When you use indicators (CCI, MACD, RSI, etc) you try and evaluate them in overall context of the stock. If there are other factors that have you concerned you may not follow the signal. The same is true for cycle analysis. There are times we will choose to ignore a "buy" signal for example.

Let me show you what I mean. We have one stock giving buy signals at a time it looks like we have 3 swing cycles bottomed or bottoming. Now this is a signal we probably want to act on. Here is that stock:

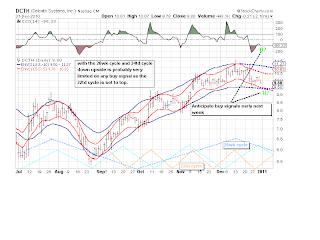

We have another stock we anticipate will give buy signals early next week. But it has 2 cycles down and a third ready to top and turn down. So any "buy" signal offers very little upside potential and considerable downside risk. This (if it happens) will be "buy" signals we ignore and pass on trading this stock. Here is the stock:

Always do your own due diligence and analysis. I can, have, and will be wrong at times because I did not consider all factors. I use these two stocks to illustrate a point and am not reccomending either. Let's work together to make 2011 a very profitable year.

No comments:

Post a Comment