The FED announcement of "taper" seemed to turn the market. Not sure I understand it - $10b a month is a small fraction of the $85b a month of QE being inserted into the monetary system by the FED. Of course - when looking at M1 velocity one sees M1V has quit going down and is now flat which implies that the FED needs to stop printing money or they are going to cause serious inflation. Also, much of the derivatives that existed back in 2008-9 have been offset, cancelled or expired (for example AIG has cleared their balance sheet of derivatives and paid back the government) so this destruction of fiat currency is no longer threatening a deflationary recession and inflation is more likely. Here is M1V showing that monetary velocity is ready to turn up:

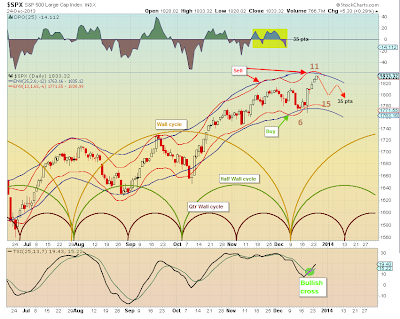

I expect though that the FED taper move has been more than compensated for by the market. We now have had the short 10-11 TD cycle up for about 5 days so it should turn down into the end of 2013 (start of 2014) then a short up tick of 4-5 days an then down into mid-January (4-5 days down) where we have a full moon.

Here is the SPX with annotated expectations:

Merry Christmas, Happy New Year and GL traders

No comments:

Post a Comment