Original post Mar 29 2011

Tonight we look at another cycle analyst - Cliff Drokes.

Drokes generally (not that I have come across) does not focus on the shorter cycles that I would call "swing trade" cycles. Still he is a frequent contributor of online articles covering cycles. Drokes is a follower of the Kress cycles (named after Samuel Kress - member of the Kress family that founded Kmart and its predecessor).

Drokes says of the yearly cycles the ones of consequence are: the 2 year, the 6 year, the 10 year and 30 year. He claims all other cycles are derivatives of these cycles. For example the 4 year is really 2 of the 2 year cycles. Or the 60 year K-Wave is 2 of the 30 year cycles. Specifically he says "The other cycles can be chalked up to merely the products of the "Rule of Alternation" or to a composite of the four cycles under discussion.".

http://www.gold-eagle.com/gold_digest_08/droke021511.html

He says -

- The 12 year cycle bottomed hard in 2002 (2 X 6 year cycles?). So I think we can assume a 6 year cycle topped in 2005 and bottomed in 2008, will top in 2011 and bottom in 2014.

- The 10 year cycle bottomed in 2004 (other analysts say 1982, 1992, 2002 were 10 year cycle bottoms). In that case it should top in 2009 and bottom in 2014.

- The 6 year cycle peaks later this year (implies a bottom in 2008 - [he says later 2008] and another bottom in 2014). See 12 year cycle above.

- As I recall Drokes claimed the 4 year cycle should bottom last Sept/Oct. Of course the 4 year cycle is really 2 X 2 year cycles - so we should see a 2 year top this fall around Sept/Oct and a bottom in Sept/Oct of 2012.

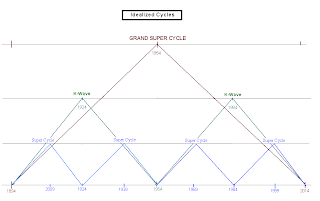

First let's look at the long cycles (idealized) projecting a bottom in 2014:

Next let's look at the less long cycles:

I believe Drokes analysis is better suited to the investor who holds longer term whereas I look at shorter cycles better suited for the trader.

GL traders. I hope you find this information helpful.

Inlet,

ReplyDeleteI just finished Drokes book and am still trying to get my head around the cycle theory. At the end of the book Drokes interviews Kress and Kress paints a fairly ominous picture of the future starting in 2012 and lasting through 2014, if his "grand super cycle" theory is correct.

I also have just started to read J.M. Hurst's book. Am I correct in my interpretation that Hurst calculates his cycles based on the individual equity, measuring from low to low and then averaging to come up with the cycle length average for each issue?

Fastarrow -

ReplyDeleteBeen a long time since I read Hurst's book, but I think in general he focuses on individual stocks. He uses envelopes to highlight cycle tops and bottoms. I do not recall if he averages cycle lengths. I know there are cycles that frequently occur that he looks for.

The last half of the book gets into some fairly complex math (regression analysis, fourier transforms) for figuring out cycles, amplitudes, etc.

I try to use the KISS method on my blog (Keep It Simple Stupid) as I know most of my audience are not students of cycles.

You will notice I use envelopes and other methods for trying to figure out the cycle bottom/tops and lengths.

I commend you for efforts.

Good post, but just wanted to correct an error.

ReplyDeleteSamuel Kress did not found Kmart he owned a chain of five and dime stores (S.H. Kress & Co.) founded in 1887 in Pennsylvania and made a fortune later starting the Samuel H. Kress Foundation.

Kmart was founded by Sebastian Kresge in 1899 in Detroit and was originally known as the S.S. Kresge Corp.

Many people get the two confused because they were essentially competitors.

c_k

ReplyDeleteGot to hand it to you MidWest guys, you know your five and dime stores. I never had the $s to shop them high class stores. Hehehehe

Hi Inlet

ReplyDeleteCan I ask you a stupid question? When you swing or trade do you always set a stop lost? I am just wondering because I have heard so many different opinions on stops.

Hey Inlet,

ReplyDeleteI like your cycle work - what software do you use to draw your charts? Seems pretty similar to Hurst's trading method mentioned above, which is now fully coded into computer software marketed as Sentient Trader. It finds the major and minor cycles for you. Pretty cool stuff actually. Keep up the good work. I'll see if I can upload a pic from it later.

Tom - the short answer is no I don't "always" set a stop losses. If I am able to monitor the market I may go with a mental stop loss. If I am not going to be in a position to monitor the market then I go with an actual stop loss.

ReplyDeleteIf it is a situation where I am accumulating a larger position I usually have limit orders at lower levels (not stop losses) hoping to accumulate at lower levels.

Setting stop losses usually should be related to volatility (Keltner channels or Bollinger bands may be helpful in this). For a more volatile stock you do not want to set your loss too tight and get whipsawed.

I generally reccomend stop losses on the assumption most people can not constantly monitor their positions.

Stockcharts.com is the basic charting software I use to draw channels and oscillators for shorter timeframes. A lot of the annotation I do manually. I also use paintbrush for some functions and manual updates.

ReplyDeleteThere are several software packages available for cycle analysis. I have none of them. Sorry, I cannot reccomend any to you. Just a personal opinion, but I believe the manual process requires one to more closely examine and observe what is going on with the market (or a stock).

Computers and software have a long ways to go to replicate the human thought process (take it from someone who spent 35 years programming and supporting computers and applications).

Thanks Inlet that was very helpful.

ReplyDeleteBanman - if you need help in getting a chart uploaded - if you put it on tinypics.com (or some other similiar site) and let me know I can move it to the blog.

ReplyDeleteOnce it is posted you can provide what you consider appropriate comments.