The second part of our 2014 outlook is based on how the cycles align. Recently the market does not seem to align with our cycle projection. Ever so often we seem to get a short cycle (or long cycle) in the cycles we follow for swing trading. According to some authorities I have read these variations in length conform to Fibonacci ratios.

When this happens we see highs when we were expecting pull backs (like now). Never argue with the data, but adapt positioning the cycles to match the data. So I have attempted to do this. It appears we will make a yearly high around mid-January 2014, a yearly low around mid-August. Lesser highs around mid-June and late October. A lesser low around the first of April.

These projections do not attempt to account for longer cycles that should bottom in the second half of 2014. There is the Grand Super Cycle (120 years - 1774, 1894, 2014?). This cycle divides into 2 K-Waves of 60 years (1894, 1954, 2014). Each K-Wave divides into 2 Super cycles of 30 years (1954, 1984, 2014). Of lesser degree are cycles of about 7-9 years (Juglar or Pi cycle (3141 days/8.6 years)), and the Kuznet cycle of 15-17 years. Kress used 40 year and 12 year divisions of the longer cycles I believe. Needless to say some are projecting a very serious downturn in 2014.

Here is 2014 graphic projections:

Happy New Year and a profitable 2014

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Tuesday, December 31, 2013

Saturday, December 28, 2013

Outlook for 2014 Part 1

Seems every talking head on CNBS (and most bloggers) see nothing but blue skies for 2014. But there are negatives - the longer the market extends the bull run the nearer we are to a turn down (that is a fact and not subject to debate). So as the market moves higher I become more negative about the market future. Do I know what the market will do in 2014? Absolutely not.

You have lots of gurus telling you the positives so I will discuss some of the cautionary signs:

1). At more than two standard deviations above its 50-day, the S&P is actually the most overbought it has been since mid-May. So near term (say first quarter 2014) a correction of 10% would be normal given this.

2). The percentage of bullish individuals rose to 55.1%, the highest level in nearly three years, in the week ended Dec. 25, according to the American Association of Individual Investors. That was a jump from the 47.5% of investors who said they were bullish the previous week. See item 1 (suggests market over bought and a correction would be expected).

3). The market for junk-rated loans increased to $683 billion, exceeding the 2008 peak of $596 billion, according to Standard and Poor’s Capital IQ Leveraged Commentary and Data. We are seeing levels that break prior peaks in several areas. Expect these extremes to get corrected (I suspect sooner rather than later).

http://www.bloomberg.com/news/2013-12-23/junk-loans-top-08-record-as-safeguards-stripped-credit-markets.html

4) The talking heads on CNBS keep telling us how reasonable the PE is, but the CAPE (10 year average of price/Earning) is a better predictor of future stock action.

The Cape in the mid 20s is at levels more commonly seen at market peaks.

5). Stocks are rising on low volume. A strong market normally rises on increased volume so this is a concern.

6). Margin debt is at levels seen in the early 2000s and 2007. People/institutions are borrowing large amounts of $s to buy stocks. This is a quicksand foundation supporting stock prices.

7). There is no fear. See item 2 - AAII bullish percentage. The VIX is known as the FEAR index. It has been low for several months. The last time you saw the VIX this low for this long was 2007-8. Caution is indicated.

8). The MSM talking heads keep talking PEs based on 2014 forecasted earnings to predict higher stock prices. It is fairly normal for earnings forecasts to decrease over time so these 2014 projections should be viewed with some skepticism.

9). In 2013 the rate of revenue growth slowed down, profits rose primarily due to increased margins. There are limits as to how much companies can cut costs and increase margins and they are probably close to that limit. Future profit growth will depend more on economic growth.

10). See item 4 (CAPE). Even the regular PE is starting to get a bit high because in 2013 the increase in stock prices was due primarily due to increased PEs and not earnings growth.

These are only some of the challenges the economy and stock market will face in 2014. There are items like ACA (Obamacare) that start to get more fully implemented over the next couple of years (partially postponed into 2015 by Obama). It seems unclear of the total impact of this. We know that state run health care in other countries have proven to be burdensome and ineffective. We also know that over 30 taxes/fees go in to effect in January. Resources diverted to health care cannot be spent on housing, autos, clothing and travel so this will have a dampening effect on the economy. It is uncertain how extensive this effect will be.

There is also the Dodd/Franks bill that financial institutions have to deal with. This will probably increase the cost of credit. This may impact fees retailers can charge for the use of credit cards. The cost to the consumer of this added regulation by multiple government agencies is unknown at this time.

You have lots of gurus telling you the positives so I will discuss some of the cautionary signs:

1). At more than two standard deviations above its 50-day, the S&P is actually the most overbought it has been since mid-May. So near term (say first quarter 2014) a correction of 10% would be normal given this.

2). The percentage of bullish individuals rose to 55.1%, the highest level in nearly three years, in the week ended Dec. 25, according to the American Association of Individual Investors. That was a jump from the 47.5% of investors who said they were bullish the previous week. See item 1 (suggests market over bought and a correction would be expected).

3). The market for junk-rated loans increased to $683 billion, exceeding the 2008 peak of $596 billion, according to Standard and Poor’s Capital IQ Leveraged Commentary and Data. We are seeing levels that break prior peaks in several areas. Expect these extremes to get corrected (I suspect sooner rather than later).

http://www.bloomberg.com/news/2013-12-23/junk-loans-top-08-record-as-safeguards-stripped-credit-markets.html

4) The talking heads on CNBS keep telling us how reasonable the PE is, but the CAPE (10 year average of price/Earning) is a better predictor of future stock action.

The Cape in the mid 20s is at levels more commonly seen at market peaks.

5). Stocks are rising on low volume. A strong market normally rises on increased volume so this is a concern.

6). Margin debt is at levels seen in the early 2000s and 2007. People/institutions are borrowing large amounts of $s to buy stocks. This is a quicksand foundation supporting stock prices.

7). There is no fear. See item 2 - AAII bullish percentage. The VIX is known as the FEAR index. It has been low for several months. The last time you saw the VIX this low for this long was 2007-8. Caution is indicated.

8). The MSM talking heads keep talking PEs based on 2014 forecasted earnings to predict higher stock prices. It is fairly normal for earnings forecasts to decrease over time so these 2014 projections should be viewed with some skepticism.

9). In 2013 the rate of revenue growth slowed down, profits rose primarily due to increased margins. There are limits as to how much companies can cut costs and increase margins and they are probably close to that limit. Future profit growth will depend more on economic growth.

10). See item 4 (CAPE). Even the regular PE is starting to get a bit high because in 2013 the increase in stock prices was due primarily due to increased PEs and not earnings growth.

These are only some of the challenges the economy and stock market will face in 2014. There are items like ACA (Obamacare) that start to get more fully implemented over the next couple of years (partially postponed into 2015 by Obama). It seems unclear of the total impact of this. We know that state run health care in other countries have proven to be burdensome and ineffective. We also know that over 30 taxes/fees go in to effect in January. Resources diverted to health care cannot be spent on housing, autos, clothing and travel so this will have a dampening effect on the economy. It is uncertain how extensive this effect will be.

There is also the Dodd/Franks bill that financial institutions have to deal with. This will probably increase the cost of credit. This may impact fees retailers can charge for the use of credit cards. The cost to the consumer of this added regulation by multiple government agencies is unknown at this time.

Wednesday, December 25, 2013

2013 end-of-year outlook

The FED announcement of "taper" seemed to turn the market. Not sure I understand it - $10b a month is a small fraction of the $85b a month of QE being inserted into the monetary system by the FED. Of course - when looking at M1 velocity one sees M1V has quit going down and is now flat which implies that the FED needs to stop printing money or they are going to cause serious inflation. Also, much of the derivatives that existed back in 2008-9 have been offset, cancelled or expired (for example AIG has cleared their balance sheet of derivatives and paid back the government) so this destruction of fiat currency is no longer threatening a deflationary recession and inflation is more likely. Here is M1V showing that monetary velocity is ready to turn up:

I expect though that the FED taper move has been more than compensated for by the market. We now have had the short 10-11 TD cycle up for about 5 days so it should turn down into the end of 2013 (start of 2014) then a short up tick of 4-5 days an then down into mid-January (4-5 days down) where we have a full moon.

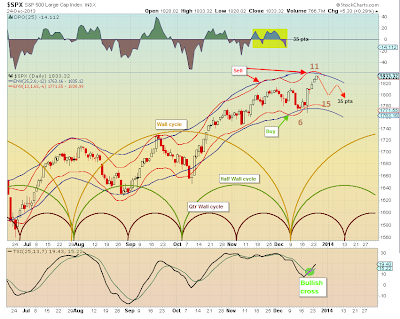

Here is the SPX with annotated expectations:

Merry Christmas, Happy New Year and GL traders

I expect though that the FED taper move has been more than compensated for by the market. We now have had the short 10-11 TD cycle up for about 5 days so it should turn down into the end of 2013 (start of 2014) then a short up tick of 4-5 days an then down into mid-January (4-5 days down) where we have a full moon.

Here is the SPX with annotated expectations:

Merry Christmas, Happy New Year and GL traders

Sunday, December 15, 2013

dec 16, 2013 weekly outlook

As expected the downside pressure from several cycles kept the market negative most of the week. The downside pressure should continue through the end of the year. But with a preponderance of down days over the past 2+ weeks we may be due an up day first part of the week. Still, the week should be down (I'd guess 1-2%) for the week.

Here is the visual:

GL traders

Here is the visual:

GL traders

Friday, December 13, 2013

2014 outlook - Bradley turn dates for 2014

Notice 2014 starts out at a low point (corresponds to my projections of cycles bottoming end of December or early January). Also corresponds with a new moon. Mid year is projected as the high point for the year (preliminary work shows this should align with my projections).

Here is the Bradley turn dates for 2014:

Key dates are 1/1, 7/16 and 11/20 in 2014.

I'll post my 2014 projections before year end and other projections when/if I come across them.

Here is the Bradley turn dates for 2014:

Key dates are 1/1, 7/16 and 11/20 in 2014.

I'll post my 2014 projections before year end and other projections when/if I come across them.

Friday, December 6, 2013

Dec 9, 2013 weekly outlook

Friday wiped most of the downside achieved Monday thru Thursday. Friday was the reversal of a short 10 day cycle (bottomed Thursday). See for yourself:

Even though it appears we could have short term chop next week over all I suspect the general pressures are down between now and year end as the following chart illustrates:

GL traders

update 12/11 - 4:45pm EST - Appears the short cycle (10 days - 5 up/5 down) has become left translated with 2-3 days up.

Even though it appears we could have short term chop next week over all I suspect the general pressures are down between now and year end as the following chart illustrates:

GL traders

update 12/11 - 4:45pm EST - Appears the short cycle (10 days - 5 up/5 down) has become left translated with 2-3 days up.

Sunday, December 1, 2013

Outlook for December 2013

November proved to be more of an up market than I anticipated as intermediate length cycles continued to be right translated (up trend action). Going in to December the Kitchin cycle remains up still. The Kitchin third cycle remains in its down leg. The Wall cycle should have topped and turned down. The Half Wall cycle remains in an up leg and the Qtr Wall is in a down leg (see prior post for short cycle chart).

So we have the Kitchin cycle and Half Wall up. The remaining cycles are down. So December should be down for the month (bottom around Christmas?).

Here are the longer cycles:

GL traders

12/04/2013 update - Great chart:

http://static.safehaven.com/authors/readtheticker/32002_b_large.png

http://www.safehaven.com/article/32002/sp500-wall-and-kitchin-cycle-review

So we have the Kitchin cycle and Half Wall up. The remaining cycles are down. So December should be down for the month (bottom around Christmas?).

Here are the longer cycles:

GL traders

12/04/2013 update - Great chart:

http://static.safehaven.com/authors/readtheticker/32002_b_large.png

http://www.safehaven.com/article/32002/sp500-wall-and-kitchin-cycle-review

Subscribe to:

Comments (Atom)