Well, it was a dull day. Thought we might push a bit higher - and at times today it looked possible, but we closed down slightly (I'd call it a flat day). Given AAPL's results you would have thought the techs would be up, yet the NAZ was the worst performer. INTC had good results which may support techs tomorrow....

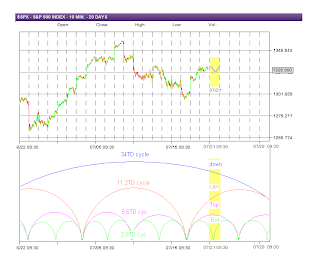

Tomorrow we have the 2.8TD cycle bottoming and the 5.6TD topping. The 11.2TD cycle is up. So is the 22TD cycle. The 34TD cycle is down. The 20 week and 65-70TD cycles are down. I believe the cycles largely offset giving us a neutral bias. So I expect movement in a fairly narrow range (now that I have typed that we get a big move up or down).

Here is a visual using SPX:

GL traders. Do your own analysis. Short any big move up? Buy any big move down?

Update - chart from Shadow:

I got things as fairly flat again with a rise into the close. I've done an intraday chart -http://tinypic.com/r/zmmqtw/7

ReplyDeleteThe drop shown for Friday should take the DOW back to 12451....but something happens over the weekend to propel us up?

Shadow - according to my chart sometime Monday all the shorter cycles should be up except the 34TD cycle. This implies some upside potential?

ReplyDeleteInlet - What do you see going on? I just saw a small peak this morning and then doing the 'V' that you show. I matched up perfectly with your prediction. Although from the chart standpoint...we hit what I'm calling the 22TD trendline this morning..so that maybe 1 reason.... But we can't be off that much?

ReplyDeletehttp://tinypic.com/r/efl1mg/7

http://tinypic.com/r/23lfhpl/7

And if we're not off...what does this mean for next week?

Shadow do you still see a drop for Friday? I was surprised by how high we went this a.m.

ReplyDeleteI think I need to add the derivatives of the 100TD (WALL Cycle): 0.78125, 1.5625, 3.125, 6.25TDs. And the derivatives of the 35TD Cycle: 0.136719,0.273438, 0.546875, 1.09375, 2.1875 4.375, 8.75TDs. I think something in the 35TD might have peaked today along with the 5.5 and 11TD peaking and going up.

ReplyDeleteYeap...the 12.5 Day Cycle of the Wall Cycle could be peaking today! I think we have to factor in all the derivatives of the cycles....this is what is throwing us off.

ReplyDeletec88 - I still think Monday is going to boom. I do see us falling Friday...the pattern shouldn't change it's just we missed this bump up. This jump was crazy...but on a chart you could clearly see we hit the trendline that started from the bottom on Tuesday. Hopefully by EOD tomorrow I'll have the derivatives of the 22,35, and 100(50)TD in my "Cyclator" to give us a updated composite.

Shadow -

ReplyDeleteNews can always temporarily impact market movement in ways that is not predictable. Whether it is one day, a week, a month or more depends on the severity of the news (ie 911 was weeks). Seems the news out of Europe regarding bailouts is the prime news mover today.

The lever pullers are doing their best to keep confidence in this market at elevated levels. Given mutual fund withdrawals in the latest period they seem to be losing the battle of confidence.

Take a gift when given one and lighten up on your longs and/or increase your short exposure... Play the market in front of you.