I generally hold some Russell inverse (RWM) as a hedge against long positions. I don't hold the shares passively but usually write calls after an 8-10% up move. The last calls I wrote in late December just expired worthless. Even with the proceeds from the calls I still have a small loss on my RWM positions as I wait for a pop to write more calls.

It appears to me that the maket should top this week. So I believe you should consider taking some profits or alternatively buy some inverses like RWM to hedge your gains if you wish to maintain your holdings. No one knows exactly when but sooner or later there will be another 40-50% sell down like the early 2000s or like 2008-2009 and inverses will soar. Many analysts believe that could start in 2013. History tells us that the average length of a bull run is about 4 years. 2009+ 4 is 2013. Or, history tells us that the 2 years after a presidential election tends to lag...

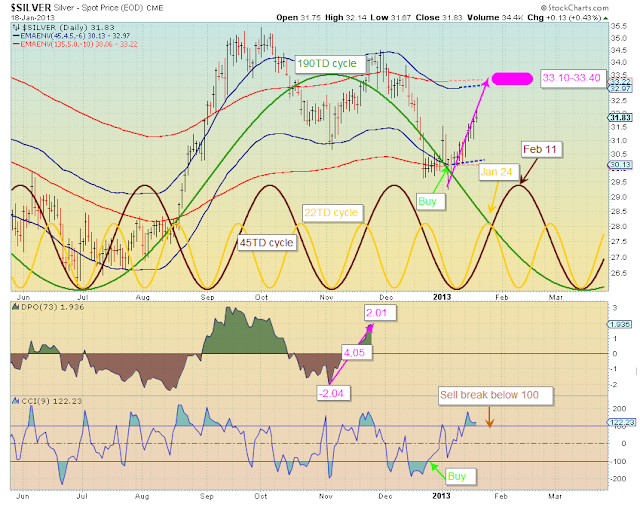

With this in mind I looked more closely at the RWM chart. Here is the results: