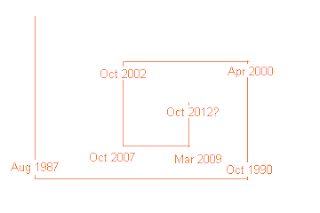

The swing cycle that appears to currently dominate is the 33-36 trading days cycle. This means the current correction should complete in the coming week (33TD cycle - 16+ day leg would complete by Tuesday; a 36TD cycle would complete Thursday 10/04). So if you ae short or holding an inverse such as RWM you will want to watch for an exit in the coming week....

After the bottom we should see about 17 TD up into late Oct, then down into the presidential election. Don't forget - there are other cycles at play that can influence the amplitude of any move by this swing cycle (Which is 1/3 of a Wall cycle).

Here is a visual:

Compare this to the predictions of the Spiral calendar:

http://spiraldates.com/

GL traders.

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Saturday, September 29, 2012

Monday, September 24, 2012

VIX trend change signal

1) VIX retreated over 50% from last high around 28

2) S&P has now had 3 consecutive down days.

I consider this a trend change signal.

Seems to me the fundamentals are now such that not much in the offing to move the market:

1) ECB - instituted QE, FED instituted QE, Japan instituted QE. The sugar high should wear off fairly quickly.

2) Many Euro countries in recession

3) China growth slowing

4) Many emerging countries slowing (Brazil, India)

5) US growth anemic

5) Economic #s continue to be poor

Also technicals seem to be lining up to suggest a top:

1) EW proponents are suggesting a substantial top in the making

2) Spirals suggesting top near

3) Slow Stos suggest a top near

4) VIX suggesting a trend change

5) Cycles suggest a top in the making

These are just some of the markers suggesting a pull back is near.

GL traders

2) S&P has now had 3 consecutive down days.

I consider this a trend change signal.

Seems to me the fundamentals are now such that not much in the offing to move the market:

1) ECB - instituted QE, FED instituted QE, Japan instituted QE. The sugar high should wear off fairly quickly.

2) Many Euro countries in recession

3) China growth slowing

4) Many emerging countries slowing (Brazil, India)

5) US growth anemic

5) Economic #s continue to be poor

Also technicals seem to be lining up to suggest a top:

1) EW proponents are suggesting a substantial top in the making

2) Spirals suggesting top near

3) Slow Stos suggest a top near

4) VIX suggesting a trend change

5) Cycles suggest a top in the making

These are just some of the markers suggesting a pull back is near.

GL traders

Friday, September 21, 2012

Slow Sto calling for a pull back?

According to Robert McHugh if the Slow Sto stays above 20 for 2.5 months a sell off normally occurs (+/- 2 weeks).

gl traders

gl traders

Thursday, September 6, 2012

Spirals and what they tell us

http://ermanometry.com/articles/log_spirals_in_the_stock_market.php

HALF SECTION VIEW OF A NAUTILUS SHELL. Successive increments of growth are united by a constant common ratio of expansion. An example of a spiral found in nature... See the above referenced article for more information on stock market cycles and their use in stock pivot point identification.

Below is a rough approximation of the spiral referenced in my last post. We should see a significant top soon (see spiral below).

Hope you find the referenced article as informative as I did.

GL traders

HALF SECTION VIEW OF A NAUTILUS SHELL. Successive increments of growth are united by a constant common ratio of expansion. An example of a spiral found in nature... See the above referenced article for more information on stock market cycles and their use in stock pivot point identification.

Below is a rough approximation of the spiral referenced in my last post. We should see a significant top soon (see spiral below).

Hope you find the referenced article as informative as I did.

GL traders

Monday, September 3, 2012

A death spiral??

Based upon the Fibonacci sequence, 1, 1, 2, 3, 5, 8, 13, 21, 34 etc we see an amazing occurence. From the 1932 bottom to 1966 top was 34 years and 1966 to 1987 was 21 years... subsequently we saw the 2000 top (13 years) and then the 2008 top (8 years). This is rather more than coincidence that every major top since 1932 was identified by following a contracting Fibonacci sequence. There is no indication for how long tops last, but in general, corrections are severe...at least 40-50%.

Five years from 2008 is 2013 suggesting a substantial top in 2013 followed by a 40-50% correction.

Implications for quickly approaching the point of singularity implies severe volatility, so do not take positions where money is required or involve leverage...this could kill you on the downside and if not, the sleepless nights could take a toll. We are just beginning to see a sampling of how volatile things are going to get in the coming years.

Timing the tops and getting out before sharp declines will be critical for ensuring no loss of capital. Tops will be closer together if the market continues to observe the contracting Fibonacci sequence (2013, 2016, 2018, etc),

In other words a DEATH spiral. Spirals is another subject for another time, but those who have studied spirals often relate then to Fibonacci sequences.....

Five years from 2008 is 2013 suggesting a substantial top in 2013 followed by a 40-50% correction.

Implications for quickly approaching the point of singularity implies severe volatility, so do not take positions where money is required or involve leverage...this could kill you on the downside and if not, the sleepless nights could take a toll. We are just beginning to see a sampling of how volatile things are going to get in the coming years.

Timing the tops and getting out before sharp declines will be critical for ensuring no loss of capital. Tops will be closer together if the market continues to observe the contracting Fibonacci sequence (2013, 2016, 2018, etc),

In other words a DEATH spiral. Spirals is another subject for another time, but those who have studied spirals often relate then to Fibonacci sequences.....

Subscribe to:

Comments (Atom)