

Longer term is operation "Twist". QE1 and QE2 both boosted equities in the spring of 2010 and 2011. TWIST seems to be doing the same this year as the FED sells short term bonds and buys longer term bonds as it attempts to suppress longer term rates. This has been working, but 10 year rates have started to move up, so maybe the FED is out of ammo. Seems they are running out of short term bonds to sell. I suspect we may see a repeat of a sell off as the FED operation "Twist" comes to an end same as we did at the end of QE1 and QE2. And "Twist" may be coming to an end sooner than expected - which could lead to a market downturn as early as April/May (there is some indication of that in the cycles).

Here is the SPX:

GL traders, have a profitable week.

Wednesday, March 21, 2012

03-21-2012 Charts from Victor

Hi Inlet,

So I have an 80/40/20/10 day cycle chart here and it seems to be in line up to a year back. I guess my question is how valid is this? I noticed that you used to reference it but have switched to a Wall Cycle and it now lines up differently because the periods are different lengths

tx,

v

Note: Victor - I inverted colors on your charts to try and make them a bit more readable.... Here are the charts:

So I have an 80/40/20/10 day cycle chart here and it seems to be in line up to a year back. I guess my question is how valid is this? I noticed that you used to reference it but have switched to a Wall Cycle and it now lines up differently because the periods are different lengths

tx,

v

Note: Victor - I inverted colors on your charts to try and make them a bit more readable.... Here are the charts:

Second chart:

Victor - BTW - nice job on the charts. To try and answer your question - I have no license that says my interpretation will always be correct. Your interpretation may be the correct one. I am just glad you are taking the time and interest to do you own analysis. I try and find the interpretation that bests fits the data. I may or may not find that best fit.

Your 80 day length closely tracks T-Theory (see blogs I follow - Terry Laundry - he uses 16 weeks and 5 x 16 = 80).

Tuesday, March 20, 2012

03-21-2012 observations

Not much of a change from last post. I had speculated a 1410 high (we got 1412+ I believe). I also speculated we would get a flattening out (with today's pullback that may be happening). After that we should see a bit of a pullback (under 1400 - maybe 1375). Not the time for a huge pullback yet - got to get all the sheep rounded up for the shearing first?

Here is an updated picture:

GL traders

Here is an updated picture:

GL traders

Friday, March 16, 2012

03-16-2012 observations

We broke above 1400 target. Seems though the market is losing upside momentum. The DOW has been up 7 (or is it 8) days in a row and runs like this are rare and overdue a rest. I suspect we could see 1408-1410 as a top.

In looking at the charts is see once we reach this juncture of cycles though the market tends to go flat for 4-5 days. Here is the SPX showing this:

GL traders

In looking at the charts is see once we reach this juncture of cycles though the market tends to go flat for 4-5 days. Here is the SPX showing this:

GL traders

Tuesday, March 13, 2012

03-14-2012 outlook

A week ago I told you I believed the Qtr Wall cycle had bottomed and we would see a drift up for about 2 weeks. The move up was much sharper than I thought and reached levels higher than I anticipated in such a short period. It now looks as if we may be reaching a top looking at the 25TD DPO (1400?). Tomorrow should give us a clearer picture. It could go somewhat higher as it is still 3-5 TDs to the time that the qtr Wall should top.

Here is the outlook:

GL traders. May buy more RWM if it breaks below $26.

Here is the outlook:

GL traders. May buy more RWM if it breaks below $26.

Thursday, March 8, 2012

03-09-2012 Slow Sto

According to Robert McHugh if the Slow Sto stays above 20 for 2.5 months a sell off normally occurs (+/- 2 weeks). Here is the Slow STO:

Bought back RWM I sold on Tuesday. GL traders.

Bought back RWM I sold on Tuesday. GL traders.

Wednesday, March 7, 2012

03-07-2012 outlook

Looked at some of the stock market blogs. Seems several are talking about a substantial sell off (1200, 1100, 1000, and lower. Now maybe they will be right (eventually), but it appears to me we set a bottom for the quarter Wall cycle (25TDs) yesterday. We now have a substantial gap down that makes a target to be filled as the Quarter Wall cycle turns up. So maybe we get the sell off many are calling for, but it is not going to be straight down. I think we take the next 12 or so TDs repairing the damage from yesterday before we continue down (turn around Mar 19-20).

Here is an updated chart for SPX:

Given this outlook I cashed in 1/2 my RWM position yesterday for a 2+% profit. I will look to buy more RWM down near $27. GL traders.

Here is an updated chart for SPX:

Given this outlook I cashed in 1/2 my RWM position yesterday for a 2+% profit. I will look to buy more RWM down near $27. GL traders.

Monday, March 5, 2012

03-06-2012 Cycles and Elliot Waves

Elliot Waves are a methodology of tracking cycles. I find it tedious with lots of rules and exceptions. But here Elliot Wave in theory as applied to the growth (inventory or Kitchin cycle and its sub cycles):

OK, that is the theory. May not be a perfect fractal as I interpret the Kitchin being divided into 9 Wall cycles. Still I check EW sites from time to time to verify my analysis. I am not an EW analyst, but here is the latest EW counts according to my understanding:

Hope - this enlightens. I feel cycles and Elliot Waves are two different approaches to extract the same information. I believe cycles are the simpler approach.

GL traders

OK, that is the theory. May not be a perfect fractal as I interpret the Kitchin being divided into 9 Wall cycles. Still I check EW sites from time to time to verify my analysis. I am not an EW analyst, but here is the latest EW counts according to my understanding:

Hope - this enlightens. I feel cycles and Elliot Waves are two different approaches to extract the same information. I believe cycles are the simpler approach.

GL traders

Subscribe to:

Posts (Atom)