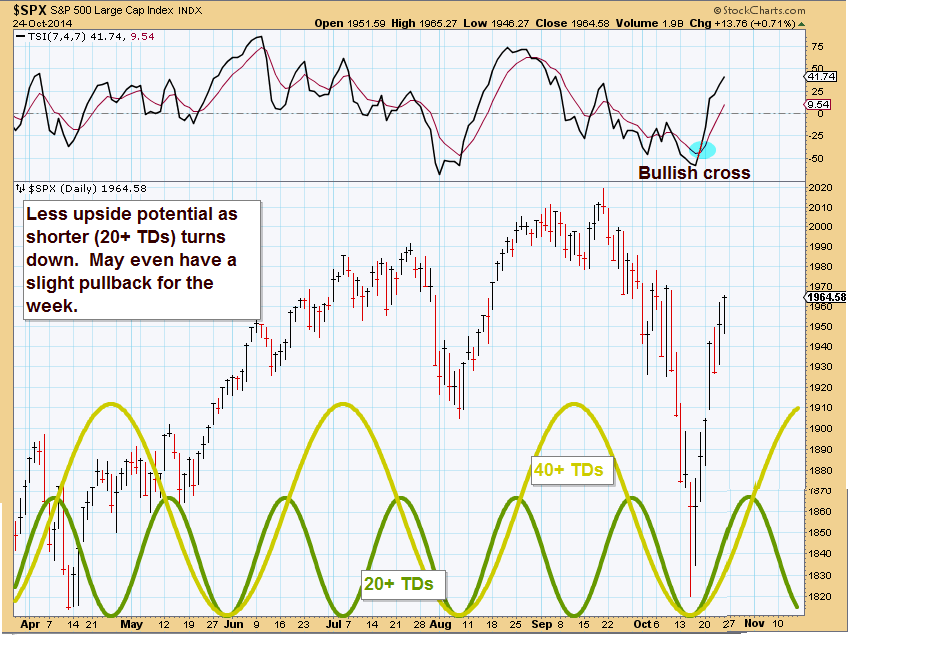

Last week I said to expect some upside from the shorter cycles. Was stronger to the upside than I expected....

This week less upside potential as shorter cycle tops and turns down.

GL traders

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Sunday, October 26, 2014

Saturday, October 18, 2014

Sunday, October 12, 2014

Oct 13, 2014 weekly outlook

I have shown you longer term cycles that indicated we should see market weakness and pullbacks in the Aug-Oct 2014 time frame. Even longer cycles may bottom in 2015-2016. I am beginning to believe the market is now under the influence of these longer cycles (3.5 year Kitchin cycle, 13 1/2-15 month 1/3 Kitchin cycle, 20 week Wall cycle). I have also recently shown you the 7 year Juglar cycle....

We may get an attempt to rally this week as the large banks report, but any rally will be short lived. Here is the outlook (Longer cycles now synched down):

GL traders

10/14/2014 update

An advancing market displays the characteristic of right translated cycles (longer periods advancing than falling). I have mentioned this several times over the past 4-5 years. A declining market is characterized by left translated cycles (down legs are longer in time and decline more than they advance). Usually the declines are more pronounced in a major decline than the advances were in the same amount of time. I showed you a chart recently showing major cycles advancing about 5.5 years to lose those advances to a large extent in 1.5 to 2 years. Here is the recent market - note the left translated cycles (peaks left of the center line of the cycle):

Left translation continues?

We may get an attempt to rally this week as the large banks report, but any rally will be short lived. Here is the outlook (Longer cycles now synched down):

GL traders

10/14/2014 update

An advancing market displays the characteristic of right translated cycles (longer periods advancing than falling). I have mentioned this several times over the past 4-5 years. A declining market is characterized by left translated cycles (down legs are longer in time and decline more than they advance). Usually the declines are more pronounced in a major decline than the advances were in the same amount of time. I showed you a chart recently showing major cycles advancing about 5.5 years to lose those advances to a large extent in 1.5 to 2 years. Here is the recent market - note the left translated cycles (peaks left of the center line of the cycle):

Left translation continues?

Saturday, October 4, 2014

Oct 6, 2014 weekly outlook

Last week said a short term bottom was expected. Bottom was 1 day later than expected. Recovered a substantial part of the loss from earlier in the week by Friday. Short term it appears we should see some gain first part of this week. Expect a top by Friday unless the unexpected happens in Europe, mid East or China. We could also see multiple cases of Ebola in Dallas (fear is not good for the market).

But based on short cycles expect continued volatility with market highs in latter part of week or fist of following week...

Here is a short term chart outlook:

GL traders. I expect to replenish my RWM positions by end of week...

update after close 10/07/2014

Weakness continued and buy signals failed to materialize...

Longer term charts showing weak Oct seem to be in effect.

But based on short cycles expect continued volatility with market highs in latter part of week or fist of following week...

Here is a short term chart outlook:

GL traders. I expect to replenish my RWM positions by end of week...

update after close 10/07/2014

Weakness continued and buy signals failed to materialize...

Longer term charts showing weak Oct seem to be in effect.

Subscribe to:

Posts (Atom)