Looks like we may have finally topped Friday Feb 27. We will find out next week. I believe I am off with my cycle bottoms so I have tried to account for holidays the last part of 2014 and early 2015 which moves the projected bottoms into mid-March. I find this is necessary with the shorter (swing trade) cycles about twice a year. I should do a better job making the adjustments as the holidays happen.

So please note I expect the bottom mid March.

GL traders

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Saturday, February 28, 2015

Sunday, February 22, 2015

Feb 23, 2015 weekly outlook

Seems unclear whether market continues up or takes a short rest. Greece can kicked down the road a bit. FOMC still in easy mode (seems they are continuing about $25B a month to their balance sheet as they continue to cycle securities plus interest back on to the FED balance sheet). May not seem like much, but it is about $300B a year ($1/3Trillion). But Russia debt downgraded to junk. So It is a mixed picture. West coast slow down may be settled, but the damage done will probably be seen in the future.

Like I said an unclear outlook, but I expect a pullback over the next 6-8 trading days.

GL traders

Like I said an unclear outlook, but I expect a pullback over the next 6-8 trading days.

GL traders

Sunday, February 15, 2015

Feb 15, 2015 weekly outlook

My expectations were off the mark the week ended Fed 13 as the market moved up Tue-Fri to new highs. This is why we use Stop and limit orders - to protect ourselves when we get it wrong.

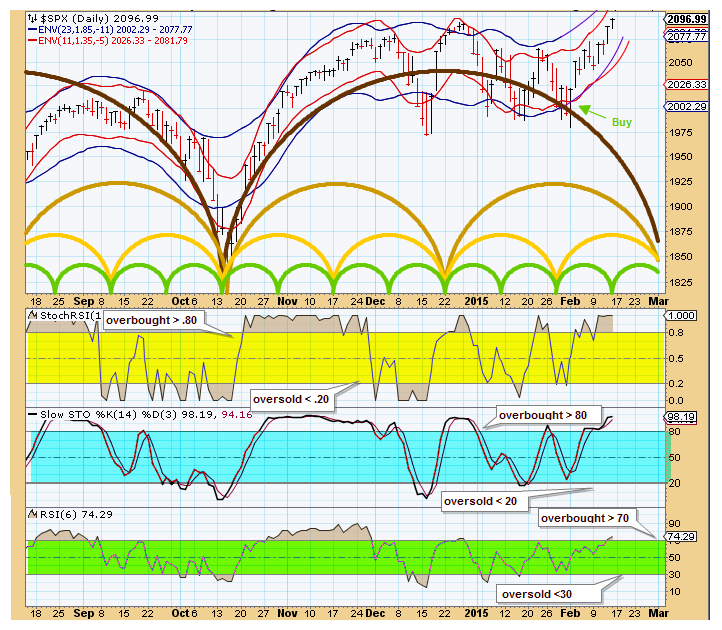

Looking at 3 indicators they seem to indicate we are in an over bought market. Now, this does not mean an immediate pull back as sometimes we stay over bought (or over sold) longer than we anticipate. Still I expect some sort of pullback during the week and into the end of the month. Given recent volatility 2-3% would probably be reasonable.

GL traders

Looking at 3 indicators they seem to indicate we are in an over bought market. Now, this does not mean an immediate pull back as sometimes we stay over bought (or over sold) longer than we anticipate. Still I expect some sort of pullback during the week and into the end of the month. Given recent volatility 2-3% would probably be reasonable.

GL traders

Saturday, February 7, 2015

Weekly outlook Feb 9, 2015

I expect the week to show weakness. Friday may have marked the top of the short term cycle(s) and the market should pull back over the next week. This is confirmed by the RSI3M3 indicators :

This is confirmed by cycles:

GL traders

This is confirmed by cycles:

GL traders

Thursday, February 5, 2015

Feb RSI3MA3 buy/sell signals

A mechanical system can remove the emotion from trading. I showed you DPO and how it aligns with stock prices. Problem is it trails price by half a cycle (if we are using 22 TDs then the DPO is 11 days behind as it averages days before/after the midpoint.

Many use RSI and looks for crossing of the lower levels like 30 as a buy point and higher levels as a sell point. If we use smaller parameters and a smoothing average we can use crossings of these as buy/sell points. Here is RWM using a parameter of "3" and a MA of "3":

Of course no mechanical system is perfect, so we will use "stop loss" and "limit" orders to minimize the effect of bad signals...

Many use RSI and looks for crossing of the lower levels like 30 as a buy point and higher levels as a sell point. If we use smaller parameters and a smoothing average we can use crossings of these as buy/sell points. Here is RWM using a parameter of "3" and a MA of "3":

Of course no mechanical system is perfect, so we will use "stop loss" and "limit" orders to minimize the effect of bad signals...

Subscribe to:

Posts (Atom)