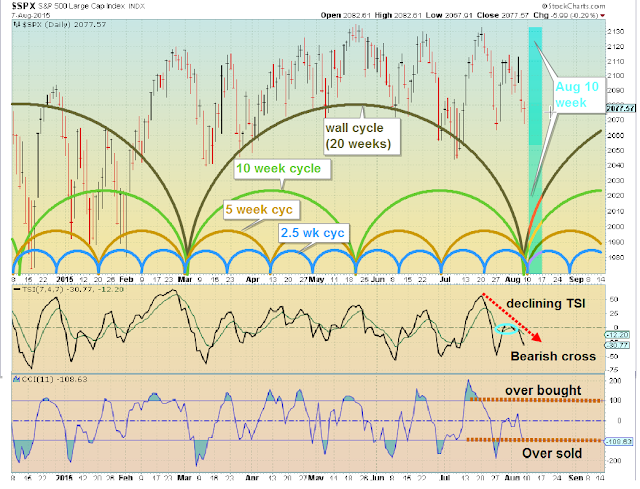

We may have seen nested bottoms Friday mid day, but may see a slightly lower low on Monday.

CCI near over sold so a slight down move Monday would result in an over sold signal. All the cycles shown above should be turning up so expect the week to be up. The strength of the move should let us know if we should expect new highs over the next few weeks. For the year SP500 is flat...

GL traders

08/12 update --- today's bottom and bounce back has the feel of a bottom. I updated charts to reflect this:

no comment. totally agree. next top at the end of the week. by the way we have a divergence, the 8/25 should be a major top but let 's see.

ReplyDeleteA top on the 5 week cycle should happen around 8/25 (and a bottom on the 2.5 week cycle). In the past (top 5 week, bottom 2.5 week) the 5 week appears to dominate. With the 10 week cycle and Wall cycles up there could be a top. Most likely a medium length/amplitude top, but let's see how it plays.

Deleteok thanks

DeleteCongrats for your nice blog!! If you also like my blog thetradingstrategist.wordpress.com you can add it to your blogroll. Many thanks!!

ReplyDeleteHave your blog listed on http://mcverryreport.com/ for additional exposure...

DeleteCongratulate you for your good work!

ReplyDeleteI just happened across your blog and truly find it fascinating. Do you ever have any coverage or analysis on the $RUT, or any Russell indices? Thank you for sharing this outstanding information.

ReplyDeleteActually I trade the Russell ETFs. Have a limit order (entered this AM) for RWM @ $58.51. Sold RWM Friday @ $60.05. Usually you will see a 3-4% move in $RUT over the period of a week and if your timing is good you swing between RWM and IWM for a 5% or so gain over a week... Usually my timing is less than perfect.

ReplyDeleteGenerally I avoid making specific stock buy or sell advice. If you can trade in sync with the general market and use index ETFs generally you can make returns regardless of market direction.

ReplyDeleteHit 2060 on SP500 I mentioned in Aug 3 weekly post. Seems I may have been off 3-4 days (so far?) in my estimate of the bottom date....

ReplyDeleteIt is not bad at all to have 3 to 4 days off for the forcast. Today seems to be the bottom of the market as you predicted according to your cycle analysis.

DeleteOnly problem i have consistently with your work is that you keep moving the cycles back and forth to meet your targets. Respecting the work, but misleading cause these time frames dont vary that widely.

ReplyDeleteI never argue with the data. If the data requires an adjustment then I adjust. If you have a better method please share it, because I have not discovered a perfect way of predicting the future. Over all I believe my projections while not perfect usually provide a fair representation of future outcomes.

ReplyDeleteI try to make and note changes If I feel they are necessary. at the beginning of my blog I note the outlooks are simply my opinion and should only be used in connection with your own analysis.