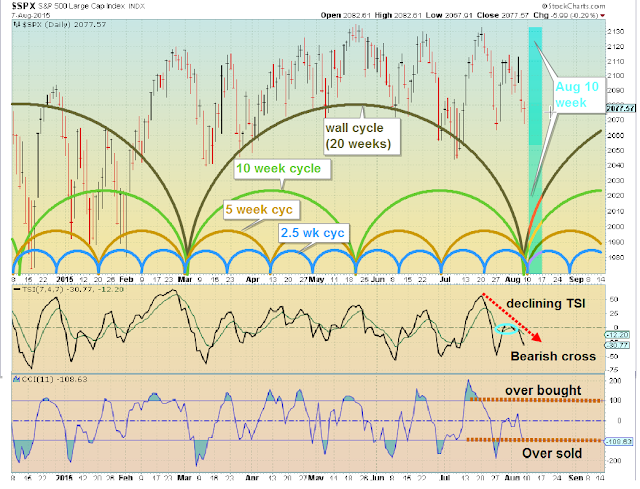

Short term cycles (20 week or shorter) are up for the week. The 2.5 week cycle should top by late week (Thur/Fri). The longer cycles (Shemitah -7 years, Kitchin - 3 1/2 years, 1/3 Kitchin - 13 1/2+ months ) are down so this should limit the upside to 2040 or less.

GL traders

Cycles are a tool and should not be used to the exclusion of other tools. There is always the possibility (high probability long term) that the data will be misinterpreted or a relevant fact over looked. So use cycles to check your analysis, not as the only reason to make a decision. Interpretation is the opinion of the author and may be incorrect and should be viewed in that light.

Saturday, August 29, 2015

Friday, August 28, 2015

Sept 2015 outlook

It appears we had a trend change of longer trends as the 3.5 year (Kitchin) cycle turns down along with some shorter but intermediate length cycles turn down. Expect the averages to stair step down over the next 5 months (or longer) as these cycles play out to the downside. Of course this will take time as after each move down the market pauses and goes sideways as it digests each down move of size (say 5-10% or so). Expect the SP500 to trade in the 1860-2000 range the first half of September and then move down the second half of September.

GL traders

GL traders

Saturday, August 22, 2015

Aug 24, 2015 weekly outlook

Traveling and will furnish updated charts when I have the time and better internet access. Interesting week just past. Mid year I posted a longer term outlook. I posted longer cycles (Kitchin cycle 3 1/2 years) and 1/3 Kitchin cycle (13+ months). . Also noted that a down turn in these longer cycles would accelerate in the last 15-20% of the cycle and these cycles should dominate during that time frame). Projected bottom on these longer cycles is around year end.

We may have now entered that down draft from the longer cycles as the up turn in shorter cycles seems to be totaled dominated. I told you the first couple of weeks after the nested bottoms would tell us if we were entering a longer term trend change.... I suspect we have and will take a closer review of this past week's action. .

Appears longer cycles have taken over to the down side and should control for most or all of 2015. Since down moves tend to be shorter and cover a lot of amplitude in a short time expect moves to be volatile and violent.

If we get a "bear" market then expect at least a 20% (400 points) pull back in SP500. Remember 20% down wipes out 40% up move,,,,

GL traders

We may have now entered that down draft from the longer cycles as the up turn in shorter cycles seems to be totaled dominated. I told you the first couple of weeks after the nested bottoms would tell us if we were entering a longer term trend change.... I suspect we have and will take a closer review of this past week's action. .

Appears longer cycles have taken over to the down side and should control for most or all of 2015. Since down moves tend to be shorter and cover a lot of amplitude in a short time expect moves to be volatile and violent.

If we get a "bear" market then expect at least a 20% (400 points) pull back in SP500. Remember 20% down wipes out 40% up move,,,,

GL traders

Friday, August 14, 2015

Aug 17, 2015 weekly outlook

Appears we got a nested bottom by mid week (2-3 days later than I had projected). By Friday indexes were up for the week as I indicated I believed would be the case as all the intermediate to short cycles I display in my charts turned up from the nested bottom.

In the coming week all these cycles will be up and the week of Aug 17 offers the best chance for new highs(SP500) near term. Expect volatility to continue with problems in China. Russian economy is in a mess. So is Brazil's economy. Of the BRICs only India seems to be in relative decent shape. The BRIC is turning into sand??? So longer term (Sep-Oct) markets look less positive.

Russell 2000 ETF:

update 8/18 after close:

GL traders

In the coming week all these cycles will be up and the week of Aug 17 offers the best chance for new highs(SP500) near term. Expect volatility to continue with problems in China. Russian economy is in a mess. So is Brazil's economy. Of the BRICs only India seems to be in relative decent shape. The BRIC is turning into sand??? So longer term (Sep-Oct) markets look less positive.

Russell 2000 ETF:

update 8/18 after close:

GL traders

Friday, August 7, 2015

Aug 10, 2015 weekly outlook

We may have seen nested bottoms Friday mid day, but may see a slightly lower low on Monday.

CCI near over sold so a slight down move Monday would result in an over sold signal. All the cycles shown above should be turning up so expect the week to be up. The strength of the move should let us know if we should expect new highs over the next few weeks. For the year SP500 is flat...

GL traders

08/12 update --- today's bottom and bounce back has the feel of a bottom. I updated charts to reflect this:

CCI near over sold so a slight down move Monday would result in an over sold signal. All the cycles shown above should be turning up so expect the week to be up. The strength of the move should let us know if we should expect new highs over the next few weeks. For the year SP500 is flat...

GL traders

08/12 update --- today's bottom and bounce back has the feel of a bottom. I updated charts to reflect this:

Saturday, August 1, 2015

Subscribe to:

Comments (Atom)