I told you in my general disclaimer - at times I might miss something or misinterpret data. It appears that I missed something and/or misinterpreted the data.

At this time the shorter cycles are having little or no influence. So I took at look to see what I was missing in the intermediate length cycles, So I reviewed some information on Gann and was drawn to the 270 calendar days as a potential cycle to investigate (this BTW is about 9 month or 40 weeks or 200TDs - 2X the 20 week Wall cycle).

With this in mind I looked at a chart of the SPX. Here is what I discovered:

As a result of my investigation I believe the 9 month and 20 week cycle are bottoming together. Based on amplitudes it appears this bottoming may be near completion. So we may have bottomed or may bottom during the week.

GL traders. Sorry I missed the potential influence of the 9 month cycle.

From shadow:

http://tinypic.com/r/2ef17ba/7

Gann liked division by 8. 1/8 = 12.5% and .125 x 1370 = 171.25 and 1370 - 171.25 = 1198.75 target.

INLET - I'm with you on that 9 month cycle bottoming.

ReplyDeleteInlet - I think it's more than just a 9 Month Cycle I think it has to go back to 2009 bottom so a cycle that is possibly 4 x 9 month cycle = 36 month ( 3 Year)...bottoming as the 6 year is peaking. So along with that we are getting the 3 year, 1.5, 9 month, and 20WK (100TD)Cycles all bottoming.

ReplyDeletehttp://www.youtube.com/watch?v=NmGc7qH4-hw

ReplyDeleteHi Inlet wanted to share this....where did we end today? 6.66% on the s&p so that's either a big sell or buy point. My take is if no QE3 is announced we are in big trouble.

Shadow - March 2009 to March 2011 is 24 months. Mar-Aug 9 is 6 months (a total of 30 months or 2.5 years). 4 x 9 month cycles (3 years) puts you back to Aug 2008. So I do not see an alignment with the Mar 2009 bottom. Am I missing something?

ReplyDeleteMouth - I doubt QE3 (if like QE2 ) would be effective. So the FED added a lot of liquidity and you are now seeing what it got us. The velocity of money (times it turns over in a given length of time) has shrunk considerably so the added liquidity has not created increased economic activity. JMHO

ReplyDeleteInlet - My bad....ok...I see now.

ReplyDeleteMouth - Your post has given me goose bumps...I've often wondered this as I've watched the closing tape. This is truly insightful...thanks.

ReplyDeleteShadow7 - the 3 year cycle?

ReplyDeletehttp://stockstop.org/download/file.php?id=3848&mode=view

nice work inlet.....

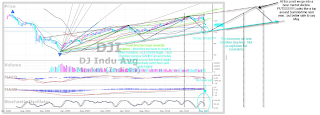

ReplyDeleteDon't be fooled by this bounce. I got where the DOW will head back up to 11,500 and SP to 1200 should hit it by Thursday 1-2 pm. I'm using Gann Price/Time Square to come up with this. Maybe some body can check this with another method. We should be in a symmetrical triangle base pattern preparing for the final leg down.

ReplyDelete1200 is the level the EWers are looking for. Also I believe 1197+ is a .3812 bounce ((1356 - 1101*.38 +1101) FIB area.

ReplyDeleteWhat a wild ride, perfect opportunity to exit any recently acquired longs and start legging into short positions. I picked a helluva week to go on vacation ... lol

ReplyDeleteInlet - I got Thursday as being another 600 pt day to the upside. I see us going down mostly today and bottoming and reversing (@ 10923) Thursday AM around the open and then going up 600+ by 1-2 pm Thursday and then we should turn around again. Please verify if you can.

ReplyDeleteInlet - I got Monday as being a significant turn down...this lines up with SPIRALS Calendar also....We should break down hard from this date....I got us falling a possible 1000 pts next week....this should be a final washout....I have a DOW Target of 10,195.

ReplyDeleteC_K living in a hurricane prone area I can tell you standing outside in the midst of a hurricane is fool hardy. You can get hit by flying debris and not live to regret it. Right now we seem to be playing the above/below 11K game.

ReplyDeleteI prefer to step aside and wait for the skies to clear.

Shadow7 - I have no tools in my arsenal that predict these types of moves you are suggesting short term.

ReplyDeleteLonger term things look bleak and I plan to post a longer term outlook soon as I believe recent market actions leave people open to the possibility of a market that behaves very poorly over the next 1-3 years.

Here's the forecast I got...Again I believe we have 1 more run into 2012 before S... Hits the Fan....: http://tinypic.com/r/2ef17ba/7

ReplyDeleteOur only saving grace (I think) now are the 4,3,2,1 year cycles. All counting now like the Mayan Calendar.