The second part of our 2014 outlook is based on how the cycles align. Recently the market does not seem to align with our cycle projection. Ever so often we seem to get a short cycle (or long cycle) in the cycles we follow for swing trading. According to some authorities I have read these variations in length conform to Fibonacci ratios.

When this happens we see highs when we were expecting pull backs (like now). Never argue with the data, but adapt positioning the cycles to match the data. So I have attempted to do this. It appears we will make a yearly high around mid-January 2014, a yearly low around mid-August. Lesser highs around mid-June and late October. A lesser low around the first of April.

These projections do not attempt to account for longer cycles that should bottom in the second half of 2014. There is the Grand Super Cycle (120 years - 1774, 1894, 2014?). This cycle divides into 2 K-Waves of 60 years (1894, 1954, 2014). Each K-Wave divides into 2 Super cycles of 30 years (1954, 1984, 2014). Of lesser degree are cycles of about 7-9 years (Juglar or Pi cycle (3141 days/8.6 years)), and the Kuznet cycle of 15-17 years. Kress used 40 year and 12 year divisions of the longer cycles I believe. Needless to say some are projecting a very serious downturn in 2014.

Here is 2014 graphic projections:

Happy New Year and a profitable 2014

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Tuesday, December 31, 2013

Saturday, December 28, 2013

Outlook for 2014 Part 1

Seems every talking head on CNBS (and most bloggers) see nothing but blue skies for 2014. But there are negatives - the longer the market extends the bull run the nearer we are to a turn down (that is a fact and not subject to debate). So as the market moves higher I become more negative about the market future. Do I know what the market will do in 2014? Absolutely not.

You have lots of gurus telling you the positives so I will discuss some of the cautionary signs:

1). At more than two standard deviations above its 50-day, the S&P is actually the most overbought it has been since mid-May. So near term (say first quarter 2014) a correction of 10% would be normal given this.

2). The percentage of bullish individuals rose to 55.1%, the highest level in nearly three years, in the week ended Dec. 25, according to the American Association of Individual Investors. That was a jump from the 47.5% of investors who said they were bullish the previous week. See item 1 (suggests market over bought and a correction would be expected).

3). The market for junk-rated loans increased to $683 billion, exceeding the 2008 peak of $596 billion, according to Standard and Poor’s Capital IQ Leveraged Commentary and Data. We are seeing levels that break prior peaks in several areas. Expect these extremes to get corrected (I suspect sooner rather than later).

http://www.bloomberg.com/news/2013-12-23/junk-loans-top-08-record-as-safeguards-stripped-credit-markets.html

4) The talking heads on CNBS keep telling us how reasonable the PE is, but the CAPE (10 year average of price/Earning) is a better predictor of future stock action.

The Cape in the mid 20s is at levels more commonly seen at market peaks.

5). Stocks are rising on low volume. A strong market normally rises on increased volume so this is a concern.

6). Margin debt is at levels seen in the early 2000s and 2007. People/institutions are borrowing large amounts of $s to buy stocks. This is a quicksand foundation supporting stock prices.

7). There is no fear. See item 2 - AAII bullish percentage. The VIX is known as the FEAR index. It has been low for several months. The last time you saw the VIX this low for this long was 2007-8. Caution is indicated.

8). The MSM talking heads keep talking PEs based on 2014 forecasted earnings to predict higher stock prices. It is fairly normal for earnings forecasts to decrease over time so these 2014 projections should be viewed with some skepticism.

9). In 2013 the rate of revenue growth slowed down, profits rose primarily due to increased margins. There are limits as to how much companies can cut costs and increase margins and they are probably close to that limit. Future profit growth will depend more on economic growth.

10). See item 4 (CAPE). Even the regular PE is starting to get a bit high because in 2013 the increase in stock prices was due primarily due to increased PEs and not earnings growth.

These are only some of the challenges the economy and stock market will face in 2014. There are items like ACA (Obamacare) that start to get more fully implemented over the next couple of years (partially postponed into 2015 by Obama). It seems unclear of the total impact of this. We know that state run health care in other countries have proven to be burdensome and ineffective. We also know that over 30 taxes/fees go in to effect in January. Resources diverted to health care cannot be spent on housing, autos, clothing and travel so this will have a dampening effect on the economy. It is uncertain how extensive this effect will be.

There is also the Dodd/Franks bill that financial institutions have to deal with. This will probably increase the cost of credit. This may impact fees retailers can charge for the use of credit cards. The cost to the consumer of this added regulation by multiple government agencies is unknown at this time.

You have lots of gurus telling you the positives so I will discuss some of the cautionary signs:

1). At more than two standard deviations above its 50-day, the S&P is actually the most overbought it has been since mid-May. So near term (say first quarter 2014) a correction of 10% would be normal given this.

2). The percentage of bullish individuals rose to 55.1%, the highest level in nearly three years, in the week ended Dec. 25, according to the American Association of Individual Investors. That was a jump from the 47.5% of investors who said they were bullish the previous week. See item 1 (suggests market over bought and a correction would be expected).

3). The market for junk-rated loans increased to $683 billion, exceeding the 2008 peak of $596 billion, according to Standard and Poor’s Capital IQ Leveraged Commentary and Data. We are seeing levels that break prior peaks in several areas. Expect these extremes to get corrected (I suspect sooner rather than later).

http://www.bloomberg.com/news/2013-12-23/junk-loans-top-08-record-as-safeguards-stripped-credit-markets.html

4) The talking heads on CNBS keep telling us how reasonable the PE is, but the CAPE (10 year average of price/Earning) is a better predictor of future stock action.

The Cape in the mid 20s is at levels more commonly seen at market peaks.

5). Stocks are rising on low volume. A strong market normally rises on increased volume so this is a concern.

6). Margin debt is at levels seen in the early 2000s and 2007. People/institutions are borrowing large amounts of $s to buy stocks. This is a quicksand foundation supporting stock prices.

7). There is no fear. See item 2 - AAII bullish percentage. The VIX is known as the FEAR index. It has been low for several months. The last time you saw the VIX this low for this long was 2007-8. Caution is indicated.

8). The MSM talking heads keep talking PEs based on 2014 forecasted earnings to predict higher stock prices. It is fairly normal for earnings forecasts to decrease over time so these 2014 projections should be viewed with some skepticism.

9). In 2013 the rate of revenue growth slowed down, profits rose primarily due to increased margins. There are limits as to how much companies can cut costs and increase margins and they are probably close to that limit. Future profit growth will depend more on economic growth.

10). See item 4 (CAPE). Even the regular PE is starting to get a bit high because in 2013 the increase in stock prices was due primarily due to increased PEs and not earnings growth.

These are only some of the challenges the economy and stock market will face in 2014. There are items like ACA (Obamacare) that start to get more fully implemented over the next couple of years (partially postponed into 2015 by Obama). It seems unclear of the total impact of this. We know that state run health care in other countries have proven to be burdensome and ineffective. We also know that over 30 taxes/fees go in to effect in January. Resources diverted to health care cannot be spent on housing, autos, clothing and travel so this will have a dampening effect on the economy. It is uncertain how extensive this effect will be.

There is also the Dodd/Franks bill that financial institutions have to deal with. This will probably increase the cost of credit. This may impact fees retailers can charge for the use of credit cards. The cost to the consumer of this added regulation by multiple government agencies is unknown at this time.

Wednesday, December 25, 2013

2013 end-of-year outlook

The FED announcement of "taper" seemed to turn the market. Not sure I understand it - $10b a month is a small fraction of the $85b a month of QE being inserted into the monetary system by the FED. Of course - when looking at M1 velocity one sees M1V has quit going down and is now flat which implies that the FED needs to stop printing money or they are going to cause serious inflation. Also, much of the derivatives that existed back in 2008-9 have been offset, cancelled or expired (for example AIG has cleared their balance sheet of derivatives and paid back the government) so this destruction of fiat currency is no longer threatening a deflationary recession and inflation is more likely. Here is M1V showing that monetary velocity is ready to turn up:

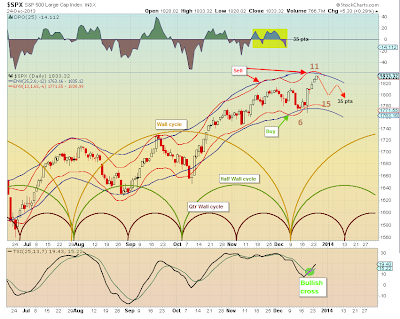

I expect though that the FED taper move has been more than compensated for by the market. We now have had the short 10-11 TD cycle up for about 5 days so it should turn down into the end of 2013 (start of 2014) then a short up tick of 4-5 days an then down into mid-January (4-5 days down) where we have a full moon.

Here is the SPX with annotated expectations:

Merry Christmas, Happy New Year and GL traders

I expect though that the FED taper move has been more than compensated for by the market. We now have had the short 10-11 TD cycle up for about 5 days so it should turn down into the end of 2013 (start of 2014) then a short up tick of 4-5 days an then down into mid-January (4-5 days down) where we have a full moon.

Here is the SPX with annotated expectations:

Merry Christmas, Happy New Year and GL traders

Sunday, December 15, 2013

dec 16, 2013 weekly outlook

As expected the downside pressure from several cycles kept the market negative most of the week. The downside pressure should continue through the end of the year. But with a preponderance of down days over the past 2+ weeks we may be due an up day first part of the week. Still, the week should be down (I'd guess 1-2%) for the week.

Here is the visual:

GL traders

Here is the visual:

GL traders

Friday, December 13, 2013

2014 outlook - Bradley turn dates for 2014

Notice 2014 starts out at a low point (corresponds to my projections of cycles bottoming end of December or early January). Also corresponds with a new moon. Mid year is projected as the high point for the year (preliminary work shows this should align with my projections).

Here is the Bradley turn dates for 2014:

Key dates are 1/1, 7/16 and 11/20 in 2014.

I'll post my 2014 projections before year end and other projections when/if I come across them.

Here is the Bradley turn dates for 2014:

Key dates are 1/1, 7/16 and 11/20 in 2014.

I'll post my 2014 projections before year end and other projections when/if I come across them.

Friday, December 6, 2013

Dec 9, 2013 weekly outlook

Friday wiped most of the downside achieved Monday thru Thursday. Friday was the reversal of a short 10 day cycle (bottomed Thursday). See for yourself:

Even though it appears we could have short term chop next week over all I suspect the general pressures are down between now and year end as the following chart illustrates:

GL traders

update 12/11 - 4:45pm EST - Appears the short cycle (10 days - 5 up/5 down) has become left translated with 2-3 days up.

Even though it appears we could have short term chop next week over all I suspect the general pressures are down between now and year end as the following chart illustrates:

GL traders

update 12/11 - 4:45pm EST - Appears the short cycle (10 days - 5 up/5 down) has become left translated with 2-3 days up.

Sunday, December 1, 2013

Outlook for December 2013

November proved to be more of an up market than I anticipated as intermediate length cycles continued to be right translated (up trend action). Going in to December the Kitchin cycle remains up still. The Kitchin third cycle remains in its down leg. The Wall cycle should have topped and turned down. The Half Wall cycle remains in an up leg and the Qtr Wall is in a down leg (see prior post for short cycle chart).

So we have the Kitchin cycle and Half Wall up. The remaining cycles are down. So December should be down for the month (bottom around Christmas?).

Here are the longer cycles:

GL traders

12/04/2013 update - Great chart:

http://static.safehaven.com/authors/readtheticker/32002_b_large.png

http://www.safehaven.com/article/32002/sp500-wall-and-kitchin-cycle-review

So we have the Kitchin cycle and Half Wall up. The remaining cycles are down. So December should be down for the month (bottom around Christmas?).

Here are the longer cycles:

GL traders

12/04/2013 update - Great chart:

http://static.safehaven.com/authors/readtheticker/32002_b_large.png

http://www.safehaven.com/article/32002/sp500-wall-and-kitchin-cycle-review

Saturday, November 30, 2013

Dec 2, 2013 weekly outlook

The prior week showed little volatility and closed the week largely unchanged (up very moderately). I had expected a slight pullback instead of the slight advance. Can't always be exact when you have the shorter cycles going in opposite directions and the longer cycles at a point where they should change direction.

This week the longer cycles will be farther along the turn down and should start showing some added influence. The half Wall cycle is up but should top during the week so its upside momentum should be about spent. Overall though downside influence should prevail for the week.

Here is a visual for the short term cycles:

GL traders

This week the longer cycles will be farther along the turn down and should start showing some added influence. The half Wall cycle is up but should top during the week so its upside momentum should be about spent. Overall though downside influence should prevail for the week.

Here is a visual for the short term cycles:

GL traders

Sunday, November 24, 2013

Looking for clues

As we follow the cycles we look for other clues (context) as to what the market may do over the next few months. Saw a chart of G7 industrial output and leading indicators. Noted the similarity between 2005-07 and 2011-13. So I placed the 2005-07 results underneath the 2011-13 results so you could observe what I saw. Does this mean we see another 2009? not necessarily, but then maybe we see that or worse.

Here is the chart - you be the judge:

GL traders

Update 11/26

Here is the chart - you be the judge:

GL traders

Update 11/26

Friday, November 22, 2013

Nov 25, 2013 weekly outlook

I speculated the week just past would be sideways with a modest range. So we were down 3 days on the DOW and up 2 days with a slight gain for the week. Not a bad call for the week. The one prediction I will make for the coming week is Thursday will be unchanged!!!

The Wall cycle is now down and increasing in downside momentum. The quarter Wall (lunar) Cycle should also be down. The Half Wall is up, This combination will give us sideways action, but the bias should be to the downside. Again I expect volatility to be moderate and no huge moves before December....

See for yourself:

GL traders

Nov 26 10:00 am update:

The Wall cycle is now down and increasing in downside momentum. The quarter Wall (lunar) Cycle should also be down. The Half Wall is up, This combination will give us sideways action, but the bias should be to the downside. Again I expect volatility to be moderate and no huge moves before December....

See for yourself:

GL traders

Nov 26 10:00 am update:

Monday, November 18, 2013

How do we identify a bubble?

Early in a cyclic bull market the moves are large and long (relatively speaking). As the market advances usually the moves become smaller and shorter. By the time we reach bubble territory the cycles have become frequent and shallow. So we know what to look for to know when the markets are becoming over valued.

Here is the current situation:

GL traders

Here is the current situation:

GL traders

Sunday, November 17, 2013

nov 18, 2013 weekly outlook

The market continues up. As I have commented in the past RIGHT translated cycles (top past mid cycle) occur within a rising trend. And the last 3 intermediate cycles have been right translated. So until proven otherwise the market is in a rising trend even though I anticipate a top in the near future.

I also mentioned last week I expected sideways to up action this past and current week. Last week we got upside action, so this week stands an improved chance of some downside action, but overall I expect sideways without much upside or downside action.

The Wall cycle should have topped and turned down. The Half Wall cycle bottomed and is up (as did the Qtr Wall cycle) which offsets the Wall cycle (hence the sideways expectation).

Here is a visual:

GL traders

I also mentioned last week I expected sideways to up action this past and current week. Last week we got upside action, so this week stands an improved chance of some downside action, but overall I expect sideways without much upside or downside action.

The Wall cycle should have topped and turned down. The Half Wall cycle bottomed and is up (as did the Qtr Wall cycle) which offsets the Wall cycle (hence the sideways expectation).

Here is a visual:

GL traders

Monday, November 11, 2013

The long cycles

The longest cycle most cycle advocates follow is the K-Wave (about 60 years) which last bottomed in 1949 (according to most cyclists). The 2 cycles contained in the K-Wave are often referred to as Super Cycles and are about 32 years in length (Last bottom 1982). Each Super cycle contains 2 Kuznet cycles (about 16 years in length - last bottom around 1998. Then there is the Juglar cycle (about 8 years in length) and finally the Kitchin cycles (2 in a Juglar cycle) which we often refer to. Here is a visual:

As you can see these long cycles are set to bottom in 2014 or 2015. Not all will bottom at the same time as depicted, but 2014 and 2015 may be a period like 1929 for the history books.

As you can see these long cycles are set to bottom in 2014 or 2015. Not all will bottom at the same time as depicted, but 2014 and 2015 may be a period like 1929 for the history books.

Saturday, November 9, 2013

Nov 11, 2013 weekly outlook

The week did not play out as anticipated. Mixed week with DJIA up, but some of the other indexes down for the week. Any pull back during the week was not near the expected pull back. It seems the 23TD (lunar or quarter Wall) cycle is no longer dominant, but the Wall cycle(140 calendar days) appears to have become dominant. I find the change of dominance of cycles one of the least predictable events.

So we see a small pull back during the week as the Wall Tops (dominates) and the 23TD and half Wall cycles bottoms. Here is a visual:

GL traders - the Wall cycle is now down into early Jan 2014 and if as expected it dominates 2013 should finish down, but the next 2 weeks will be sideways to slightly up.

So we see a small pull back during the week as the Wall Tops (dominates) and the 23TD and half Wall cycles bottoms. Here is a visual:

GL traders - the Wall cycle is now down into early Jan 2014 and if as expected it dominates 2013 should finish down, but the next 2 weeks will be sideways to slightly up.

Sunday, November 3, 2013

The Kitchin Cycle (is it Bibical?)

Daniel 12:4 ...'even to the time of the end: many shall run to and fro, and knowledge shall be increased.' "run to and fro" - we have our autos trains and planes and we run to and fro like never before in history. "knowledge shall be increased" - this has accelerated as we solve the mystery of gene mapping and many complex mysteries of life.

Just a small sample of secrets revealed in the Bible that may tells one what to expect.

The Tribulation would climax in the Jews being delivered into the hand of their enemy for 3 1/2 years, "a time, times and half a time" (Dan. 7:25) (1260 days).

Nazi extermination camps operated 3 1/2 years. Was the demonic attempt to exterminate the Jewish people foretold in the Bible? 3 1/2 years is a oft repeated time frame in the Bible. It is 42 months or what is referred to as a Kitchin cycle.

Also, 7 is a number common in the Bible. Seven days (the seventh day is the Sabbath, 7th year is a Sabbath year, 49 years (7x7) is followed by Jubilee. Revelation is sometimes referred to as the "Book of 7s" because of the common occurrence of that number in Revelations.

So do events occur on 7 year timelines? In 1987 there was the crash, in 1994 there was the Asian financial crisis (also Mexico and Turkey), in 2001 the "dotcom" crash, in 2008 the financial crisis (bottom early 2009) and in 2015 another economic failure (???).

I am not pushing the Christian faith, just observing cycle/patterns in the Bible and the accuracy of prophecy made as long 3500 years ago (Daniel).

I invite you to do your research.... Hint: search "bible 1260" will get you started.

Just a small sample of secrets revealed in the Bible that may tells one what to expect.

The Tribulation would climax in the Jews being delivered into the hand of their enemy for 3 1/2 years, "a time, times and half a time" (Dan. 7:25) (1260 days).

Nazi extermination camps operated 3 1/2 years. Was the demonic attempt to exterminate the Jewish people foretold in the Bible? 3 1/2 years is a oft repeated time frame in the Bible. It is 42 months or what is referred to as a Kitchin cycle.

Also, 7 is a number common in the Bible. Seven days (the seventh day is the Sabbath, 7th year is a Sabbath year, 49 years (7x7) is followed by Jubilee. Revelation is sometimes referred to as the "Book of 7s" because of the common occurrence of that number in Revelations.

So do events occur on 7 year timelines? In 1987 there was the crash, in 1994 there was the Asian financial crisis (also Mexico and Turkey), in 2001 the "dotcom" crash, in 2008 the financial crisis (bottom early 2009) and in 2015 another economic failure (???).

I am not pushing the Christian faith, just observing cycle/patterns in the Bible and the accuracy of prophecy made as long 3500 years ago (Daniel).

I invite you to do your research.... Hint: search "bible 1260" will get you started.

Nov 4, 2013 weekly outlook

The big cap stocks (S and P, Dow) do not seem to want to pull back and give us a cycle bottom. On the other hand the NAZ and Russell 2K were down for the week. So we have a mixed market whereas I expected a pull back of the whole market. But the down leg of the cycle should last most of the week. We will know by Friday.

Here is a visual of the market (SPX):

GL traders

Here is a visual of the market (SPX):

GL traders

Thursday, October 31, 2013

Nov 2013 monthly outlook

When we look at longer cycles we should remember that most of the downside occurs within the last 1/8th or so of the cycle. For example: if it were a Wall cycle (~~4 1/2 months) we would expect the most damage within the last month of the cycle. Or, 1/3 of a Kitchin Cycle (~~13 1/2 months) would have the most down side action with the last 2 months of the cycle. We are entering the period where we should start seeing that down side pressure from the 1/3 Kitchin cycle early in November and the down side pressure from the Wall Cycle by the end of November.

Additionally we have the interplay of the shorter cycles (which I will try to cover weekly) as these longer cycles start giving us market weakness strengthening throughout November and reaching a point of maximum downside by year end.

Here is the picture for November:

GL traders

Additionally we have the interplay of the shorter cycles (which I will try to cover weekly) as these longer cycles start giving us market weakness strengthening throughout November and reaching a point of maximum downside by year end.

Here is the picture for November:

GL traders

Saturday, October 26, 2013

oct 28, 2013 weekly outlook

Expected the week just past to end up to the down side. Instead the SPX was up about 1% for the week. The shorter 12TD cycle appears to have asserted itself, and now should be turning down so for the coming week we should see the 12TD and 23/24TD (lunar) shorter cycles down. The 1/2 Wall cycle is down as the Wall cycle tops. So I would not be surprised to see 1 or 2 days down with some vigor...

Here is a visual:

GL traders

Update: Take a look at new post on cycles:

http://www.safehaven.com/article/31589/the-3521-month-3-year-cycle-revisited

Here is a visual:

GL traders

Update: Take a look at new post on cycles:

http://www.safehaven.com/article/31589/the-3521-month-3-year-cycle-revisited

Saturday, October 19, 2013

week of Oct 21, 2013 outlook

I had the market direction correct for the week just ended, but I was not aggressive enough on my upside projections. We may have seen the top of this 23TD (lunar) cycle as we there was a full moon Oct 18.

Assuming a top we should see 2 weeks down for the 23TD (lunar) cycle into the new moon in early November. After that we will see as some longer cycles may exert more pressure than they have in the recent past (Wall cycle, 1/3 Kitchin cycle) as they should bottom in early January.

Here is a visual for the next week:

GL traders

Assuming a top we should see 2 weeks down for the 23TD (lunar) cycle into the new moon in early November. After that we will see as some longer cycles may exert more pressure than they have in the recent past (Wall cycle, 1/3 Kitchin cycle) as they should bottom in early January.

Here is a visual for the next week:

GL traders

Saturday, October 12, 2013

Oct 14, 2013 weekly outlook

The week started out as if it was going to be a disaster for the bulls and an all you can eat picnic for the bears. Looked like my expectations of a move up to SPX 1700 was a fantasy... Then Thursday happened and the market regained what it had lost Mon-Wed. By Friday we saw the SPX 1700. The spring got wound tight the first 3 days and reacted strongly Thur when it was released. So the market bottomed a couple of days late (new moon was Saturday), but the large caps turned up as expected (small caps pretty much flat for the week).

Can the Mess in DC affect the cycles? I would think so in the short term (a few days), but longer term the cycles will follow their natural course. One thing is fairly certain, unless we get some resolution (like - kick the can) volatility will increase. I suspect any short term agreement of 2-3 months will weigh on the market adding to any natural cyclic down turn (which I believe will start around mid October).

First though any agreement (even short term) would probably boost the market for a week or so. Don't forget earnings season is upon us. Appears the eateries are missing (5 of 5 last week), two large banks looked less than robust and it appears Penny's is into heavy discounting which is impacting retailers (Gap, Fitch, etc.),

I noticed also California had installed a new computer system for unemployment claims and had under reported claims for the last few weeks by about 15,000 a week - so the unemployment claims numbers in September looked good but were garbage.

It is my opinion we have several factors converging that could give us a 10-15% correction by the end of the year. In the meantime next week should be up 1 % or so.

Here is a visual:

GL traders

Can the Mess in DC affect the cycles? I would think so in the short term (a few days), but longer term the cycles will follow their natural course. One thing is fairly certain, unless we get some resolution (like - kick the can) volatility will increase. I suspect any short term agreement of 2-3 months will weigh on the market adding to any natural cyclic down turn (which I believe will start around mid October).

First though any agreement (even short term) would probably boost the market for a week or so. Don't forget earnings season is upon us. Appears the eateries are missing (5 of 5 last week), two large banks looked less than robust and it appears Penny's is into heavy discounting which is impacting retailers (Gap, Fitch, etc.),

I noticed also California had installed a new computer system for unemployment claims and had under reported claims for the last few weeks by about 15,000 a week - so the unemployment claims numbers in September looked good but were garbage.

It is my opinion we have several factors converging that could give us a 10-15% correction by the end of the year. In the meantime next week should be up 1 % or so.

Here is a visual:

GL traders

Monday, October 7, 2013

indexes diverge

You may have noticed last week the Russell and NAS were setting new highs as the SandP 500 and DJIA were down. Most of the time we expect these indexes to move in synch not diverge.

So as we were seeing a head and shoulders on the SPX one would expect to see an inverse Head and shoulders for RWM (inverse Russell 2000). We didn't see that. Instead we saw a "W" pattern. Take a look:

So how do we explain this divergence from a cycle perspective. I looked and I saw that instead of the 23TD cycle being dominant for the Russell 2000 that the 1/2 Wall Cycle (~~50TDs) was dominant. So this cycle was topping (dominating the Russell) as the 23TD was bottoming (dominating the SandP 500). See for yourself:

So we cannot assume that these indexes will behave the same going forward. It appears the 1/2 Wall cycle is down (Russell) now and the 23TD cycle (SPX) should be turning up now. In short the Russell should lead any downturn, so watch the Russell for the expected move by the larger (DJIA, SPX) stock indexes.

GL traders

So as we were seeing a head and shoulders on the SPX one would expect to see an inverse Head and shoulders for RWM (inverse Russell 2000). We didn't see that. Instead we saw a "W" pattern. Take a look:

So how do we explain this divergence from a cycle perspective. I looked and I saw that instead of the 23TD cycle being dominant for the Russell 2000 that the 1/2 Wall Cycle (~~50TDs) was dominant. So this cycle was topping (dominating the Russell) as the 23TD was bottoming (dominating the SandP 500). See for yourself:

So we cannot assume that these indexes will behave the same going forward. It appears the 1/2 Wall cycle is down (Russell) now and the 23TD cycle (SPX) should be turning up now. In short the Russell should lead any downturn, so watch the Russell for the expected move by the larger (DJIA, SPX) stock indexes.

GL traders

Saturday, October 5, 2013

Week of Oct 7, 2013 outlook

The dominant cycle is the 23TD (lunar) cycle and we just experienced a new moon phase Saturday Oct 4 so Thursday was possibly the cycle low (but a low on Monday is also possible). Regardless next week should close up as this cycle turns up.

We have a longer 10 week (1/2 Wall cycle) turning down so this should limit the 23TD cycle up leg over the next 2 weeks (or so). I expect a high for the week around 1700. Over the 2 weeks up leg I expect the cycle to set a lower high in the 1710-15 area as the market sets up for a move down after mid-October.

Take a look:

GL traders

We have a longer 10 week (1/2 Wall cycle) turning down so this should limit the 23TD cycle up leg over the next 2 weeks (or so). I expect a high for the week around 1700. Over the 2 weeks up leg I expect the cycle to set a lower high in the 1710-15 area as the market sets up for a move down after mid-October.

Take a look:

GL traders

Wednesday, October 2, 2013

Nenner outlook from mid-August interview

Does his outlook match what I have told you?

http://www.moneynews.com/StreetTalk/charles-nenner-recession-economy-united-states/2013/08/19/id/521167?s=al

GL traders

http://www.safehaven.com/article/31337/bad-news-and-the-october-outlook

Another guru's outlook

http://www.moneynews.com/StreetTalk/charles-nenner-recession-economy-united-states/2013/08/19/id/521167?s=al

GL traders

http://www.safehaven.com/article/31337/bad-news-and-the-october-outlook

Another guru's outlook

Tuesday, October 1, 2013

Outlook for Oct 2013

New moon Oct 5 and that often marks monthly lows (Friday Oct 4 or Mon Oct 7). This may be an exception even though there should be some move up into mid-October. After mid-month there should be substantial downside pressures as longer cycles have topped and had time to build some downside momentum. Add to that that the lunar cycle will also have topped by around Oct 18 and turned down.

So if we are to get a 10% or greater pullback in 2013 odds favor that happening after Oct 15. Most of the downside for longer cycles will happen in the last half of the down leg as the turn down requires the first half of the leg to turn and develop downside momentum. So if we get the expected down trend well under way by the end of October then it should accelerate in November and December and bottom by around year end.

Here is a visual of the longer term outlook:

GL

So if we are to get a 10% or greater pullback in 2013 odds favor that happening after Oct 15. Most of the downside for longer cycles will happen in the last half of the down leg as the turn down requires the first half of the leg to turn and develop downside momentum. So if we get the expected down trend well under way by the end of October then it should accelerate in November and December and bottom by around year end.

Here is a visual of the longer term outlook:

GL

Saturday, September 28, 2013

Week of Sep 30, 2013 outlook

The lunar (23TD) cycle appears to be the dominant shorter cycle. It is now about hallway through its down leg which suggests that we should have a second week down. The move should be about 1% (15 or so points) for the week. Hope this visual helps:

GL traders

Hourly chart SnP - Head and Shoulders (symmetrical) pattern suggests down trend in effect:

GL traders

Hourly chart SnP - Head and Shoulders (symmetrical) pattern suggests down trend in effect:

Wednesday, September 25, 2013

tops, bottoms, uptrends, downtrends part 2

In part 1 I discussed tops and bottoms and patterns often associated with tops and bottoms. This was not intended to identify specific buy or sell points, but to provide alerts that a change was probably taking place. Given this knowledge you would use your other tools to identify specific buy/sell points.

But, how do I know if a trend is apt to continue. If the tops of a trend is right translated (the up leg is longer - time and amplitude) then the market is in an uptrend and that trend will probably continue as long as the shorter cycles are right translated. Once, these shorter cycles become symmetrical then most like a trend change is in the making. People talk of flags wedges, diagonals etc. which are a result of the cycles being right translated.

Take a look (Note: I am using charts of the recent past to illustrate my points and not searching past history to find a period that proves my discussion):

Now, we could probably identify flags, wedges, diagonals and other formations on the chart, but why would we want to do that when we have a much simpler way to evaluate whether a trend is apt to continue up (we continue to hold our long position) or we tighten stops as we suspect a top is near. Our other tools will aid us in identifying a more exact time/price to act.

Finally, how do we know if we are in a downtrend and if that trend will continue?

Again many technicians focus on patterns as with up trends. But, we have a simpler approach because we know cycles can be symmetrical (top or bottoms) or right translated (up trends) and that leaves one other option - Left translated. When the tops are left translated the down trend is apt to continue. When we get a symmetrical bottom (W, V, inverted head and shoulders, etc.) most likely we are witnessing a bottom and a trend change to up.

Let's look at a recent example see:

Note the "W" shaped bottom, not a perfect "W" but close...

So by mere observation you can often identify future market action. You don't have to be a super technician to do so. Hope you find this discussion helpful.

But, how do I know if a trend is apt to continue. If the tops of a trend is right translated (the up leg is longer - time and amplitude) then the market is in an uptrend and that trend will probably continue as long as the shorter cycles are right translated. Once, these shorter cycles become symmetrical then most like a trend change is in the making. People talk of flags wedges, diagonals etc. which are a result of the cycles being right translated.

Take a look (Note: I am using charts of the recent past to illustrate my points and not searching past history to find a period that proves my discussion):

Now, we could probably identify flags, wedges, diagonals and other formations on the chart, but why would we want to do that when we have a much simpler way to evaluate whether a trend is apt to continue up (we continue to hold our long position) or we tighten stops as we suspect a top is near. Our other tools will aid us in identifying a more exact time/price to act.

Finally, how do we know if we are in a downtrend and if that trend will continue?

Again many technicians focus on patterns as with up trends. But, we have a simpler approach because we know cycles can be symmetrical (top or bottoms) or right translated (up trends) and that leaves one other option - Left translated. When the tops are left translated the down trend is apt to continue. When we get a symmetrical bottom (W, V, inverted head and shoulders, etc.) most likely we are witnessing a bottom and a trend change to up.

Let's look at a recent example see:

So by mere observation you can often identify future market action. You don't have to be a super technician to do so. Hope you find this discussion helpful.

Monday, September 23, 2013

Tops, bottoms, uptrends, downtrends part 1

From time to time I try to include discussion to help you with your own analysis. This is one of those occasions.

You hear/read discussions about different chart patterns and usually whether it is a topping or bottoming pattern. They may also discuss trend continuation patterns. Can we simplify the whole subject without all the discussion that surrounds the different patterns? I hope so.

Tops and bottoms generally occur when we get a symmetrical cycle top (probably a trend change to down is happening) or symmetrical cycle bottom (probably a trend change to up is happening). Some symmetrical top patterns are a Head and shoulders, a M, or a inverted V. All of these are symmetrical cycle patterns indicating a probable top and trend change to down. That is pretty simple isn't it?

Some symmetrical bottom patterns are an Inverted head and shoulders, a W, or a V. These are usually bottom patterns indicating a trend change from down to up. Again, that is pretty simple isn't it? The key factor in all these patterns is they are symmetrical!!! In summary we are looking for symmetrical cycle tops and bottoms to alert us to possible trend changes..

Are we topping? Let's look at a chart and make a judgment from that:

The cycles are indeed becoming more symmetrical as the up legs and down legs become more equal. So this alerts us to be extra careful and tighten up our stop losses and maybe even buy some insurance (puts or inverse ETFs).

OK, this doesn't prove the case because we do not know how the future plays out. Let's look at a case that we do know what happened:

You can check and see what happened in 2010. From this chart you also see once a symmetrical bottom was set (a V shaped bottom) the market was onward and upward.

We will discuss uptrends/downtrends (flags, wedges, etc.) in part 2.

You hear/read discussions about different chart patterns and usually whether it is a topping or bottoming pattern. They may also discuss trend continuation patterns. Can we simplify the whole subject without all the discussion that surrounds the different patterns? I hope so.

Tops and bottoms generally occur when we get a symmetrical cycle top (probably a trend change to down is happening) or symmetrical cycle bottom (probably a trend change to up is happening). Some symmetrical top patterns are a Head and shoulders, a M, or a inverted V. All of these are symmetrical cycle patterns indicating a probable top and trend change to down. That is pretty simple isn't it?

Some symmetrical bottom patterns are an Inverted head and shoulders, a W, or a V. These are usually bottom patterns indicating a trend change from down to up. Again, that is pretty simple isn't it? The key factor in all these patterns is they are symmetrical!!! In summary we are looking for symmetrical cycle tops and bottoms to alert us to possible trend changes..

Are we topping? Let's look at a chart and make a judgment from that:

The cycles are indeed becoming more symmetrical as the up legs and down legs become more equal. So this alerts us to be extra careful and tighten up our stop losses and maybe even buy some insurance (puts or inverse ETFs).

OK, this doesn't prove the case because we do not know how the future plays out. Let's look at a case that we do know what happened:

You can check and see what happened in 2010. From this chart you also see once a symmetrical bottom was set (a V shaped bottom) the market was onward and upward.

We will discuss uptrends/downtrends (flags, wedges, etc.) in part 2.

Saturday, September 21, 2013

Sep 23, 2013 outlook

The market continues to rot at its core. The longer it is before we get a substantial correction the larger the rotten core becomes. The larger the rotten core the more potent the stink when the market does correct.

1) The velocity of money continues to slow.

2) The real unemployment rate continues to be very high (even though the labor force shrinks as people drop out).

3) Debt levels continue to rise.

Note: If personal and corporate debt were included it would be about 4X GDP.

4) There is no real underlying economic recovery (anemic growth).

5) The actions by the FED of loose money continues (zero interest and QE), which is representative of the poor and continuing deterioration of the underlying market and economic conditions.

6) The sheep continue to be sucked into the trap while trying to convince themselves it is different this time.

7) Technical analysis does not work and why the man behind the curtain has complete control.

This past week I had projected a top for Tuesday, but with no "taper" the top was a day later than projected. Also, the FED inaction provided enough "mo" to set new highs, but by Friday close it appeared the short term trend may have indeed turned. So next week expect some pullback.

GL

Longer term chart (to clarify comments regarding longer term):

GL

1) The velocity of money continues to slow.

2) The real unemployment rate continues to be very high (even though the labor force shrinks as people drop out).

3) Debt levels continue to rise.

Note: If personal and corporate debt were included it would be about 4X GDP.

4) There is no real underlying economic recovery (anemic growth).

5) The actions by the FED of loose money continues (zero interest and QE), which is representative of the poor and continuing deterioration of the underlying market and economic conditions.

6) The sheep continue to be sucked into the trap while trying to convince themselves it is different this time.

7) Technical analysis does not work and why the man behind the curtain has complete control.

- “Pay no attention to the man behind the curtain,” so said the great and powerful Wizard of Oz to Dorothy, the Tin Man, Scarecrow, and the Lion. For if they had looked behind the curtain they would have seen the wizard using machines, levers and stuff to sound strong and powerful. The wizard was using his smoke and mirrors to convince the four to listen to him, and to not believe what they saw.

This past week I had projected a top for Tuesday, but with no "taper" the top was a day later than projected. Also, the FED inaction provided enough "mo" to set new highs, but by Friday close it appeared the short term trend may have indeed turned. So next week expect some pullback.

GL

Longer term chart (to clarify comments regarding longer term):

GL

Subscribe to:

Posts (Atom)