Who better to know the economic outlook of the United States than the CEO of the largest private employer and retailer (400k employees and about 10% of retail sales in the United States). I would suggest that his data is better and more current than that of anyone in the nation. Mike Duke CEO of Walmart said over a month ago that inflation was moving up. Check, this was just confirmed by no less that the head of the Federal Reserve.

Mike Duke just said:

WalMart shoppers, many of whom live paycheck to paycheck, typically shop in bulk at the beginning of the month when their paychecks come in. Lately, they're "running out of money" at a faster clip, he said.

"Purchases are really dropping off by the end of the month even more than last year," Duke said. "This end-of-month [purchases] cycle is growing to be a concern.

So how do we benefit from this information. We can short WMT, buy puts, etc. - no less than the CEO is telling us things don't look good. So I took a look at WMT - here is a visual:

If the past is a guide WMT should break below 50 (46-47?) before July. If things are getting worse as Duke suggests then under 45 would not be a surprise.

Gl traders. Not often we get a CEO suggesting we should short their stock (OK, he didn't say that, but the implication was there). Hehehe

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Thursday, April 28, 2011

comments and outlook for 04-29

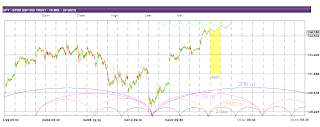

Today was much as anticipated. Maybe a little stronger close than I thought. Tomorrow we have the 11.2TD cycle and 2.8TD cycles down. The 5.6 day cycle should top by around the end of the day.

So we have two cycles up (22TD and 5.6TD cycles) and two cycles down (11.2TD and 2.8TD). IMO it is a close call as to whether we close red or green tomorrow. So I expect a flat market tomorrow without much change.

Here is a visual:

GL traders. Do your own analysis. The market should top no later than early next week, so tighten up any stops.

So we have two cycles up (22TD and 5.6TD cycles) and two cycles down (11.2TD and 2.8TD). IMO it is a close call as to whether we close red or green tomorrow. So I expect a flat market tomorrow without much change.

Here is a visual:

GL traders. Do your own analysis. The market should top no later than early next week, so tighten up any stops.

Wednesday, April 27, 2011

comment and outlook for 04-28-2011

Today was as expected as we set new highs. Tomorrow is not as clear, but I expect we will make marginally new highs by the end of the day and should close up for the day.

Here is the visual:

GL. Do your own analysis.

Here is the visual:

GL. Do your own analysis.

amzn update 04-23

I last commented on AMZN in early April: http://swingcycles.blogspot.com/2011/04/amzn-update-04-04.html . I said it should move up the first 3 weeks of April and pull back. It pretty much followed that script, pulled back a bit earlier than expected.

Now AMZN is moving up again and it appears it should continue up for another 6-7 trading days, but a good part of the upside gain may already be in the bag (another 3 points or so of upside?). Best guess is there is no big surprise or breakout when earnings are reported Tuesday. I am projecting a top around May 3.

Here is a visual:

GL traders. Do your own analysis. Earnings can always surprise - so be careful. You got to wonder about AMZN "cloud" problems which they have visions of expanding to 50% of their business....

04-27 - earnings miss, revenues looked good. AMZN has now hit my upside targets and a top looks imminent within 3-4 trading days.

Now AMZN is moving up again and it appears it should continue up for another 6-7 trading days, but a good part of the upside gain may already be in the bag (another 3 points or so of upside?). Best guess is there is no big surprise or breakout when earnings are reported Tuesday. I am projecting a top around May 3.

Here is a visual:

GL traders. Do your own analysis. Earnings can always surprise - so be careful. You got to wonder about AMZN "cloud" problems which they have visions of expanding to 50% of their business....

04-27 - earnings miss, revenues looked good. AMZN has now hit my upside targets and a top looks imminent within 3-4 trading days.

Tuesday, April 26, 2011

comments and outlook for 04-27-2011

Totally blew the call for Tuesday. I had thought we may test/break highs Monday and thoughft we may get a slight pull back on Tuesday. Seems I am off by a day on my calls.... So I have tried to fine tune my positioning of the cycles to address this. There is a reason I always tell you to do your own analysis because I will get it wrong more often than I like.

It appears the push up should continue for a couple of days as 3 of the 4 shorter cycles should be up. The 11.2 day cycle has topped, but as yet has not developed a lot of down side.

Here is a visual:

GL. Do your own analysis.

It appears the push up should continue for a couple of days as 3 of the 4 shorter cycles should be up. The 11.2 day cycle has topped, but as yet has not developed a lot of down side.

Here is a visual:

GL. Do your own analysis.

Monday, April 25, 2011

May 2011 - the month ahead

I read one theory that the longer cycles have most of their down thrust in the last 15% or so of the time span. In the case of the 1 year cycle that would be the last half of May and June into early July. So based on this theory we should start seeing a more pronounced impact of the 1 year cycle within a couple of weeks.

So the "sell in May" may be appropriate, but it appears we get one more push up before we see that impact. If we do not see that push up then the sell down into the summer may be more severe than currently anticipated. We also have a 4+ month (20 +/- weeks) in play and it should also top by mid-May. We have a 1 month (22TD) cycle which should bottom in mid-May and top by the end of May and bottom again in mid-June.

Here is the visual:

When we combine the cycles with the chart patterns (some call these fractals) we see an inverted Head an Shoulders pattern (the low in mid-March is the Head, and the recent low is the Right Shoulder). This also implies a push higher. Now patterns are the result of the interaction of cycles and can be explained in terms of the cycles we currently see.

This visual shows that pattern and how it is formed by the current cycles:

So, it appears we get a push up the first part of May, and then we start a sell off that could last into the summer. GL traders, do your own analysis.

So the "sell in May" may be appropriate, but it appears we get one more push up before we see that impact. If we do not see that push up then the sell down into the summer may be more severe than currently anticipated. We also have a 4+ month (20 +/- weeks) in play and it should also top by mid-May. We have a 1 month (22TD) cycle which should bottom in mid-May and top by the end of May and bottom again in mid-June.

Here is the visual:

When we combine the cycles with the chart patterns (some call these fractals) we see an inverted Head an Shoulders pattern (the low in mid-March is the Head, and the recent low is the Right Shoulder). This also implies a push higher. Now patterns are the result of the interaction of cycles and can be explained in terms of the cycles we currently see.

This visual shows that pattern and how it is formed by the current cycles:

So, it appears we get a push up the first part of May, and then we start a sell off that could last into the summer. GL traders, do your own analysis.

Comments and outlook for 04-26-2011

"I see both bullish and bearish arguments, so guess we’ll have to wait for tomorrow. "

"The bottom line? Got to let things continue to clarify until a clearer picture emerges."

I often check to see what others are saying. Above are two examples. OK, at 4PM EDT tomorrow I can tell you what the market will do tomorrow. Makes almost as much sense as the above opinions. I try to give you an opinion. Am I wrong sometimes? Far too often I am wrong, but that is the hazard of predicting the future (I do much better when predicting the past).

Looking at the cycles it appears tomorrow will be difficult for the bulls. Two of the shorter cycles are now down The 2.8day cycle and 5.6 day cycle will both be pushing hard down to a bottom. At the same time the 11.2 day cycle will be pushing up to a top. The 22 day cycle remains up. As I have shown short cycles can move multiple points in a short time frame. So I believe the shorter cycles will rule the day tomorrow and we end up down for the day, but a moderate range during the day.

See for yourself:

GL. Do your own analysis. Keep stops in place, I believe we are entering a dangerous time period.

"The bottom line? Got to let things continue to clarify until a clearer picture emerges."

I often check to see what others are saying. Above are two examples. OK, at 4PM EDT tomorrow I can tell you what the market will do tomorrow. Makes almost as much sense as the above opinions. I try to give you an opinion. Am I wrong sometimes? Far too often I am wrong, but that is the hazard of predicting the future (I do much better when predicting the past).

Looking at the cycles it appears tomorrow will be difficult for the bulls. Two of the shorter cycles are now down The 2.8day cycle and 5.6 day cycle will both be pushing hard down to a bottom. At the same time the 11.2 day cycle will be pushing up to a top. The 22 day cycle remains up. As I have shown short cycles can move multiple points in a short time frame. So I believe the shorter cycles will rule the day tomorrow and we end up down for the day, but a moderate range during the day.

See for yourself:

GL. Do your own analysis. Keep stops in place, I believe we are entering a dangerous time period.

Sunday, April 24, 2011

Comments and outlook for week of 04-25

IMO the market cycles have changed as the 33TD cycle has faded and the 22TD cycle has emerged. We will have more data to make a determination by the end of April.

It is going to be an interesting week as on 04-27 the FED chairman is hosting a show and tell media event. Now The Bernank and the FED seem to have painted themselves into a corner. If they continue the easy money policy and QE to try and stimulate jobs they run the risk of igniting run away inflation. With high gas prices (and food prices) Joe Sixpack and Emma BoxWine are turning negative very quickly (70% say we are on the wrong track according to recent polls) and will not be doing a lot of shopping for anything that is not a necessity.

So the FED easy money policy is pushing on a rope and is destroying the value of the dollar causing commodity and food prices to spike. With Joe and Emma not spending we risk an economy that is barely growing or even contracting. So with the economy stalled and prices increasing we end up with stagflation. Many of the research firms are already starting to cut their projections for growth in the second half of the year.

So the FED can't cut rates (they are at 0) to boost the economy. Easy money (more QE) increases the risk of inflation and stagflation. And the possibility of tightening and higher interest rates are remote. The FED is painted into a corner with no good options IMO. So what can The Bernank say that will provide fuel for the market? Nothing that I see. I see no upside from this FED media event (but I see a lot of downside). We will see.

So what are the cycles saying? We should have an up week next week, and top the 1st or 2nd trading day of May (I would not be surprised if the top is early if the reaction to The Bernank is negative enough).

Take a look:

At this time it appears the market should open higher Monday. I think there is a reasonable chance we test (and possibly set new) highs. If we do that it should be followed by a pullback in the afternoon. Take a look:

GL traders. Do your own analysis. Be careful - we are entering a high risk period IMO.

It is going to be an interesting week as on 04-27 the FED chairman is hosting a show and tell media event. Now The Bernank and the FED seem to have painted themselves into a corner. If they continue the easy money policy and QE to try and stimulate jobs they run the risk of igniting run away inflation. With high gas prices (and food prices) Joe Sixpack and Emma BoxWine are turning negative very quickly (70% say we are on the wrong track according to recent polls) and will not be doing a lot of shopping for anything that is not a necessity.

So the FED easy money policy is pushing on a rope and is destroying the value of the dollar causing commodity and food prices to spike. With Joe and Emma not spending we risk an economy that is barely growing or even contracting. So with the economy stalled and prices increasing we end up with stagflation. Many of the research firms are already starting to cut their projections for growth in the second half of the year.

So the FED can't cut rates (they are at 0) to boost the economy. Easy money (more QE) increases the risk of inflation and stagflation. And the possibility of tightening and higher interest rates are remote. The FED is painted into a corner with no good options IMO. So what can The Bernank say that will provide fuel for the market? Nothing that I see. I see no upside from this FED media event (but I see a lot of downside). We will see.

So what are the cycles saying? We should have an up week next week, and top the 1st or 2nd trading day of May (I would not be surprised if the top is early if the reaction to The Bernank is negative enough).

Take a look:

At this time it appears the market should open higher Monday. I think there is a reasonable chance we test (and possibly set new) highs. If we do that it should be followed by a pullback in the afternoon. Take a look:

GL traders. Do your own analysis. Be careful - we are entering a high risk period IMO.

Friday, April 22, 2011

Peter Eliades Mega T top

He has a projected top of April 27: http://ttheory.typepad.com/files/tracking-eliades-mega-t3.pdf

CREE 04-22-2011 Bottom Fishing?

The Motley Fool, The Street dot Com - everybody seems to hate CREE. And to be honest it seems to have negatives. So it seemed appropriate to take a look since it is setting 52 week lows. Now bottom fishing can be dangerous and should only be done if you are nimble and use stops to limit potential losses.

It appears CREE is setting a bottom and has 10% or more upside potential. Here is a visual:

GL traders. Do your own analysis, and this is a high risk situation only for the nimble trader. Use limits to buy and maintain stops.

It appears CREE is setting a bottom and has 10% or more upside potential. Here is a visual:

GL traders. Do your own analysis, and this is a high risk situation only for the nimble trader. Use limits to buy and maintain stops.

Thursday, April 21, 2011

comments for 04-21-2011

The market continues up which is consistent with a 22TD cycle (not a 33TD cycle). Each day it goes up strengthens the case for the 22TD cycle.

Take a look:

GL traders. Do your own analysis. Keep stops in place, and use limits to get good entries.

Take a look:

GL traders. Do your own analysis. Keep stops in place, and use limits to get good entries.

Wednesday, April 20, 2011

comments and outlook 04-20-2011 midday

I speculated over the weekend that the 33TD cycle had faded and the 22TD cycle was emerging as dominant. This week's action seems to support that.

I have been trying to pinpoint the primary focal point for the cycles, and believe that now has become clearer. Now I expect we will also see a 45-50 day cycle emerge as a dominant (Jim Curry has mid-March as a bottom for the 45 day cycle). Another site I follow has mentioned the 22 day cycle.

Here is my current interpretation of the cycle positions:

GL traders. Do your own analysis. May get some afternoon pullback?

I have been trying to pinpoint the primary focal point for the cycles, and believe that now has become clearer. Now I expect we will also see a 45-50 day cycle emerge as a dominant (Jim Curry has mid-March as a bottom for the 45 day cycle). Another site I follow has mentioned the 22 day cycle.

Here is my current interpretation of the cycle positions:

GL traders. Do your own analysis. May get some afternoon pullback?

Monday, April 18, 2011

comments and outlook 04-19-2011

Looks like my concerns about a change in cycles may have been premature and the 33TD cycle is still in dominance. It that is the case we should have a down week and usually we get the most down action as a cycle bottoms. So I expect the sell down to continue tomorrow.

Here is a visual of the SPY:

GL traders, do your own analysis...

Here is a visual of the SPY:

GL traders, do your own analysis...

Sunday, April 17, 2011

comments and outlook for week of 04-18-2011

Things are a bit confused at this time. If I am right the 33TD cycle is fading and the 22TD cycle is emerging. I would think this possibility is better than 50%. So with this in mind I believe the probabilities favor an up week. If I am wrong then the 33TD cycle should bottom (that favors a down week).

Here is a visual of IF I am right (cycles adjusted to reflect the change):

Tomorrow could possible be down, I expect it to be flattish.

GL traders. Do your own analysis.

Here is a visual of IF I am right (cycles adjusted to reflect the change):

Tomorrow could possible be down, I expect it to be flattish.

GL traders. Do your own analysis.

Saturday, April 16, 2011

Changing of the cycles?

By the end of the week my expectations were being frustrated by the market. I was expecting some downside to the market, yet the market was going up..... It seemed market action was not conforming to my interpretation of the data. So I began to look more closely at the data.

Not a certainty yet (may take a couple of weeks to determine) but it appears that there may be a change occurring in what cycles are dominant. It seems the 33TD cycle is decreasing in effect (less amplitude) as a 22TD day cycle is getting stronger (greater amplitude). If that proves to be the case them mid-week was a short term bottom and the market will be up the next two weeks. This scenario better explains the market action after mid-week. As I said it may take a couple of weeks to prove out.

Still I feel it probable enough to bring it to your attention. Here is a visual:

Often when we see the 22TD cycle we also see a 45TD cycle. That was the case last spring/summer. In other words we see either the 33TD cycle or the 22TD and 45TD cycle (22 and 45 averages out at 33).

Not enough evidence yet to form an opinion or conclusion on the 45TD cycle so that is purely speculation at this time. Some cycle analysts stick to a set of cycles regardless of what the data says. They rationalize the data by claiming left or right translation or cycle expansion or contraction. I try not to have a preconceived opinion and interpret the data in front of me.

If you have a different opinion or interpretation let's discuss it.

GL traders. Do your own analysis.

Not a certainty yet (may take a couple of weeks to determine) but it appears that there may be a change occurring in what cycles are dominant. It seems the 33TD cycle is decreasing in effect (less amplitude) as a 22TD day cycle is getting stronger (greater amplitude). If that proves to be the case them mid-week was a short term bottom and the market will be up the next two weeks. This scenario better explains the market action after mid-week. As I said it may take a couple of weeks to prove out.

Still I feel it probable enough to bring it to your attention. Here is a visual:

Often when we see the 22TD cycle we also see a 45TD cycle. That was the case last spring/summer. In other words we see either the 33TD cycle or the 22TD and 45TD cycle (22 and 45 averages out at 33).

Not enough evidence yet to form an opinion or conclusion on the 45TD cycle so that is purely speculation at this time. Some cycle analysts stick to a set of cycles regardless of what the data says. They rationalize the data by claiming left or right translation or cycle expansion or contraction. I try not to have a preconceived opinion and interpret the data in front of me.

If you have a different opinion or interpretation let's discuss it.

GL traders. Do your own analysis.

Thursday, April 14, 2011

comments and outlook for 04-15-2011

Well as I commented - we started out weak and looked like we were going for a red day until the last hour. So another day that closed green (just barely on the S&P).

So let's try this one more time - we open weak and close red. Best guess is we are down 10 or more points by the end of the day.

Lots of good info on the visual:

GL traders. Do your own analysis.

So let's try this one more time - we open weak and close red. Best guess is we are down 10 or more points by the end of the day.

Lots of good info on the visual:

GL traders. Do your own analysis.

Revisiting the GOOG 04-14-2011

Looks like that there is a bottom by end of the week or early next week (could be related to earnings report?). This is a short term bottom followed by a top by the second week of May.

Here is a visual:

GL traders. Do your own analysis

Here is a visual:

GL traders. Do your own analysis

comments and outlook for 04-14-2011

The day showed early strength (as suggested) and then faded as expected until mid afternoon. Then after the release of the FED beige book the market found some traction and closed green by a smidgen on the S&P. So I missed the close (of course 5 down days in a row is unusual, but it was what the cycles suggested). The SPY did manage a red close for the 5th day in a row.

The charts are suggesting that today should be weak and probably red for the day. My work suggests at least a 5-6 point pullback (possibly more) as most of the shorter cycles are down.

Here is a visual:

GL traders. Do your own analysis.

The charts are suggesting that today should be weak and probably red for the day. My work suggests at least a 5-6 point pullback (possibly more) as most of the shorter cycles are down.

Here is a visual:

GL traders. Do your own analysis.

Tuesday, April 12, 2011

Comments and outlook for 04-12-2011

Today was down as expected. I speculated that we would be down 5-10 points on the S&P - we were down just over 10 points. Gonna have to work on that. Hehehehe.

Tomorrow looks as if it should be another down day. The 33TD cycle continues down, as well as the 11.2TD cycle. The 5.6TD day cycle turns down in the moring about the same time the 2.8TD cycle turns up. So we have 3 of these cycles down, and 1 up. The Wall cycle is up, but some longer cycles are down (a wash?). So I expect tomorrow to be down (maybe a little strength early) another 5-10 points.

Here is the visual:

GL traders. Do your own analysis.

Tomorrow looks as if it should be another down day. The 33TD cycle continues down, as well as the 11.2TD cycle. The 5.6TD day cycle turns down in the moring about the same time the 2.8TD cycle turns up. So we have 3 of these cycles down, and 1 up. The Wall cycle is up, but some longer cycles are down (a wash?). So I expect tomorrow to be down (maybe a little strength early) another 5-10 points.

Here is the visual:

GL traders. Do your own analysis.

Monday, April 11, 2011

VIX signal 04-11-2011 (update 04-12)

Today the VIX pulled back more than 47.5% form its top in March. This is a trend change signal.

Three consecutive down days is needed for confirmation. Today was the 3rd consecutive down day on the S&P (but the DJIA was green today). I believe this is confirmation of a trend change (to down), but would like to see a 4th down day to be certain. Regardless, it seems the market has topped.

You decide.

Update 04-12: Got a 4th consecutive down day. Confirmation is definite.

Three consecutive down days is needed for confirmation. Today was the 3rd consecutive down day on the S&P (but the DJIA was green today). I believe this is confirmation of a trend change (to down), but would like to see a 4th down day to be certain. Regardless, it seems the market has topped.

You decide.

Update 04-12: Got a 4th consecutive down day. Confirmation is definite.

update projections 04-11-2011

I have updated projections including the effect of the 1 year and 2 year cycles into those projections. It appears into the first week of May we should be dow about 50-60 points (1270 range) and turn up for most of May. The rally in May will be rather tepid - probably to around 1295-1300.

After that the next significant bottom should be the first week of August with a bottom of around 1140. During the remainder of the year (Aug-Dec) the 2 year cycle down and the 1 year cycle up largely offset. So I expect the market to be flattish to down from Aug-Dec as there are other longer cycles that should be pushing it down.

Here is the visual:

GL traders. Hope this longer term outlook helps.... Do your own analysis.

After that the next significant bottom should be the first week of August with a bottom of around 1140. During the remainder of the year (Aug-Dec) the 2 year cycle down and the 1 year cycle up largely offset. So I expect the market to be flattish to down from Aug-Dec as there are other longer cycles that should be pushing it down.

Here is the visual:

GL traders. Hope this longer term outlook helps.... Do your own analysis.

comments and outlook 04-12-2011

Today started out with a uptick (as expected) and then drifted lower during the day (as expected).

Tomorrow the 33TD, 11.2TD and 2.8TD cycles are down. The 20 week (Wall) and 5.6TD cycles are up. I expect the bias to be down tomorrow and the market to be down at the end of the day (5-10 point loss?).

Here is the visual:

GL traders. Do your own analysis.

Tomorrow the 33TD, 11.2TD and 2.8TD cycles are down. The 20 week (Wall) and 5.6TD cycles are up. I expect the bias to be down tomorrow and the market to be down at the end of the day (5-10 point loss?).

Here is the visual:

GL traders. Do your own analysis.

Sunday, April 10, 2011

Gold (GLD) cycles - using DPO

Here is a link : http://www.readtheticker.com/Pages/Blog1.aspx?65tf=173_gold-step-up-to-heaven-2011-03

Notice lower half of the chart and use of DPO in calculating the cycles. This confirms (I believe) that using DPO for projections is a valid approach.

GL traders. Do your own analysis.

Notice lower half of the chart and use of DPO in calculating the cycles. This confirms (I believe) that using DPO for projections is a valid approach.

GL traders. Do your own analysis.

Saturday, April 9, 2011

HL and MMR update 04-11

When we last looked at these two we projected they would top around 04-11: http://swingcycles.blogspot.com/2011/03/hl-and-mmr-03-26.html . It appears they are topping after hitting our targets. Now, if I have it right - they are set to decline for about 16-17 trading days into the first week of May.

I have set new targets in anticipation of this pullback. If HL gives us an average decline I would expect a pullback to 8.50 area. If it tests the declining trend line it could pull back to around 7.50 (that is almost a 25% decline from its high). MMR also looks ready to top. It appears it should pull back to 16.50 or 16.00 if it hits its trend line (a 15-20% decline).

Here are the charts:

GL traders. Do your own analysis - but these are nice short possibilities (or puts).

I have set new targets in anticipation of this pullback. If HL gives us an average decline I would expect a pullback to 8.50 area. If it tests the declining trend line it could pull back to around 7.50 (that is almost a 25% decline from its high). MMR also looks ready to top. It appears it should pull back to 16.50 or 16.00 if it hits its trend line (a 15-20% decline).

Here are the charts:

GL traders. Do your own analysis - but these are nice short possibilities (or puts).

Friday, April 8, 2011

comments and the week ahead 04-11-2011

The week played out much as expected - trading in a fairly narrow range. Never could build enough upside to test February highs (got within 4-5 points). Never felt sure we could/would tests and break those highs. If I am right about the 33TD cycle topping we should get a choppy market for the next 3-4 trading days with the shorter cycles providing the action until the 33TD cycle builds some downward momentum. The 11.2 trading day cycle also topped and should turn and will build downside momentum quicker as it has a shorter turning axis.

Given this I believe the week even though choppy should develop a downside bias by mid week. I believe we close the week down 1-1.5% from Friday's close by next Friday. Here is a chart:

Based on detrending the 33 day cycle (DPO(17)) it appears we should lose about 45 (3-3.5%) points over the next three weeks giving us a downside target of around 1285. After that we have the 33TD cycle and 20wk (Wall cycle) up into late into May and that should result in new highs of around 1355. Time will tell and projections are subject to update as the market plays out.

We start the week with the 20wk (Wall cycle), the 33TD and 11.2TD cycles down. The 5.2 TD cycle is up for Monday. The 2.8td cycle starts out as up and tops and turned down by midday. Best guess is some strength in the early hours, but weakness by the end of the day on Monday.

Here is a visual:

GL traders. Do your own analysis. Careful in buying the dips as the trend should now be down.

Given this I believe the week even though choppy should develop a downside bias by mid week. I believe we close the week down 1-1.5% from Friday's close by next Friday. Here is a chart:

Based on detrending the 33 day cycle (DPO(17)) it appears we should lose about 45 (3-3.5%) points over the next three weeks giving us a downside target of around 1285. After that we have the 33TD cycle and 20wk (Wall cycle) up into late into May and that should result in new highs of around 1355. Time will tell and projections are subject to update as the market plays out.

We start the week with the 20wk (Wall cycle), the 33TD and 11.2TD cycles down. The 5.2 TD cycle is up for Monday. The 2.8td cycle starts out as up and tops and turned down by midday. Best guess is some strength in the early hours, but weakness by the end of the day on Monday.

Here is a visual:

GL traders. Do your own analysis. Careful in buying the dips as the trend should now be down.

Thursday, April 7, 2011

BIDU 04-08-2011

Sometimes you come across a chart that looks like a perfect setup. I believe BIDU has that type of chart. Could I be wrong? Of course I could. Take a look for yourself:

I don't believe you will find a better setup for a short (or my preference is some May puts $15 or more out of the money). This is a setup where $1,000 of puts could return you $5,000 over 2-3 weeks.

As always - do your own research and don't risk more than you are willing to lose. GL traders.

I don't believe you will find a better setup for a short (or my preference is some May puts $15 or more out of the money). This is a setup where $1,000 of puts could return you $5,000 over 2-3 weeks.

As always - do your own research and don't risk more than you are willing to lose. GL traders.

comments and outlook 04-08-2011

Early on it looked like we might make a run to test Feb highs. Then around 10:30 we got news of an earthquake in Japan that dropped the market and it never recovered fully. I think we would have to call it a flat to slightly down day. Looking more and more like a topping process....

Tomorrow we should have the 33 trading day cycle topping and the 11.3 trading day cycle also topping (assuming I have the cycles right). Of course we have a couple of shorter cycles turning up. My best guess we open up and then fade during the day and close down. Not a huge down day, but down.... Have to give the two longer cycles 1-2 days to build some downward momentum.

Here is the visual:

GL traders. Make sure you have stops in place, and do your own analysis.

Tomorrow we should have the 33 trading day cycle topping and the 11.3 trading day cycle also topping (assuming I have the cycles right). Of course we have a couple of shorter cycles turning up. My best guess we open up and then fade during the day and close down. Not a huge down day, but down.... Have to give the two longer cycles 1-2 days to build some downward momentum.

Here is the visual:

GL traders. Make sure you have stops in place, and do your own analysis.

Wednesday, April 6, 2011

Alternate interpretation of swing cycles

Is my interpretation of the swing cycles the only one (even the right one)? As we saw when I covered the different cycle analysts they don't always agree. I give you my best interpretation of what I believe the cycles are. I encourage you to do your own analysis.

So let's look at what may be an alternate interpretation of the cycles that explain what is happening:

Now you know why I say - do your own analysis. If I can come up with an alternate explanation there may be a third (or fourth) and better explanation. If you have an alternate explanation let's share it.... I am sure we can make arrangements to get it posted.

GL traders. Do your own analysis

So let's look at what may be an alternate interpretation of the cycles that explain what is happening:

Now you know why I say - do your own analysis. If I can come up with an alternate explanation there may be a third (or fourth) and better explanation. If you have an alternate explanation let's share it.... I am sure we can make arrangements to get it posted.

GL traders. Do your own analysis

comments and outlook for 04-07-2011

Today we got a bit of an advance. But, it seemed to lack any conviction. One might say the type of action they expect in a topping market. I have been talking about this most of this week.

It appears to me if we are to test the Feb highs it will be tomorrow or Friday morning (as Friday is when I expect the 33TD and 11.2TD cycles to top. Time will tell. So we have a shot at testing the old highs, but it is not a sure thing. Of course, the market could surprise and even break those highs as many indices have.

Take a look:

GL traders, do your own analysis.

It appears to me if we are to test the Feb highs it will be tomorrow or Friday morning (as Friday is when I expect the 33TD and 11.2TD cycles to top. Time will tell. So we have a shot at testing the old highs, but it is not a sure thing. Of course, the market could surprise and even break those highs as many indices have.

Take a look:

GL traders, do your own analysis.

APPL outlook 04-06

I last looked at APPL on 03-15. http://swingcycles.blogspot.com/2011/03/aapl-03-15.html

We got the expected pullback. Looks like APPL trades in a range (325-355) for the next month or so. May test the lower end in the next few days and then move up toward the upward end by the end of April.

Here is APPL:

GL traders. Do your own analysis.

We got the expected pullback. Looks like APPL trades in a range (325-355) for the next month or so. May test the lower end in the next few days and then move up toward the upward end by the end of April.

Here is APPL:

GL traders. Do your own analysis.

comments and outlook for 04-06-2011

Looked like we might run yesterday midday and then we got an afternoon pullback and closed flat. As one would expect near a top the up momentun seems to have faded and the market is having problems advancing. If we get an up gap and go maybe we can break above 1338 resistance and test old highs. Else, it looks like we are running put of time.

There is still a chance we test old highs, but a diminishing chance. Let's see if we can gap up. We should still get some advance for the week. Many of the averages have set new 52 week highs and a couple of averages (like the S&P mid cap) have set all time highs, The 33 and 11.2 day cycles should top by the end of the week.

Here is the visual:

GL traders, Be careful, do your own analysis.

There is still a chance we test old highs, but a diminishing chance. Let's see if we can gap up. We should still get some advance for the week. Many of the averages have set new 52 week highs and a couple of averages (like the S&P mid cap) have set all time highs, The 33 and 11.2 day cycles should top by the end of the week.

Here is the visual:

GL traders, Be careful, do your own analysis.

Monday, April 4, 2011

Watch the cycles fade,,,, continued

I don't want to short change the DPO tool. I have not examined its potential fully. We should be able to take the points shown as detrended and calculate the amplitude of a cycle. If I have cycles nesting (topping/bottoming together) and add up the detrended points I should be able to estimate the top or bottom point. Now I have not back tested this and it is a theory only.

Let me show you what I mean:

From this you see we are at or near an estimated top (may have already seen the top). Also, the estimated top (subject to change) in late May should be a lower top by 10-15 points. If you have the time and desire to play with this maybe we can maximize the use and benefit of this tool. I would welcome the help and feedback.

GL traders

Let me show you what I mean:

From this you see we are at or near an estimated top (may have already seen the top). Also, the estimated top (subject to change) in late May should be a lower top by 10-15 points. If you have the time and desire to play with this maybe we can maximize the use and benefit of this tool. I would welcome the help and feedback.

GL traders

Comments and outlook for 04-05-2011

Not exactly the type of day I expected. I expected a bit more of a push to the upside. We got a bit of push the last hour, but nothing to write home about.

Still, I believe we get at least one more surge to the upside over the next 2-3 days which may well test (or break) the old highs. I suppose it could do that 4 points a day on the S&P over the next 3 days or do it at the open one morning. I would observe that it appears though the longer cycles are starting to lose some upward momentum and move more slowly (this is what we would expect as we approach a top).

Tomorrow should be up. How much? Not sure, but at least 3-4 points. Don't forget the DJIA has already set a new high and often it leads. Here is how tomorrow looks:

GL traders. Do your own analysis. Might want to tighten stops....

Still, I believe we get at least one more surge to the upside over the next 2-3 days which may well test (or break) the old highs. I suppose it could do that 4 points a day on the S&P over the next 3 days or do it at the open one morning. I would observe that it appears though the longer cycles are starting to lose some upward momentum and move more slowly (this is what we would expect as we approach a top).

Tomorrow should be up. How much? Not sure, but at least 3-4 points. Don't forget the DJIA has already set a new high and often it leads. Here is how tomorrow looks:

GL traders. Do your own analysis. Might want to tighten stops....

Sunday, April 3, 2011

Watch the cycles fade,,,,

I was asked how do we measure the decay/decrease in amplitude in a cycle (or the increase as it expands). If you recall Barker talked about 3 sets of 3 wall cycles and how the 3rd of each cycle showed more downside tendency. Is that true (and how do we know)?

We look at the DPO indicator on stockcharts. We look at weekly cycles over about 3 years. Since we are looking to detrend a 20 week cycle we set the DPO parameter to 11 (see stock charts school for a complete explanation of DPO). Here are the results for the 20 week cycle. As we are into #6 (3rd of set 2) we expect the DPO values to increase (and the recent top Feb 18, bottom around Mar 16 and now bounce back may result in that - time will tell).

Here is what we see as of today:

My research into this is very preliminary, so decide for yourself. I claimed the 45 day cycle which seemed dominant last spring and summer faded later in the year. So what do we see when we detrend for the 45 day cycle? Here it is:

My research needs more work and time before I presume this is a valid way to identify the decay or growth in a cycle. At this point it is interesting and shows some potential. I leave it to you to decide if it is something you want to use.

GL traders.

We look at the DPO indicator on stockcharts. We look at weekly cycles over about 3 years. Since we are looking to detrend a 20 week cycle we set the DPO parameter to 11 (see stock charts school for a complete explanation of DPO). Here are the results for the 20 week cycle. As we are into #6 (3rd of set 2) we expect the DPO values to increase (and the recent top Feb 18, bottom around Mar 16 and now bounce back may result in that - time will tell).

Here is what we see as of today:

My research into this is very preliminary, so decide for yourself. I claimed the 45 day cycle which seemed dominant last spring and summer faded later in the year. So what do we see when we detrend for the 45 day cycle? Here it is:

My research needs more work and time before I presume this is a valid way to identify the decay or growth in a cycle. At this point it is interesting and shows some potential. I leave it to you to decide if it is something you want to use.

GL traders.

AMZN update 04-04

I last commented on AMZN om March 8. I commented it was near a bottom (which it achieved a little later). http://swingcycles.blogspot.com/2011/03/amzn-03-09.html

AMZN is now in an uptrend which should last through about the first 3 weeks of April. Here is how it looks:

If you own this stock it should be OK to hold a while longer (just keep your stops in place). Not sure I would buy it at this point as a good portion of the upside may be priced in. GL traders. Do your own analysis.

AMZN is now in an uptrend which should last through about the first 3 weeks of April. Here is how it looks:

If you own this stock it should be OK to hold a while longer (just keep your stops in place). Not sure I would buy it at this point as a good portion of the upside may be priced in. GL traders. Do your own analysis.

NFLX update 04-04

We last commented on NFLX on 03-08 and said it should bottom mid March, which it did.

http://swingcycles.blogspot.com/2011/03/nflx-update-03-09.html

NFLX is now at or near a top it appears. Here is how it looks:

GL traders. To limit capital at risk you might consider May puts if you decide to act. Do your own analysis.

http://swingcycles.blogspot.com/2011/03/nflx-update-03-09.html

NFLX is now at or near a top it appears. Here is how it looks:

GL traders. To limit capital at risk you might consider May puts if you decide to act. Do your own analysis.

Saturday, April 2, 2011

What the cycle analysts are saying - summary

Four cycle experts and they all have their favorite combinations of cycles. What is a person think?. We should not be surprised as there are many, many cycles and untold combinations. I tend to like the Wall cycle (Barker) and Kitchin cycle (Barker and Ferrera) and 10 year cycle (Ferrera, Drokes).

They don't always agree about the positioning of the cycles either. Drokes has the 10 year cycle as bottoming in 2004, whereas Ferrera has it bottoming in 2002 (projecting the next bottom in 2012 or 2014). All the analysts other than Curry and Barker tend to focus on cycles longer than 1 year. Barker covers the Wall (20 week) cycle. Curry covers the 45 trading day cycle (10 weeks?) and the 90 trading day cycle (18-20 weeks).

That leaves a niche of 20 weeks or shorter which is where I tend to focus most of my analysis as this is the time span that probably most interests swing traders (and day traders). I believe I have identified (and often use) the 20 week cycle (100 trading days or 4.5 months), the 33 trading days or 1 1/2 month cycle, the 11.2 trading days or 1/2 month cycle.

In deference to day traders I also look at the 5.6 trading day cycle (1/4 a month) and the 2.8 trading day cycle (1/8 of a month). I am not opposed to using a 45 trading day cycle (10 weeks) if the data suggests that is the cycle currently in dominance. I try to adjust as the data suggests I should as cycles fade (amplitude decays) or come to the forefront (amplitude expands).

I try to cover some of the longer cycles every month or so to give you a look at the overall environment in which these shorter cycles are functioning - as we should not ignore the big picture. So I am not in competition with these analysts (and their conclusions), but I believe I extend their analysis into the shorter cycle arena.

Additional cycle information (some mathematical relationships):

Gann liked 360 and factors of 360 (270, 135, 90,45, etc) as cycle lengths. These are the basis of Jim Curry's analysis (also described by JM Hurst).

I would suggest Curry with minor modifications to his described cycle lengths is on the same wave length as the other analysts

Finally - just for the heck of it (everybody seems to be pretty much in agreement on the longer cycles) let's consider one more cycle - the PI cycle.

Definitions:

= 8.61 years (8.61/ 3.39 = 2.54

= 103 months (103/40.68 = 2.54

= 448 weeks (448/20 =22.38 ~ 22 Wall cycles (22/9 =2.50 Kitchin cycles)

Conclusions:

1 PI cycle = 2.5 Kitchin cycle

1 Kitchin cycle = 9 Wall cycles

9 Month cycle = 2 Wall cycles

1 Kitchin cycle = 4.5 X 9 month cycles

3 Kitchin Cycles = 123 months ~ 10 year cycle

As you can see there are mathematical relationships between all these cycle.... There seems to be a mathematical order to cycles. This by no means covers all cycles. For Example: a Super cycle is 30 years or 3 x 10 year cycle (or 9 Kitchin cycles). Some claim there is a 17 year cycle (which is approximately 2 PI cycles). Just something to think about.,,,

They don't always agree about the positioning of the cycles either. Drokes has the 10 year cycle as bottoming in 2004, whereas Ferrera has it bottoming in 2002 (projecting the next bottom in 2012 or 2014). All the analysts other than Curry and Barker tend to focus on cycles longer than 1 year. Barker covers the Wall (20 week) cycle. Curry covers the 45 trading day cycle (10 weeks?) and the 90 trading day cycle (18-20 weeks).

That leaves a niche of 20 weeks or shorter which is where I tend to focus most of my analysis as this is the time span that probably most interests swing traders (and day traders). I believe I have identified (and often use) the 20 week cycle (100 trading days or 4.5 months), the 33 trading days or 1 1/2 month cycle, the 11.2 trading days or 1/2 month cycle.

In deference to day traders I also look at the 5.6 trading day cycle (1/4 a month) and the 2.8 trading day cycle (1/8 of a month). I am not opposed to using a 45 trading day cycle (10 weeks) if the data suggests that is the cycle currently in dominance. I try to adjust as the data suggests I should as cycles fade (amplitude decays) or come to the forefront (amplitude expands).

I try to cover some of the longer cycles every month or so to give you a look at the overall environment in which these shorter cycles are functioning - as we should not ignore the big picture. So I am not in competition with these analysts (and their conclusions), but I believe I extend their analysis into the shorter cycle arena.

Additional cycle information (some mathematical relationships):

Gann liked 360 and factors of 360 (270, 135, 90,45, etc) as cycle lengths. These are the basis of Jim Curry's analysis (also described by JM Hurst).

- 45 calendar days = (45 - 12.85 weekend days) is 32.15 trading days

- Note: 46 calendar days works better. One month avg = 30.4 days. so 1.5 months is 45.6 days. 12 (months)/1.5 = 8 periods per year. 8 x 45.6 = 364.8 days (1 year). So 1 year is 2 and 2/3 Wall cycles.

- 92 calendar days (2 x 46) is about 66TDs, and 3 calendar months (92 / 30.4 = 3.02 months)

- 138 calendar days (3 x 46) = 4.5 months (138/30.4 = 4.53 mths)

- 138/7 = 19.7 weeks. 138 - 19.7 x 2 = 98.6 TDs (approx. 3 X 33 TDs)

I would suggest Curry with minor modifications to his described cycle lengths is on the same wave length as the other analysts

Finally - just for the heck of it (everybody seems to be pretty much in agreement on the longer cycles) let's consider one more cycle - the PI cycle.

Definitions:

- PI cycle = 3,142 calendar days.

- Kitchin cycle = 40.68 months

- Wall cycle = 20 weeks (100 trading days)

= 8.61 years (8.61/ 3.39 = 2.54

= 103 months (103/40.68 = 2.54

= 448 weeks (448/20 =22.38 ~ 22 Wall cycles (22/9 =2.50 Kitchin cycles)

Conclusions:

1 PI cycle = 2.5 Kitchin cycle

1 Kitchin cycle = 9 Wall cycles

9 Month cycle = 2 Wall cycles

1 Kitchin cycle = 4.5 X 9 month cycles

3 Kitchin Cycles = 123 months ~ 10 year cycle

As you can see there are mathematical relationships between all these cycle.... There seems to be a mathematical order to cycles. This by no means covers all cycles. For Example: a Super cycle is 30 years or 3 x 10 year cycle (or 9 Kitchin cycles). Some claim there is a 17 year cycle (which is approximately 2 PI cycles). Just something to think about.,,,

Friday, April 1, 2011

outlook for week of 04-04-2011

Last week's outlook was pretty much on target as we expected an up week. We expect the move up to continue this week with the 33TD (trading days) cycle topping toward the end of the week. The 11TD cycle should top around the same time. So by the end of the week these cycles should be ready to turn and may lose some momentum by Thur/Fri of the week. Still we should tests the old highs of Feb. 18 and may break them (but not by much). So we may get as high as 1353 or 1354. Note: based on the weakness down into Mar 16 and strength the past 2 weeks I concluded I needed to reposition the Wall cycle to account for this so it has been shifted right by about 17 days.

So I expect we may get some increased volatility by the end of the week as these two cycles (33 and 11 TD) top. So late in the week we may see shorter cycles starting to affect the market movement more and get more of a day trading market for 6-8 trading days.

Here is a visual:

Monday should be an up day as the longer cycles dominate. Also, the 5.6TD cycle is up Monday and the 2.8 day cycle is up part of the day. Possibly - Monday morning we fill the gap down from Feb 22 (1138-1140 approximately), and pull back some in the afternoon. Time will tell.

Here is the shorter cycles:

GL traders. Do your own analysis. Don't forget to start tightening up your stops by mid-week and it may not be prudent to try and continue to buy the dips except for day trading activity.

So I expect we may get some increased volatility by the end of the week as these two cycles (33 and 11 TD) top. So late in the week we may see shorter cycles starting to affect the market movement more and get more of a day trading market for 6-8 trading days.

Here is a visual:

Monday should be an up day as the longer cycles dominate. Also, the 5.6TD cycle is up Monday and the 2.8 day cycle is up part of the day. Possibly - Monday morning we fill the gap down from Feb 22 (1138-1140 approximately), and pull back some in the afternoon. Time will tell.

Here is the shorter cycles:

GL traders. Do your own analysis. Don't forget to start tightening up your stops by mid-week and it may not be prudent to try and continue to buy the dips except for day trading activity.

Subscribe to:

Comments (Atom)