Seems to be a lot of interest in the PMs (gold, silver) with the $100 decline in gold. I believe the CME just increased margins (again)... that should help... hehehe.

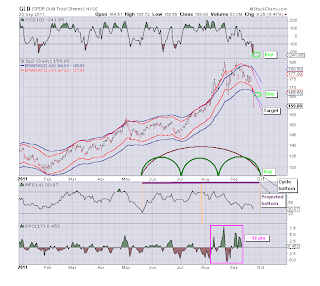

So I looked at the GLD etf. Appears the CCI is giving a buy signal. Of course, we'd like to see confirmation by other indicators. I suspect by Mon/Tue the envelope charts will confirm. Then by the end of the week we should get a second confirmation of bottoming cycles. My opinion - gold is almost at a buy point, but not quite yet.

Here is a chart showing the points discussed above:

GL traders. As always - do your own analysis and be careful.

Hi Inlet

ReplyDeleteI´d like you to ask the reasons you set your envelopes in GLD and why are they different forn SPX, like to konow the philosophi settings.

Also ask you about the cycles drown in GLD.

Jekyll - setting the envelopes is somewhat a trial and error process. The idea is to get a fit that includes most of the price data. For a volatile stock the means adjusting the width of the envelope (second parameter). Then there is the matter of dominant cycle lengths. A look at the chart gives you an idea of that and you set the first parameter accordingly.

ReplyDeleteIt may take 3-4 attempts to get the fit that you find acceptable. The main point though is to get a good fit of the envelope and data.

My buy date still holds firm @ Oct 4-7. I think it has to go to 155 now and it may got all the way to 143 by that date.....so difinitely waiting for more confirmation.

ReplyDelete