Lots of news the past week:

1) A Plan in Europe, but not a final plan it appears. Partial "kick the can" down the road as the plan seems insufficient to address all the problems in the Eurozone.

2) Earnings seem to maintain a positive tilt as companies continue to moderate hiring and try to increase efficiency. Probably not a lot of productivity left to be gotten without some heavy investment in capital equipment.

3) GDP was better than expected. Not something to get too excited about as these numbers will be revised (down is my guess).

4) Local and state government layoffs are offsetting the moderate pace of business hiring so unemployment continues to be flat at high levels.

5) Foreclosures may be increasing, but they are already at high levels.

6) Consumer spending was up, but savings rate was down. It appears consumers are using savings to spend.

I am sure you can think of other items. Over all the environment is mixed, but about as good as can be expected. With Europe off the table temporarily (or so it appears) and earnings winding down I expect attention to shift to the super committee. Last rumor I heard is there is a push for $1.5 trillion in tax increases and an equal amount in spending cuts. The problem with this (as I see it) is tax increases are aways now and cuts are always in the future. Are we supposed to be so stupid we think this is a solution?

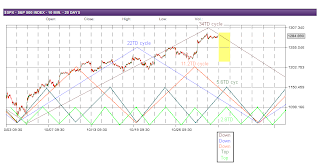

So with things about as good as can be expected a pull back should not be unexpected. So we look at the cycles and it appears we have several cycles bottoming toward the end of next week. This could give us a short (but severe) pull back. Since we are up about 200 points in October a quick pullback of 100 points (50%) would not be out of reason.

The pull back may start Monday as we have two shorter cycles topping mid day. I suspect end of month window dressing is over (or nearly so) and the first week of November is an ideal time for a pullback. So I expect Monday could be a down day.

Here are the SPX swing cycles as I interpret them:

GL traders. As always - do your own analysis and be careful.

No comments:

Post a Comment