I commented yesterday: "The pull back may start Monday as we have two shorter cycles topping mid day. I suspect end of month window dressing is over (or nearly so) and the first week of November is an ideal time for a pullback. So I expect Monday could be a down day.". That appears to have been the case. Not much has changed from yesterday.

I looked at a couple of bloggers and they seem to think we see a bounce tomorrow. I look at the cycles on the charts and can't agree. All the short cycles from the 2.8TD to 34TD cycles should be down tomorrow if my interpretation is correct. So to me this indicates possibly a sharp sell off tomorrow.

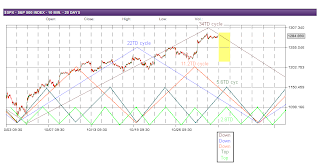

Here is the SPX swing cycles:

GL traders. Do your own analysis and be careful.

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Monday, October 31, 2011

Sunday, October 30, 2011

Spiral dates calendar for November

The calendar shows a broad top for the week coming up (a turn down?) and two peaks around Thanksgiving (expected low turn).

http://spiraldates.com/2011/charts/scores_1011.png

FYI - there is also a Bradley turn date around Nov 22 which correlates to the second tops on the Spiral calendar.

http://spiraldates.com/2011/charts/scores_1011.png

FYI - there is also a Bradley turn date around Nov 22 which correlates to the second tops on the Spiral calendar.

outlook for 10-31-2011 and the week

Lots of news the past week:

1) A Plan in Europe, but not a final plan it appears. Partial "kick the can" down the road as the plan seems insufficient to address all the problems in the Eurozone.

2) Earnings seem to maintain a positive tilt as companies continue to moderate hiring and try to increase efficiency. Probably not a lot of productivity left to be gotten without some heavy investment in capital equipment.

3) GDP was better than expected. Not something to get too excited about as these numbers will be revised (down is my guess).

4) Local and state government layoffs are offsetting the moderate pace of business hiring so unemployment continues to be flat at high levels.

5) Foreclosures may be increasing, but they are already at high levels.

6) Consumer spending was up, but savings rate was down. It appears consumers are using savings to spend.

I am sure you can think of other items. Over all the environment is mixed, but about as good as can be expected. With Europe off the table temporarily (or so it appears) and earnings winding down I expect attention to shift to the super committee. Last rumor I heard is there is a push for $1.5 trillion in tax increases and an equal amount in spending cuts. The problem with this (as I see it) is tax increases are aways now and cuts are always in the future. Are we supposed to be so stupid we think this is a solution?

So with things about as good as can be expected a pull back should not be unexpected. So we look at the cycles and it appears we have several cycles bottoming toward the end of next week. This could give us a short (but severe) pull back. Since we are up about 200 points in October a quick pullback of 100 points (50%) would not be out of reason.

The pull back may start Monday as we have two shorter cycles topping mid day. I suspect end of month window dressing is over (or nearly so) and the first week of November is an ideal time for a pullback. So I expect Monday could be a down day.

Here are the SPX swing cycles as I interpret them:

GL traders. As always - do your own analysis and be careful.

1) A Plan in Europe, but not a final plan it appears. Partial "kick the can" down the road as the plan seems insufficient to address all the problems in the Eurozone.

2) Earnings seem to maintain a positive tilt as companies continue to moderate hiring and try to increase efficiency. Probably not a lot of productivity left to be gotten without some heavy investment in capital equipment.

3) GDP was better than expected. Not something to get too excited about as these numbers will be revised (down is my guess).

4) Local and state government layoffs are offsetting the moderate pace of business hiring so unemployment continues to be flat at high levels.

5) Foreclosures may be increasing, but they are already at high levels.

6) Consumer spending was up, but savings rate was down. It appears consumers are using savings to spend.

I am sure you can think of other items. Over all the environment is mixed, but about as good as can be expected. With Europe off the table temporarily (or so it appears) and earnings winding down I expect attention to shift to the super committee. Last rumor I heard is there is a push for $1.5 trillion in tax increases and an equal amount in spending cuts. The problem with this (as I see it) is tax increases are aways now and cuts are always in the future. Are we supposed to be so stupid we think this is a solution?

So with things about as good as can be expected a pull back should not be unexpected. So we look at the cycles and it appears we have several cycles bottoming toward the end of next week. This could give us a short (but severe) pull back. Since we are up about 200 points in October a quick pullback of 100 points (50%) would not be out of reason.

The pull back may start Monday as we have two shorter cycles topping mid day. I suspect end of month window dressing is over (or nearly so) and the first week of November is an ideal time for a pullback. So I expect Monday could be a down day.

Here are the SPX swing cycles as I interpret them:

GL traders. As always - do your own analysis and be careful.

Friday, October 28, 2011

outlook 10-28-2011

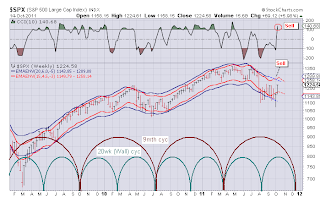

In September the shorter cycles (5.6 and 11.2TD) seemed to exert the most influence in the market and we got quick moves up and down. In October that influence seemed to shift to the longer (22 and 34TD) cycles. If I have it right those 2 cycles have now topped. Will influence continue to shift to longer cycles. If it does then the 20 week (Wall) cycle should become more dominant. Not saying this will happen but speculating it might. If it does then we could see a down trending market for about 8 weeks into the third week of December as the 20 week cycle should have topped by mid October.

The Europeans seem to have come up with a partial fix, but are also kicking the can down the road. Earnings season is almost over. So I expect we will start hearing more about the Congressional super committee. I am not optimistic about the results coming out of this group. I hope I am wrong and they do some much needed budget cutting.

In my estimation most of the cycles should be down today (did the 34TD cycle top yesterday?) and therefore expect we will end down at the close of the day. Here is the SPX swing cycles:

Gl traders. Do your own analysis.

The Europeans seem to have come up with a partial fix, but are also kicking the can down the road. Earnings season is almost over. So I expect we will start hearing more about the Congressional super committee. I am not optimistic about the results coming out of this group. I hope I am wrong and they do some much needed budget cutting.

In my estimation most of the cycles should be down today (did the 34TD cycle top yesterday?) and therefore expect we will end down at the close of the day. Here is the SPX swing cycles:

Gl traders. Do your own analysis.

Thursday, October 27, 2011

10-27-2011

Sorry I was unable to offer comments the past few days. Things happen in life that require you drop everything and deal with them. Reviewing the news the past few days it seems the news out of Europe is about as good as can be expected. Also, earning reports will start to wind down as we get into November. So I wonder what will drive the market the next few weeks. Seems to me it is about as good as we can expect at this time.

Looking at the data I would opine the longer swing cycles have been dominant in the market in October. I believe I mentioned the 34TD cycle should top this week. With the open today we well could be setting a top now. We will see.

Here is the SPX with my interpretation of the cycles:

Gl traders. My long positions are largely offsetting my "wrong" short positions. Not a way to make money, but it protects you when your analysis fails you. So - do your own analysis because I guarantee there will be times I fail to properly interpret the data.

Looking at the data I would opine the longer swing cycles have been dominant in the market in October. I believe I mentioned the 34TD cycle should top this week. With the open today we well could be setting a top now. We will see.

Here is the SPX with my interpretation of the cycles:

Gl traders. My long positions are largely offsetting my "wrong" short positions. Not a way to make money, but it protects you when your analysis fails you. So - do your own analysis because I guarantee there will be times I fail to properly interpret the data.

Saturday, October 22, 2011

10-24-2011

Who knows what we will see out of Europe by Monday. Friday may have been the topping of the 34TD cycle. The only thing I am sure of is the higher we go the neared we are to a top.

Here are the SPX swing cycles:

GL traders.

Note: Due to a personal situation I will be on the road (out of town) early next week and will not be posting the first part of the week.

Here are the SPX swing cycles:

GL traders.

Note: Due to a personal situation I will be on the road (out of town) early next week and will not be posting the first part of the week.

Thursday, October 20, 2011

It all ends in a week so don't worry.

Current Events have been Carey's focus during this year of 2011 when the Mayan Day of Change will usher in the long-awaited New Creation Cycle. Carey believes this will occur during the month of October, soon after the Final and Irreparable Collapse of both the Stock Market and the current global financial system.

http://www.2011-2012kencareystarseed.com/announcements/#axzz1bNlMXEJe

http://www.2011-2012kencareystarseed.com/announcements/#axzz1bNlMXEJe

10-21-2011 outlook

Today we got another data point that seems to support the idea of a rounded top. Tomorrow noon or a little later we should have the 2.8TD and 5.6TD cycles topping. This may give us some upside push. To keep with the rounded top theory it should not exceed 1225. Then we should sell off toward the close (2.8TD, 5.6TD, and 22TD cycles down at the close). So overall I think we rally some (not a lot) into mid day and then sell off toward the end of the day (I doubt with what is happening in Europe people will want to hold over the weekend and that fits our expectations for Friday). The French and Germans haven't agreed on anything for 200 years - is there any reason to think that will change this week end? Hehehe.

Here is the SPX swing cycles:

GL traders. Be careful, do your own analysis.

Here is the SPX swing cycles:

GL traders. Be careful, do your own analysis.

Wednesday, October 19, 2011

worth a read

Cycles are very powerful. When you find a price series that has a controlling dominant cycle, all one needs to do to profit from it is execute a timing method on the price series change in line with the cycle. However cycles do have an powerful signal that is a little harder to market time.

http://www.safehaven.com/article/23005/cycles-produce-one-of-the-most-powerful-signals-part-one

http://www.safehaven.com/article/23005/cycles-produce-one-of-the-most-powerful-signals-part-one

10-20-2011 outlook

Nothing is ever certain in the market, but today added to the picture (one more data point) of a top that is rolling over. If that is the right picture then I would expect a couple of moderately down days as the 22TD cycle and 20 week (Wall) cycle gain some downside momentum. Then by Monday we get no plan (or a crappy plan) out of Europe and we could get a strong down day. This is the picture I believe the cycles are suggesting at this time.

Here is the SPX Swing cycles:

Gl traders. Do your own analysis.

Here is the SPX Swing cycles:

Gl traders. Do your own analysis.

Tuesday, October 18, 2011

10-19-2011 outlook

IBM was light on revenues, INTC beats, AAPL misses. Seems that not all tech companies are going to beat estimates and that will make for an interesting earnings season and probably will not be good for stock prices.

I believe we saw the peak of the 22TD and 20 week (Wall) cycles today. We should sell off tomorrow morning and recover some toward the end of the day as the shorter cycles turn up. Here is the SPX swing cycles:

GL traders. Be careful. Do your own analysis.

I believe we saw the peak of the 22TD and 20 week (Wall) cycles today. We should sell off tomorrow morning and recover some toward the end of the day as the shorter cycles turn up. Here is the SPX swing cycles:

GL traders. Be careful. Do your own analysis.

Monday, October 17, 2011

10-18-2011 outlook

The expected top may have been Friday? Today's action down was more like what I am showing for 10-18 on my charts. I guess we see tomorrow if I am off by 1 day - because I am showing everything except the 22TD cycle down tomorrow (and the 22TD cycle should be fading/losing "mo" fast). Also. we may have seen the 20 week (wall cycle) top.

My charts show lots of downside potential tomorrow unless that happened today. Here is the SPX:

GL traders, exact timing is difficult. I did tell you late last week we were getting buy signals for RWM and QID and they did well for me today.

My charts show lots of downside potential tomorrow unless that happened today. Here is the SPX:

GL traders, exact timing is difficult. I did tell you late last week we were getting buy signals for RWM and QID and they did well for me today.

Sunday, October 16, 2011

10-17-2011 outlook

As expected we did move back up to 1220. Not only did we test 1220 we broke slightly above that level. The 1229-1230 level is now in play. This week we should see the 22TD cycle top. Also there is the 20 week cycle which bottomed in early August that should be nearing a top. These cycles topping should result in the market topping by mid week. So far earnings results have been mixed. The 20 week cycle:

Monday the 22TD cycle is up but momentum should start to fade as it starts a topping process. The 11.2TD cycle and 5.6TD cycle are down on Monday. The 2.8TD cycle is up. The 34TD cycle should still be up for about another week. So I expect Monday to be flattish (up or down 5 points or so on the S&P).

Here are the SPX swing cycles:

GL traders. Do your own analysis

Monday the 22TD cycle is up but momentum should start to fade as it starts a topping process. The 11.2TD cycle and 5.6TD cycle are down on Monday. The 2.8TD cycle is up. The 34TD cycle should still be up for about another week. So I expect Monday to be flattish (up or down 5 points or so on the S&P).

Here are the SPX swing cycles:

GL traders. Do your own analysis

Friday, October 14, 2011

Sectors and cycles

The Market Cycle precedes the Economic Cycle because investors try to anticipate economic effects. Here is how the Market and Economy relate to different sectors:

So how are the different sectors performing now? Aren't you glad I asked?

Energy (IE oil), basic materials, industrials has topped and had a pull back. That is expected at the market top (so that suggests we have seen the market top). Consumer staples, health care, and utilities are strong and financials are weak which suggests the economy has/is topping and the market downturn is in progress.

We should see technology and cyclicals (IE consumer discretionary) start to strengthen at the market bottom. So keep an eye on techs during earnings (GOOG was strong - but it is exceptional), but what about INTC, MSFT, CSCO, etc....

Just a different look at cycles that I thought you would find informative.

So how are the different sectors performing now? Aren't you glad I asked?

Energy (IE oil), basic materials, industrials has topped and had a pull back. That is expected at the market top (so that suggests we have seen the market top). Consumer staples, health care, and utilities are strong and financials are weak which suggests the economy has/is topping and the market downturn is in progress.

We should see technology and cyclicals (IE consumer discretionary) start to strengthen at the market bottom. So keep an eye on techs during earnings (GOOG was strong - but it is exceptional), but what about INTC, MSFT, CSCO, etc....

Just a different look at cycles that I thought you would find informative.

10-14-2011 outlook

The close was a mixed closed - I'd call it flattish.

Tomorrow we have the 22TD cycle and 5.6TD cycle up while we have the 11.2TD cycle and 2.8TD cycle down. The 34TD cycle being up breaks the tie. So tomorrow continues trading in a fairly narrow range with and upside bias. 1220 appears to be resistance so I would not be surprised if we test that level again over the next 2-3 days. The charts are starting to appear as if we get a rolling top with two peaks around 1220 and the 22TD cycle tops 10-19 just as the shorter cycles bottom (so any upside potential is small).

Here is the SPX swing cycles:

GL traders. Do your own analysis.

Tomorrow we have the 22TD cycle and 5.6TD cycle up while we have the 11.2TD cycle and 2.8TD cycle down. The 34TD cycle being up breaks the tie. So tomorrow continues trading in a fairly narrow range with and upside bias. 1220 appears to be resistance so I would not be surprised if we test that level again over the next 2-3 days. The charts are starting to appear as if we get a rolling top with two peaks around 1220 and the 22TD cycle tops 10-19 just as the shorter cycles bottom (so any upside potential is small).

Here is the SPX swing cycles:

GL traders. Do your own analysis.

Wednesday, October 12, 2011

QID and RWM 10-13-2011

If you follow the blog closely you know my GTC limit buy orders for QID and RWM got hit earlier in the week. I said at the time I was probably early. That has proven to be the case. This high lights the short comings of limit orders. Still - I do not want to be tied to my computer all day - so I use limit orders. Then I am free to go for a walk or take a nap during the market day. So it is a trade off - I don't get the best entry (exit) but I have more freedom from monitoring the market minute by minute. It is a personal choice, maybe you are more dedicated to monitoring the market than I.

Now RWM and QID have triggered buy signals. If they are good signals then then QID and RWM should be bought within the next 1-3 days. A signal should give you a window in which to act (at least 1 day IMO). So I may buy the second part of a position tomorrow or Friday in these ETFs.

Here is QID:

Here is RWM:

GL traders.

Now RWM and QID have triggered buy signals. If they are good signals then then QID and RWM should be bought within the next 1-3 days. A signal should give you a window in which to act (at least 1 day IMO). So I may buy the second part of a position tomorrow or Friday in these ETFs.

Here is QID:

Here is RWM:

GL traders.

10-13-2011 outlook

The longer cycles continue to dominate. It is 3-4 days to the top of the 22TD cycle so it should lose some upside momentum as it gets ready to top and turn down. Still you have to be impressed by the strength of the longer cycles (22TD and 34TD) with a little help form the 2 shorter cycles.

Tomorrow we have the 34TD and 22TD cycles still up. The 5.6TD cycle is also still up. The 11.2 and 2.8TD cycles are down. I'd say given the dominance of the longer cycles should lead to an up day, but less so than today. So flat to up tomorrow is my best guess. Also, the double top back around Sep 16 to Sep 20 (1120 S&P) should provide a challenge (resistance) according to traditional TA.

Here is the SPX swing cycles:

GL traders. Do your own analysis.

Tomorrow we have the 34TD and 22TD cycles still up. The 5.6TD cycle is also still up. The 11.2 and 2.8TD cycles are down. I'd say given the dominance of the longer cycles should lead to an up day, but less so than today. So flat to up tomorrow is my best guess. Also, the double top back around Sep 16 to Sep 20 (1120 S&P) should provide a challenge (resistance) according to traditional TA.

Here is the SPX swing cycles:

GL traders. Do your own analysis.

Tuesday, October 11, 2011

10-12-2011 outlook

It appears the 11.2TD cycle topped in the AM on 10-11-11 as shown on my chart. This suppressed any move up.

So how does this work? Let's suppose the 11.2TD cycle has an amplitude of 110 S&P points. Then it moves the S&P 110 points over a 5.6 day leg up/down (about 20 points a day move on average). So that gives us up to 20 points of downside pressure. At the same time let's say the 22 day cycle is up and it has am amplitude of 110 points. This is about 10 points a day move over 11 days (the length of an up/down cycle leg). So if we have 20 points of downside pressure and 10 points of upside pressure or a net of 10 points of upside pressure. Finally lets suppose the 34TD cycle (also up) has an amplitude of about 100 points. Over 17 days (the length of an up/down leg) that is about 6 points of upside pressure a day and cancels out all but 4 points of the 11.2TD cycle downside pressure (when combined with the 22TD cycle). Since the 11.2TD cycle was only for a partial day we get a flattish day.

I have been asked if my interpretations are somewhat subjective. Yes, they are - but I try to honestly interpret the data in front of me. The above illustrates the type of things I try and consider. Of course nothing is static in the market so understanding when a change is happening and interpreting that change is subjective and at times I will not do that correctly. That is one reason (of course there are many) you should do your own analysis.

So given the current alignment of cycles I believe tomorrow should be down. Not a huge move down, but still up to 10 points or so. Here is the swing trade SPX cycles:

GL traders. Do your own analysis.

So how does this work? Let's suppose the 11.2TD cycle has an amplitude of 110 S&P points. Then it moves the S&P 110 points over a 5.6 day leg up/down (about 20 points a day move on average). So that gives us up to 20 points of downside pressure. At the same time let's say the 22 day cycle is up and it has am amplitude of 110 points. This is about 10 points a day move over 11 days (the length of an up/down cycle leg). So if we have 20 points of downside pressure and 10 points of upside pressure or a net of 10 points of upside pressure. Finally lets suppose the 34TD cycle (also up) has an amplitude of about 100 points. Over 17 days (the length of an up/down leg) that is about 6 points of upside pressure a day and cancels out all but 4 points of the 11.2TD cycle downside pressure (when combined with the 22TD cycle). Since the 11.2TD cycle was only for a partial day we get a flattish day.

I have been asked if my interpretations are somewhat subjective. Yes, they are - but I try to honestly interpret the data in front of me. The above illustrates the type of things I try and consider. Of course nothing is static in the market so understanding when a change is happening and interpreting that change is subjective and at times I will not do that correctly. That is one reason (of course there are many) you should do your own analysis.

So given the current alignment of cycles I believe tomorrow should be down. Not a huge move down, but still up to 10 points or so. Here is the swing trade SPX cycles:

GL traders. Do your own analysis.

Monday, October 10, 2011

10-11-2011 outlook

Germany and France have a plan to come up with a plan... Guess if they had an actual plan the market would have been up 1000 points. Hehehe As I mentioned last week it appeared the longer swing cycles may be regaining dominance. I'd say after today's (11.2TD and 22TD cycles up, 5.6 and 2.8TD cycles down) action we can assume that is the case.

So here are the longer of the swing cycles (SPX):

Note that the 34TD cycle is also up at this time. I have upped my upside target to around 1215. The 11.2TD cycle should top tomorrow, which should provide some restraint to push up once it tops, but the 22TD cycle has about 5-6 TDs before it tops (Oct 17-18?). The 34TD cycle will top around the same time. So this should provide a mid-month top and then a drop into the end of the month.

And here are the shorter cycles (SPX):

Gl traders. I bought some QID and RWM today. Probably early, so I bought half a position and will consider adding if we rise more (QID and RWM fall more). Do your own analysis.

So here are the longer of the swing cycles (SPX):

Note that the 34TD cycle is also up at this time. I have upped my upside target to around 1215. The 11.2TD cycle should top tomorrow, which should provide some restraint to push up once it tops, but the 22TD cycle has about 5-6 TDs before it tops (Oct 17-18?). The 34TD cycle will top around the same time. So this should provide a mid-month top and then a drop into the end of the month.

And here are the shorter cycles (SPX):

Gl traders. I bought some QID and RWM today. Probably early, so I bought half a position and will consider adding if we rise more (QID and RWM fall more). Do your own analysis.

Sunday, October 9, 2011

10-10-2011 outlook

We got a minor pullback Friday. This was not totally unexpected after some strong up days.

Monday we have the 2.8TD and 5.6TD cycles down. We have the 11.2TD and 22TD cycles up. So I am expecting these cycles to offset giving us mostly as flattish/sideways market. This may offer some short term trading opportunities between 1145-1165. I am looking for a chance to establish positions in QID around $48 and RWM under $33. We will see....

Here is the SPX swing cycles:

GL traders. Do your own analysis.

Monday we have the 2.8TD and 5.6TD cycles down. We have the 11.2TD and 22TD cycles up. So I am expecting these cycles to offset giving us mostly as flattish/sideways market. This may offer some short term trading opportunities between 1145-1165. I am looking for a chance to establish positions in QID around $48 and RWM under $33. We will see....

Here is the SPX swing cycles:

GL traders. Do your own analysis.

Thursday, October 6, 2011

10-07-2011 outlook

Clearly I have been off in my outlooks the past 3 days (since we bottomed Monday). So I am examining the data to see if dominance has shifted to longer cycles and it appears that may be the case. We should have a clearer picture in the next few days. For now - I am going with that assumption and made some adjustments to reflect that.

So we may see some additional upside next few days if my adjustments prove out. I continues to hold some longs, but have now sold covered calls on them. Let's me collect the dividends and generate additional cash flow while offering some downside insurance.

Here is the SPX swing trade cycles:

Gl traders. Do your own analysis.

So we may see some additional upside next few days if my adjustments prove out. I continues to hold some longs, but have now sold covered calls on them. Let's me collect the dividends and generate additional cash flow while offering some downside insurance.

Here is the SPX swing trade cycles:

Gl traders. Do your own analysis.

Wednesday, October 5, 2011

10-06-2011 outlook

Not much of a dip during the day (disappointed me). Then we rallied the last hour. Seems to me after 4 down days followed by two robust up days it is time for a pause and possibly a pullback tomorrow.

Tonight we learned Steve Jobs passed away. Not sure how that will affect AAPL, but would not be surprised to see some weakness in AAPL at the open. I was never an Apple product purchaser. Not an Ipod, Iphone, Ipad or Mac. My objection to products like the Ipod, Iphone, Ipad was the follow on costs of music downloads, expensive cell phone plan for the Iphone or a data plan for the Ipad (if it is to be mobile). Seems to me a lot of people spent a lot of money on these products and follow on services that should have gone to pay credit cars or student loans.... JMHO.

Tomorrow have the 2.8TD, 5.6TD and 11.2TD cycles down. The 2.8TD and 5.6TD cycles should have topped at the close today. Given this alignment tomorrow should be a down day.

Here is the SPX swing cycles:

GL traders. I will be looking for long entries Friday afternoon or Monday morning. Do your own analysis.

Tonight we learned Steve Jobs passed away. Not sure how that will affect AAPL, but would not be surprised to see some weakness in AAPL at the open. I was never an Apple product purchaser. Not an Ipod, Iphone, Ipad or Mac. My objection to products like the Ipod, Iphone, Ipad was the follow on costs of music downloads, expensive cell phone plan for the Iphone or a data plan for the Ipad (if it is to be mobile). Seems to me a lot of people spent a lot of money on these products and follow on services that should have gone to pay credit cars or student loans.... JMHO.

Tomorrow have the 2.8TD, 5.6TD and 11.2TD cycles down. The 2.8TD and 5.6TD cycles should have topped at the close today. Given this alignment tomorrow should be a down day.

Here is the SPX swing cycles:

GL traders. I will be looking for long entries Friday afternoon or Monday morning. Do your own analysis.

10-05-2011 outlook

I had opined the day would be flat Tuesday trading in a range below 1100 after an initial drop. For most of the day that was the case, but the last hour we got an impressive rally and closed green. Two days in a row that the latter part of the day behaved unexpectedly.

Read a couple of blogs and it seems most think we have set a bottom. That may be true, but then again we may retest the low set Tuesday. I am inclines to think that is a likely scenario and if we do retest a bottom today it would be an opportune time to consider buying the dip. So my outlook is we start off flat, dip to test the low and then begin an advance.

Here is the SPX swing cycles:

GL traders. It may be time to cautiously buy for a 4 day or so swing trade. Do your own analysis.

Read a couple of blogs and it seems most think we have set a bottom. That may be true, but then again we may retest the low set Tuesday. I am inclines to think that is a likely scenario and if we do retest a bottom today it would be an opportune time to consider buying the dip. So my outlook is we start off flat, dip to test the low and then begin an advance.

Here is the SPX swing cycles:

GL traders. It may be time to cautiously buy for a 4 day or so swing trade. Do your own analysis.

Monday, October 3, 2011

10-04-2011 outlook

My outlook (some upside morning, pull back mid day) was looking good. Then the afternoon happened. Never got the bounce I thought we might. Tomorrow morning it looks like the down side should continue at least thru mid day.

The shorter cycles (11.2TD, 5.6TD, 2.8TD) continue to dominate the market movements. The 2.8TD should bottom mid day tomorrow. The 11.2TD and 5.6TD cycles are down all day. So I expect lows early then maybe we settle in a range under 1100 for the rest of the day?

Here is the SPX swing trading cycles:

GL traders. I would not attempt to buy the dip tomorrow - late Wednesday early Thursday - maybe?

The shorter cycles (11.2TD, 5.6TD, 2.8TD) continue to dominate the market movements. The 2.8TD should bottom mid day tomorrow. The 11.2TD and 5.6TD cycles are down all day. So I expect lows early then maybe we settle in a range under 1100 for the rest of the day?

Here is the SPX swing trading cycles:

GL traders. I would not attempt to buy the dip tomorrow - late Wednesday early Thursday - maybe?

Sunday, October 2, 2011

10-03-2011 outlook

Friday was red as expected. The 5.6TD cycle bottomed near the close it appears and the 2.8TD cycle topped. So we have the 2.8TD cycle down. The 22TD cycle is near a top (by Thursday?). The 11.2TD cycle is down.

So we have the 34TD cycle, the 5.6TD cycle, 20TD cycle is up. The 2.8TD cycle and 11.2TD cycle is down. So we get largely offsetting forces. But, I expect we open up, pullback mid day as the 2.8TD cycle bottoms and then moves up into the close and closes the day green. So a volatile day with a modest up move is my best guess.

Here is the SPX swing cycles:

GL traders. Be careful as the market is volatile and can turn on a dime.

So we have the 34TD cycle, the 5.6TD cycle, 20TD cycle is up. The 2.8TD cycle and 11.2TD cycle is down. So we get largely offsetting forces. But, I expect we open up, pullback mid day as the 2.8TD cycle bottoms and then moves up into the close and closes the day green. So a volatile day with a modest up move is my best guess.

Here is the SPX swing cycles:

GL traders. Be careful as the market is volatile and can turn on a dime.

Subscribe to:

Comments (Atom)