The past week was not one of my better weeks in figuring out what the market would do. Many were predicting surges higher to S&P 1260 or higher while I was looking for a pullback. They were wrong (as was I) as the market was flat for the week.

I warned you in my header statement that at times I will be wrong, that I will misinterpret the data. So my task was/is to figure out where I went wrong. Since I look mostly at shorter (swing trade) cycles I believe that the longer cycles were impacting the markets in a way for which I had not accounted. So I took a closer look at the longer cycles. I believe that I now understand what is happening.

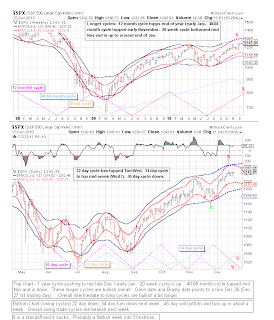

The 1 year cycle is pushing up hard to a top (Dec 26 is 180 days from the July 1 low). As I interpret Gann this should be a turn date (see prior post). It is also listed as a Bradley turn date (see post on Bradley dates). It is unusual to go 180 days without a sizable pull back (so we are due for a 10% or so pullback soon). We also have a 20 week cycle that should top around the end of January that is helping to keep the market from pulling back. The 40.68 month (often called a 41 month cycle) topped by mid-November. In total though the longer cycles are providing upside momentum (with the 1 year cycle dominating).

This is offsetting any dowside momentum from shorter swing cycles and giving us a sideways market.

Looking at the swing trade cycles the 22 day cycle topped this past week and is down. The 34 day cycle should top by the middle of next week and turn down. The 45 day cycle is down but should bottom soon. So the total impact of the shorter cycles should be down. But, as noted above this is being offset by the longer cycles.

See for yourself:

Merry Christmas all

I concur with your analysis. I see a pullback at the year-end. Based on the positive attitude of the market it would make sense that everyone make this last and end on a good note which would say 12/27-12/30 will be some down days. Books have started closing and volume is light. VIX is awfully low and S&P is almost oberbought...has a little more room to run. Thanks for your blog.

ReplyDeleteShadow7 - Thanks for your feedback. It is always interesting to see the fundamental reasoning (as you provided) match the technical analysis.

ReplyDelete